Monthly Briefing on The Events of The Syrian Scene - August 2023

Executive Summary

This report provides an overview of the key events in Syria during the month of August 2023, focusing on political, security, and economic developments. It examines the developments at different levels.

- Security and Military Sector: In Deir Ezzor, the security situation has deteriorated significantly following the disbandment of the “Deir Ezzor Military Council” and the subsequent arrest of its leaders by the Syrian Democratic Forces “SDF”. This has sparked intense conflicts between the SDF and local Arab tribes, who are calling for the creation of a genuine local government that truly represents the region's inhabitants.

- Political Sector: Civilian demonstrations escalated in the province of As-Suwayda, with people asking for political changes based on a specific Security Council Resolution /2254/ after the regime's failure to achieve popular demands for twelve years.

- Economic Sector: The Regime's efforts to alleviate the severe economic crisis by raising the salaries of workers have proven to be ineffective. Despite the increase in wages, the cost of essential goods has more than doubled, making the monthly average living cost for a family of five in Syria exceed /10.3/ million Syrian Pounds.

Frustration and Resistance: Emerging from the Regime's Policies

Bashar al-Assad has made the decision to replace the governor of Tartous, “Abdel Halim Khalil”, with the retired Brigadier General “Firas Ahmed al-Hamid”. This move is seen as an effort to quell the growing dissatisfaction among civilians due to bad living conditions in Tartous.

In August 2023, the protests against the poor economic conditions intensified with a higher number of participants in As-Suwayda province. The scope of these protests has significantly expanded, spreading to /48/ distinct areas, a substantial increase from only /3/ areas during previous demonstrations.

Map (1): Protest points in As-Suwayda governorate during August 2023

If the protest in as-Suwayda province evolved, we might see the Regime adapting different tactics in dealing with these protests such as, using local gangs in the city to incite violence or even assassinate key figures in the protest movement, particularly if it begins to threaten the interests of the regime and its allies, including potential disruptions to drug trafficking routes (primarily Captagon).

In August, the head of the National Coalition of Syrian “SOC” received a letter from the French Foreign Minister. The letter stated France's belief in the need for political change in Syria and their goal to hold war criminals responsible. Also in August, Bader Jamous was chosen again as the president of the Syrian Negotiations Commission for a second term.

Syria's Shifting Sands: The Impact of Recent Security and Military Events on Territorial Control

During 2023, the Regime held-areas have seen a rise in IEDs attacks aimed at the regime military's and security forces, during August 2023 two IED's attacks were recorded, one in the city of al-Moadamyeh and the other attack was at al-Quneitra province, the rise in IED attacks is a clear indication of the regime's growing weakness of its security capabilities, after becoming more reliant on untrained foreign militias on one hand, and the ongoing failure in limited ISIS cells attacks in 2023 on the other hand.

In the Opposition held-areas, in southern Idlib, specifically in the northwest region of Jabal al-Zawiya, ongoing battles have been reported between the “al-Fateh al-Mubin” opposition factions and the regime forces alongside their allied militias. The conflict escalated after the opposition took control of the “Milaja” village and other strategic points. In response, Russian warplanes-initiated airstrikes to aid the regime forces in recapturing the lost territories. The clashes over three days resulted in numerous casualties, including dozens from the regime forces and 7 opposition fighters.

Map(2):Developments in battles between tribal forces and SDF in Deir Ezzor (August 31.2023)

In the SDF held-areas, in Deir Ezzor, tensions increased between the SDF and tribal forces following the arrest of the Deir Ezzor Military Council commander, “Ahmed al-Khabil”, and several other leaders of the council by the SDF. The situation worsened as the SDF implemented a security policy to manage the backlash, which triggered further violence. The aggressive stance of the SDF towards civilian demonstrators spurred other tribes, including al-Akidat clan, to join the fight, demanding redress for the grievances of the Deir Ezzor populace and the removal of Kurdistan Workers' Party “PKK” leaders from the region. This situation poses a significant challenge to the “Autonomous Administration of North and East Syria” project and its influence over the area.

Discontent and Migration on the Rise as Syria Grapples with Economic Crises

Regime Held-Areas

Bashar al-Assad approved a decree to double the salaries of public sector workers, both civilian and military. This was followed by a 50% bonus for certain groups. However, the regime also increased fuel prices and reduced subsidies on drinking water by up to 400%, leading to a surge in the cost of living, with the average family now needing over /10.3/ million Syrian pounds to get by, according to Qasioun newspaper. These measures, aimed at covering the salary increase, have resulted in a continuous devaluation of the Syrian pound and increased poverty.

On another note, the regime will have to import around two million tons of wheat to meet the country's needs, as the local season's won't exceed /800,000/ tons, far below the required three million tons. Meanwhile, to foster ties with Saudi Arabia, the regime granted licenses to two Saudi-owned companies to invest in Syria's phosphate, fertilizer, and cement sectors. However, Saudi Arabia has imposed restrictions on Syrian trucks entering its territory, causing delays at the Nasib crossing.

Moreover, there has been a significant increase in the migration of traders, especially from Aleppo and Damascus, with some transferring substantial gold reserves abroad, highlighting the deepening economic crisis.

SDF Held-Areas

The “Autonomous Administration of North and East Syria” has doubled the salaries of its civilian and military employees, setting the minimum wage at /1,040,000/ Syrian pounds and the maximum at /8,222,000/ Syrian pounds. They also increased the price of heating diesel and allocated /300/ liters per household for the upcoming winter.

In terms of early recovery projects, 90% of the “Ambara” road project, linking al-Qamishli city to the M4 international road, has been completed with a 2023 budget of around $/794,633/.

To regulate economic activities, two laws were enacted:

- One governing exchange and transfer operations, setting the minimum capital for exchange companies at $/500,000/ and for exchange offices at $/50,000/.

- And another regulating the trade and manufacture of precious metals, outlining licensing procedures and prohibiting unlicensed operations. The administration also approved a draft law comprising 66 articles to combat money laundering.

Opposition Held-Areas

In northwest Syria, the “Salvation Government” raised the prices of gasoline and domestic gas following a two-week shortage in its controlled areas. To foster investment, the “Syrian Interim Government” initiated discussions with local entities to organize an investment conference aimed at enhancing the investment environment in northern Syria. A memorandum of understanding was signed with various stakeholders to foster cooperation and prepare for the conference.

Meanwhile, the electricity crisis is escalating in rural Aleppo, with “Ak Energy” hiking electricity prices, sparking public outrage and protests in front of the company’s headquarters in Azaz. Local councils are considering new contracts with alternative energy providers to address the issue.

In terms of early recovery, projects are underway in rural Aleppo and Idlib, including housing projects and road expansions to improve infrastructure. Various organizations are working on these initiatives to facilitate better living conditions and connectivity in the region.

Syria Monthly briefing - July 2023

General Summary

This report provides an overview of the key events in Syria during the month of July 2023, focusing on political, security, and economic developments. It examines the developments at different levels.

-

Security and Military Sector: The eastern parts of Syria have seen heightened military activity by several groups along the Euphrates River. Additionally, disagreements between the Deir Ezzor Military Council and the Syrian Democratic Forces “SDF” have led to armed clashes and road blockades in the northern Deir Ezzor villages and towns.

-

Political Sector: The continuation of the Arab rapprochement initiative, this rapprochement appears to be contingent on the reciprocal actions and offerings from the Assad regime, emphasizing a “Step-for-Step” approach. Furthermore, Russia's veto against the extension of cross-border aid challenges the UN and other humanitarian organizations, necessitating new strategies to deliver aid amidst Syria's dire humanitarian crisis.

-

Economic Sector: Syria's economic situation is deteriorating, marked by a significant rise in the cost of living paired with decreasing salaries. Concurrently, the Assad regime is aiming to further assert its control over vital resources and gain a monopoly over critical, high-revenue sectors, benefiting both the regime and its allies.

Internal Security Issues and Rising Military Presence Across Various Frontlines

Regime Held-Areas:

Israel conducted strikes on multiple security and military sites in the regions of Damascus countryside, Eastern Homs, and Tartus. Out of the five sites targeted, three are under the control of militias backed by Iran. ([1])

Map (1), Highlighting Israeli strikes in Syria from January of 2023 to July 2023

Security chaos continues in the south, /37/people were assassinated in Daraa province, with /20/ more in various security incidents throughout the month. During July, the regime used drones in its operations in Daraa, hinting at a shift to newer security tools, possibly supported by Iranian expertise.

In al-Suwayda Province, in retaliation for the regime's recent arrest campaign, local groups apprehended regime officers. Such incidents highlight the regime's fragile security control in the province.

Opposition Held-Areas:

Hay'at Tahrir al-Sham “HTS” continued its security campaign, arresting over /300/ of its members from different departments, accused of spying for the Syrian regime, Russia, or the USA.

SDF Held-Areas

Deir Ezzor witnesses military mobilizations by various parties along the Euphrates River.

-

Numerous military supply convoys for the International Coalition have reached their bases near the al-Omar oil field.

-

The Syrian Democratic Forces “SDF” have increased their presence and set up operations rooms in Deir Ezzor.

In the northern countryside of Deir Ezzor, several villages and towns experienced clashes between the “Deir Ezzor Military Council” and the SDF's Military Police. This conflict arose following the killing of two council members and the detention of several others.

International Coalition forces intervened to mediate and stabilize the situation, assuring that those responsible for the incident would be held accountable. These events highlighted the vulnerabilities within the SDF's internal unity and underscored concerns about the PKK's dominance over these forces, often sidelining local factions in decision-making.

A general strike took place in Manbij city against the conscription campaign carried out by the SDF.

Despite Renewing International Ties, Assad Regime Continues to Use Extortionate Behavior

Following the failure of the UN Security Council to extend the decision on cross-border aid delivery due to Russia's veto, the Assad regime announced that it would allow the UN and its specialized agencies to deliver humanitarian aid through the Bab al-Hawa crossing, on the condition that it would not be handed over to what he termed as “Terrorist Entities”, and the aid distribution should be coordinated with the Syrian Red Crescent. Several Western countries rejected this, and the UN considered it contrary to its independence and freedom of operation. The regime aims with this decision to control the UN aid and use it as a new tool to put more pressure on the international communities and the Syrian oppositions. Meanwhile, Bashar al-Assad received the Iraqi PM, Mohammed Shia' al-Sudani, in Damascus during his first official visit for an Iraqi PM since 2011. Al-Sudani emphasized the importance of coordination between the two countries. Assad mentioned the “Theft” of Syria's and Iraq's water by neighboring countries in supporting terrorism, referencing Turkey, Despite Erdogan's expressed willingness to meet with Assad, the path to reconciliation has been hindered due to the regime's preconditions, primarily the demand for a withdrawal timetable from Syria.

On a technical level, the first meeting of the Jordanian-Syrian Committee to Combat Cross-Border Drug Smuggling took place in Amman. This committee was established following the decisions made at the consultative meeting hosted by Jordan in Amman last May.

Fragile Markets and Increasing Economic Challenges

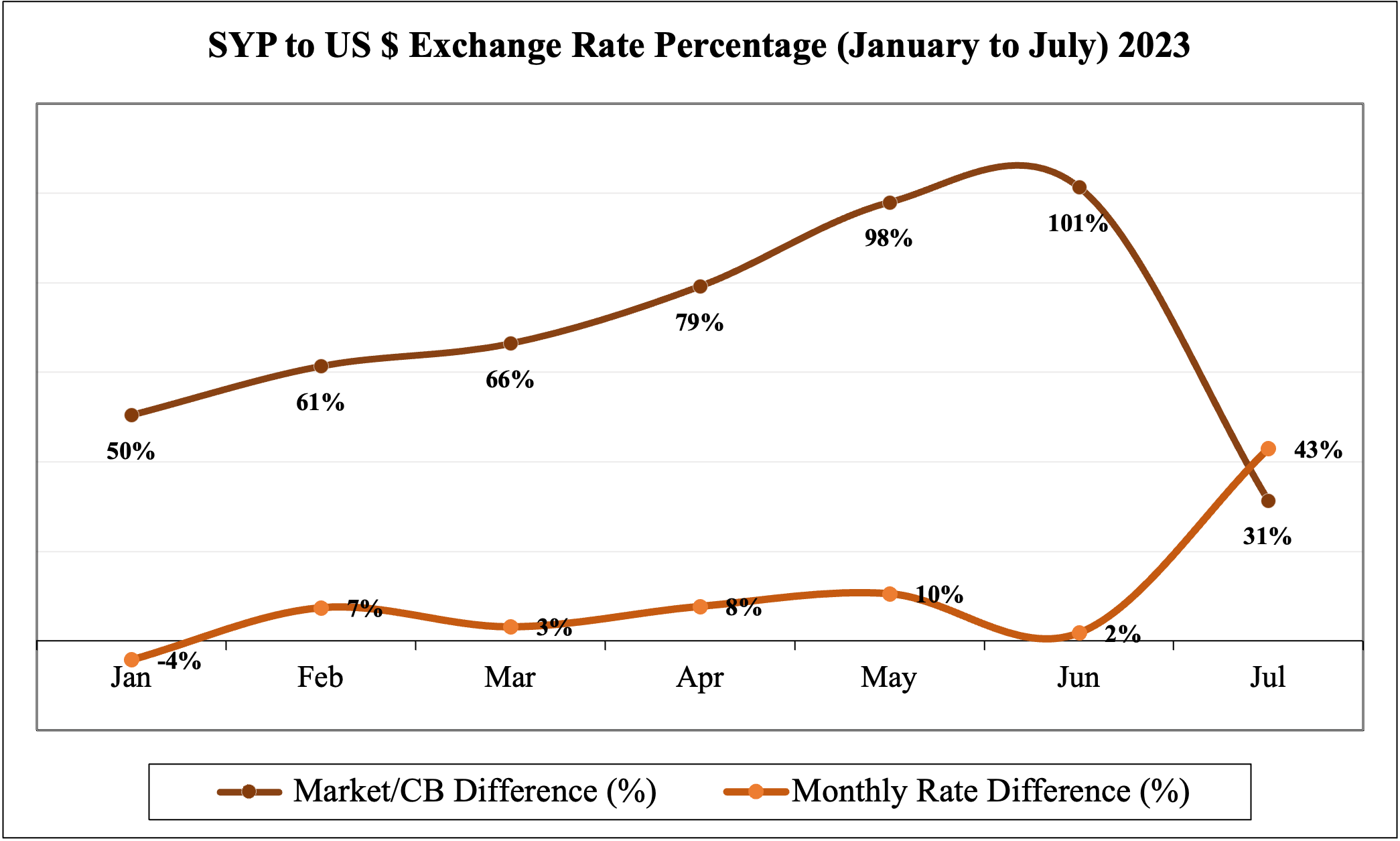

The SYP rate continued to fall against foreign currencies, registering /13,000/ SYP to the US Dollar in markets of Damascus, Aleppo, Idlib, and al-Hasakah. Meanwhile, the Regime Central Bank adjusted the US Dollar exchange rate to /9,900/ SYP for banking operations, money exchange companies, individuals, and foreign transfer exchange rates.

This month's SYP depreciation is attributed to the vast amount of money introduced into the market due to wheat payments, estimated at 2 trillion SYP (2,000 billion SYP) for purchasing /800,000/ tons of wheat from farmers in Regime held-areas. It's valued at $/516/ million in SDF held-areas in northeast, and $/64/ million in Opposition held-areas in northwest, causing a cash surplus. The central bank also approved printing a /5,000/ Lira note to add to market liquidity. The decrease in the SYP’s value led to a significant, uncontrolled increase in the prices of co0mmidities in regime held-areas, with some products witnessing over a 200% increase. The average living cost for a family of 5 in Syria has reached more than /6.5/ SYP, while the average salary stands at /150,000 SYP/.

Given these continuous crises, the PM of the regime, “Hussein Arnous”, announced the formation of a joint committee from the People's Assembly and the economic committee in the Council of Ministers to prepare a proposal to boost the economic and living conditions, even though the People's Council admits its inability to change the country's economic reality.

During the UN Food Systems Summit in Italy, Agriculture Minister “Mohammed Hassan Qatana” urged his Saudi counterpart, “Abdul Rahman al-Fadhli”, to ease the import of Syrian goods into the kingdom. Meanwhile, the Director General of the regime's Civil Aviation Corporation announced that Saudi Arabia has approved the resumption of flights between the two Syria and KSA. Consequently, the Syrian Arab Aviation Corporation has started setting up its offices in Riyadh.

The regime's Ministry of Transport announced an investment partnership with “Iluma”, a company closely linked to Bashar and Asma al-Assad, for the Damascus International Airport. The General Organization for Aviation will retain a 51% stake, while the investing company will hold 49%. “Iluma” will be responsible for all tasks and services related to air transport of passengers and goods, including owning, purchasing, leasing, and investing in aircraft, as well as organizing flights and ground services. This move underscores the regime's strategy to exert control over resources and monopolize key sectors, ensuring significant returns for itself and its allies.

In Opposition held-areas, food prices have surged by 48% in the past six months due to the depreciation of the Turkish lira. According to the UN REACH team, the minimum expenditure on basic food items has increased from /1,600/ TL to nearly /2,700/ TL within a year.

In eastern Syria, the Autonomous Administration raised fuel prices, leading to a temporary halt in sales at gas stations until new prices were set, also the cost of diesel for vehicles and industrial purposes rose from /425/ SYP to 525 SYP per liter, while the cost of free diesel rose from /1,200/ SYP to /1,700/ SYP per liter. However, diesel prices for generators and bread ovens remained unchanged, but the cost of a domestic gas cylinder increased, going from /7,500/ SYP to /10,000/ SYP.

The Autonomous Administration has designated the regions of al-Hasakah, Tal Tamr, and their surrounding areas, as disaster zones due to the ongoing water crisis. The water scarcity in Hasaka has worsened since 2019, primarily because of water supply disruptions from the opposition-controlled “Alouk” wells. Additionally, in al-Qamishli, the devaluation of the SYP value to less than a third of its value since early July has led to a decline in food sales. Both consumers and retailers have reported a drop in food orders by up to 70%.

[1]See Map (1) Israeli strikes break down in 2023, Map is designed by Omran team, and the information is based on credible open source along with Omran team special private source in Syria.

Syria Monthly briefing June 2023

Executive Summary

This report provides an overview of the key events in Syria during the month of June 2023, focusing on political, security, and economic developments. It examines the developments at different levels.

- Security and Military sector, the report highlights the following: 1) Opposition held areas in northwest Syria witnessed intensification of Russian strikes. 2) Rise in ISIS security operations in eastern Syria. 3) Increase in assassination victims, and clashes between local factions and militias associated with the regime forces in Daraa.

- Political sector, the report highlights the regime's ongoing efforts to foster closer ties with the Arab world through economic agreements, considering the Western resistance towards normalizing relations or lifting sanctions without substantial measures undertaken by the regime.

- Economic sector, the report focuses on the persistent depletion and devaluation of the Syrian pound, a consequence of the economic and financial policies pursued by the Assad regime. In the meantime, local councils and civil organizations in northwestern Syria have successfully concluded the implementation of numerous early recovery projects across several critical sectors, with particular emphasis on the industrial sector.

High indicators of security instability

In northwestern Syria, both the regime and Russia have conducted aerial and artillery bombardments in several areas in Idlib. This ongoing security and military complexity can be used as pressure to reach understandings or technical agreements, particularly due to the increased military capabilities of local actors in both regime-controlled and opposition-controlled areas. Simultaneously, Hay'at Tahrir al-Sham security forces have arrested over 80 individuals accused of engaging in dealings and espionage for hostile parties. Among those detained are notable figures from the General Security Agency and certain military brigades.

In northeastern Syria, ISIS has claimed responsibility for more than 24 attacks targeting the Syrian Democratic Forces (SDF) and their allies. These attacks resulted in the death of 11 people and left 26 others wounded. The following charts provides a comparison of ISIS attacks against the SDF between April and June for the years 2022 and 2023.

| 2022 | 2023 | Difference ratio | |

| April ISIS attacks | 34 | 13 | - 61.76% |

| May ISIS attacks | 11 | 8 | - 27.27% |

| June ISIS attacks | 17 | 24 | + 41.18% |

The Autonomous Administration in northeastern Syria has made a significant announcement. They have decided to initiate public prosecutions for approximately 10,000 ISIS operatives who are currently detained by them. This decision was prompted by the international community's delayed response to the autonomous administration's requests for assistance in repatriating their detained citizens. The trials of these operatives will be conducted in accordance with a local anti-terrorism law that was developed in 2022. While the ISIS operatives on trial will have the right to appoint their own lawyers, it has not been clarified whether the court will appoint lawyers for them. It's important to note that the death penalty is not applicable in northeastern Syria. Furthermore, Turkey persistently refused to acknowledge the Autonomous Administration, labeling it as a "terrorist" entity associated with the Kurdistan Workers' Party (PKK). In line with this stance, Turkey continued its strikes against the administration's leaders and key figures. Most recently, Turkish drones conducted an airstrike on a vehicle transporting the leaders of the “Qamishlo Provincial Council|” in the eastern part of Qamishli. The strike caused the death of the co-chair of the Council, the deputy co-president, and the driver, while the co-chairman of the council, "Kabi Chamoun," sustained severe injuries as a result of the drone strike.

Regarding Daraa, ongoing evident signs indicating the failure of the regime's efforts for reconciliations and settlements. The notable indicators include:

- Ongoing assassinations: A total of 30 individuals were killed in targeted assassinations during the month. Additionally, eight people lost their lives in other security incidents.

- Clash between local factions and pro-Assad militias near the Naseeb crossing, situated along the Syrian Jordanian border.

- Continuation of drug smuggling operations across the Jordanian border, either through the Naseeb crossing or the border strip.

The Assad regime between Arab rapprochement and western rejection

During the month of June 2023, the Syrian regime recently made several diplomatic moves. They appointed an ambassador to the Arab League, and their foreign minister visited Iraq and Saudi Arabia, resulting in an agreement to resume economic cooperation between Syria and Arab countries. Additionally, Bashar al-Assad, the Syrian leader, met with the United Nations Under-Secretary-General for Humanitarian Affairs and Emergency Relief Coordinator. During their meeting, al-Assad emphasized the importance of not politicizing the return of refugees and providing the necessary resources for reconstructing damaged structures and rehabilitating service facilities.

However, these statements by Assad also highlight the regime's refusal to address key security concerns regarding the safe return of refugees. These concerns include stopping security prosecutions against refugees, controlling, and restructuring the security services, and releasing detainees while reforming the judicial system.

It is likely that in the future, the Assad regime will continue to exploit the refugee issue to pressure the international community. Their aim is to achieve economic gains and the lifting of sanctions imposed on Syria.

In a parallel development, Canada and the Netherlands jointly lodged a lawsuit against the Assad regime at the International Court of Justice in The Hague. The lawsuit accuses the regime of torture and violations of international law, highlighting the ongoing stance of Western countries rejecting any form of normalization with the Syrian regime government.

During the recent 20th round of the Astana meetings, the final statement included several significant points. One of the key highlights was:

- Rejection of unilateral sanctions that violate international law, international humanitarian law, and the UN Charter. This statement implies the potential development of a Turkish stance favoring the lifting or easing of sanctions on the Assad regime.

- The participants at the Astana meetings expressed their approval of the regime's consent to allow aid entry through the al-Rai and Bab al-Salama crossings. This reaffirmed their opposition to any attempts to bypass the regime and Russia's approval after the extension expires in August 2023.

Current economic policies increasing Syrian’s suffering

In the Regime areas, The Syrian pound continues to experience massive declines against the US dollar, reaching a rate of 9,250 SYP per dollar. These declines are a result of the economic and financial policies implemented by the regime government. To restore stability to the currency, the Monetary and Credit Council issued a decision allowing individuals entering Syria to bring in financial revenues up to $500,000. However, those leaving the country are restricted from taking out more than $10,000 or its equivalent in foreign currency. Living conditions in regime areas remain challenging, with the population enduring rising prices during Eid al-Adha. Price increases ranged from 15% to 45%, with notable examples such as the cost of "30 eggs" reaching 30,000 SYP in Daraa and 34,000 SYP in Damascus. The price of sacrificial animals during Eid al-Adha reached 3 million SYP in certain areas, recording a 6 time increase for 2022 price. Reports indicate a significant decrease in foreign remittances to Syria during Eid al-Adha compared to Eid al-Fitr. The regime government refrained from providing any financial grants or salary increases prior to Eid al-Adha. The regime's Ministry of Finance estimated inflation rates for 2022 at 10-0% and projected a range of 10-4.7% for 2023. It is important to note that the inflation rate has reached approximately 16,000% between 2011 and 2023.

In Opposition areas, both the interim government and the salvation government have established the price of durum wheat at $330 per ton, and the price for soft wheat is set at $285 per ton. On the other hand, in areas under the Autonomous Administration, the price of durum wheat is set at $430 per ton, while in regime-controlled areas, it is set at $222 per ton.

This difference in pricing may discourage farmers in opposition areas from selling their crops to the regime or motivate them to consider alternative crops that offer higher profits, given the current pricing conditions. As part of early recovery initiatives, local councils and civil society organizations have successfully completed various projects across multiple sectors. For instance, the local council in Mare' inaugurated a new industrial city consisting of 50 operational factories and 100 others in the process of being equipped. In the city of al-Ra'i, a significant infrastructure development project, involving the establishment of a major transformer for the industrial zone, has been implemented to facilitate future projects.

In the Autonomous Administration, citizens in Hasakah protested the shortage of domestic gas, which led to its price doubling on the black market to 150,000 Syrian pounds. In Amuda market, remittance and currency exchange companies closed in objection to new licensing requirements that impose financial guarantees and office conditions beyond their capabilities. Additionally, the Customs Department has implemented a new customs system. The updated fees for shipments of vegetables and fruits are as follows:

| Item | New customs fees per ton |

| Potatoes – Tomatoes – Green Onions | 3$ |

| Onions | 10$ |

| Garlic | 20$ |

| Cherries (non-local) | 6$ |

| Bananas (non-local) | 16$ |

| Pineapple (non-local) | 60$ |

The fire brigade in al-Hasakah province has reported crop fire damage in 2023. Approximately 370 dunums of land in the countryside of al-Hasakah city and 418 dunums in al-Qamishli city have been affected.

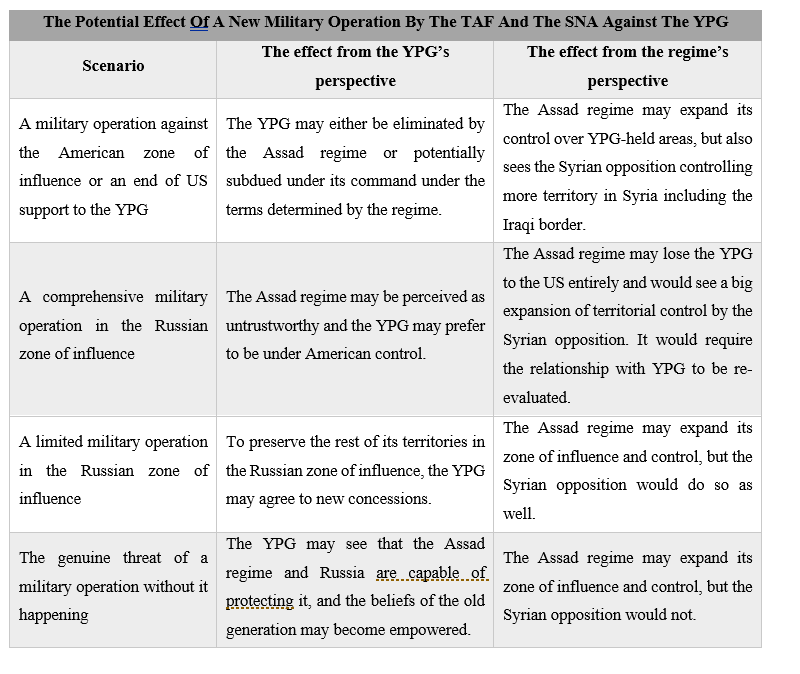

Dynamics in YPG-Regime Relations

While facing a potential new military operation by the Turkish Armed Forces and the Syrian National Army (SNA) in northern Syria, the general commander of the YPG-dominated Syrian Democratic Forces (SDF) stated in his interview with Asharq al-Awsat:

“We are not opposed to the SDF becoming part of the defense organization of the Syrian army. We have conditions, however. We boast over 100,000 fighters, who have spent the past ten years in combat. They need a constitutional and legal resolution. The SDF must have a role and specific distinction in the military. We are in agreement over general issues, but the problems lie in the details.”

He also stated; “I want dispatch a delegation and go to Damscus when the conditions fora solution are available. I want my trip to Damascus to help in reaching a peaceful solution to the current crisis. ”This statement outlines the current relationship between the Assad regime and the YPG. To understand this relationship and how a potentially new military operation may impact it, this report explores the dynamics of the relationship with focusing on the main dynamics that are related to a Turkish-Syrian military operation.

The first dynamic in the YPG-regime relationship is the concept of a common enemy. For both actors, Turkey and the Syrian opposition are perceived as enemies. However, the YPG’s and the regime’s perspectives oppose one another. The YPG perceives Turkey as an existential threat and sees the Syrian opposition as an actor that enables and facilitates Turkish military operations against the YPG. The Assad regime perceives the Syrian opposition as an existential threat and Turkey as an actor that enables the continuing presence and territorial control of the Syrian opposition. But, since 2016 during Operation Euphrates Shield, there was growing cooperation between the YPG and the Assad regime. Both YPG and the regime forces worked together against Turkey and the current situation resulting in YPG-regime signing an agreement in 2019. During this time, the Assad regime protected the YPG along the frontlines with the Turkish Armed Forces and SNA. Furthermore, in the past, the Assad regime handed over predominantly Kurdish territories to YPG as part of their cooperation in capturing Tal Rifaat and their joint fighting to besiege Aleppo city.

In looking at the second dynamic, the American military presence in Syria negatively influenced the YPG-regime relationship due to their support for the YPG. The US enabled the YPG to control vast territories and altered the balance of power between these two actors. The Assad regime and its supporters, including Iran and Russia did not want the US to remain in Syria. Moreover, there is a difference in ideology between the old and new generations within the PKK – the YPG’s main branch – as it relates to its international relationships. While the old generation values historic partners like the Assad regime, the new generation places its trust in its partnership with the US.

Interdependency is the last main dynamic in the YPG-regime relationship. The YPG and the Assad regime both have territorial control that relies on one another to cooperate. For example, the regime's territorial control in Qamishli and Hasakah is surrounded by the YPG and requires YPG cooperation. Similarly, YPG’s presence in Tal Rifaat and the Shaikh Maqsoud neighborhood in Aleppo city is dependent on the cooperation and protection of the regime that surrounds those areas. Since 2019, the Assad regime deployed army soldiers to the frontlines alongside the Turkish Armed Forces and SNA to function as protection to and from the YPG. This is due to the regime units being located in areas that are far away from regime-held territories where if a war broke out or the regime decided to withdraw their forces, then the YPG could have the ability to target and eliminate these units before the possibility of support arrives. Thus, this delineates the interdependency these two parties have with each other with the regime’s ability to provide YPG with the protection requested while also ensuring their weak points are exposed to minimal dangers.

In looking at the prospects of the YPG-regime relationship, the Assad regime has stated that it wants to go back to how things were in 2010, but with a ‘controllable population.’ It would require the regime to either assert full authority or accept some level of autonomy under the Russian reconciliation agreement model. On the other hand, the PKK’s new generation wants to establish an autonomous region in Syria and achieve international legitimacy via the US with the possibility of engaging in deals on the behalf of Syrian between the US and Russia. With that, the old generation believes that going through Damascus could result in international legitimacy, and would be more realistic as they would gain more legal standing and recognition on a local/national level.

Based on this examination, the report provides four different options for a Turkish-Syrian military operation against the YPG that may alter the YPG-regime relationship:

Dr. Ammar Kahf | How important is the conflict in Syria to the EU?

Dr. Ammar Kahf, executive director of the Omran Center for Strategic Studies, commented on the Brussels donor conference, saying, "The pledges were better than expected, except that the focus was always on the aid approach rather than the systematic empowerment approach that the Syrian people need to create more jobs.

For More: https://bit.ly/39vJMvY

Normalizing with the Assad regime, Different Approaches at Different Levels

From the beginning of the Syrian uprising, several Arab countries were almost unanimous in isolating the Syrian regime to punish it for its violations of Arab League resolutions and the rights of the Syrian people. This approach was translated by Qatar’s leadership in the Arab League and the important support of Saudi Arabia and post-revolutionary Tunisia and Egypt into a resolution that led to the suspension of the regime’s membership in the Arab League in November 2011.

In the following years, most Arab countries called on the regime to stop military operations against civilians, and some of them even played a greater rolein actively seeking regime change in diplomatic manners and by supporting and financing the opposition. However, in the coming years, political changes occurred in some Arab countries such as in Egypt and the United Arab Emirates, causing a departure from regime change politics to the restoration of pre-Arab spring MENA security order, thus affecting the regional attitude towards the Syrian regime.

Egypt resumed consular relations in 2013, when most Arab countries took a stand against the Syrian regime, but has not fully normalized its relations with the regime to date. This shows that Egypt prioritizes the stability of the Syrian regime in its foreign policy, as Egypt distrusts the opposition and considers it a proxy for Turkey. Moreover, Egypt prefers to work with the army and considers it more reliable.

The UAE and Jordan, on the other hand, were on the opposite side and supported the Syrian opposition to varying degrees, but after the Russian intervention in 2015, the situation on the ground had changed, which, along with other factors such as the UAE’s attempt to counter Turkey and contain Iran with a different approach in Syria, led to a change in the countries’ priorities in their foreign policy toward Syria. In 2018, the UAE and Bahrain reopened their embassy in Damascus and resumed relations with the Syrian regime. The UAE wants to normalize its relations with the Syrian regime in order to have relations with all parties on the ground.

Similarly, when the Syrian opposition lost control of southern Syria in 2018 and signed reconciliation agreements, Jordan reopened its border with Syria with some restrictions, as it had done before 2015, Jordan has not completely severed relations with the Syrian regime, but it has downgraded its representation. It normalized its relations only in October 2021 after a telephone conversation between King Abdullah and Bashar al-Assad, which was expected after King Abdullah’s speech on CNN during his visit to Washington and after his meeting with President Biden.

Looking at the factors behind this action, the first one seems to be the economic factor, because the country is in a difficult economic situation, aiming at normalization and cross-border trade, as the Arab gas pipeline will help the Kingdom’s economy. In addition, the security factor is not as important as the economy, but it plays a role because the Kingdom is concerned about stability on its northern border and normalization will help in security coordination with the Syrian regime to prevent possible threats.

2021, the beginning to regime regional re-integration

In the last quarter of 2021, more precisely on November 9, 2021, the Foreign Minister of the United Arab Emirates, Abdullah bin Zayed, visited Damascus as the highest UAE official since the beginning of the Syrian uprising in 2011. The visit came at a time when the idea of normalizing relations between Arab countries was discussed among Arab officials, and some expressed this on various occasions. In addition, Jordan’s King Abdullah spoke to Bashar al-Assad by phone in October last year, removing doubts about relations between the two countries.

At the same time, Egypt, which has maintained close relations with the Syrian regime in recent years, has not yet fully normalized its relations. So, if we look at the approach of each country, we can examine the differences between these three actors in the region-Egypt and the UAE, Jordan-in terms of timing and level, as well as their advocacy for the Syrian regime. Timing shows how long these countries have been linked to the regime, while level shows how deep these links are. Advocacy shows which countries are committed to the regime’s return to the Arab world.

As for the level, not all countries that normalize with the regime do so to the same degree. Egypt has played a role in supporting the Syrian regime, although it has not yet fully restored its relations with the country. There are several reasons for this, such as the desire to maintain relations with the Gulf States, as they have led the front against the Assad regime.

Egypt’s main objective is to view this relationship from a political and security perspective. The UAE, on the other hand, is looking at the relationship from an economic and political perspective. They want to participate in the reconstruction process in the coming years. Therefore, its normalization process with the Syrian regime has taken place without any conditions.

Although it has not severed its relations with the regime, Jordan has taken positions close to the Syrian opposition over the past decade, but has kept its border open with the Syrian regime for economic reasons. The Kingdom believes that normalizing its relations with the regime will help its economy recover and that it wants to play a role in resolving the conflict. Jordan has also sought to reactivate the bilateral agreement with Syria on various issues such as water. It also wanted to reactivate the Arab Gas Pipeline to reach Lebanon through Syria, which is part of the kingdom’s ambitions to become an energy hub in the region.

What sets Jordan apart, however, is that it is not only Jordan that wants to engage with the regime, but also brings along other countries that have the same idea of changing the regime’s behavior through concessions and vice versa. It is an approach that has met with the approval of the Biden administration. As part of its strategy to manage the Syria conflict by focusing on changing the regime’s behavior rather than regime change, this administration’s new approach to Syria is the opposite of the previous administration, which pursued a policy of maximum pressure.

In March 2022, another important UAE rapprochement with the Syrian regime took place, namely Bashar al-Assad’s visit to the country. This visit is considered very significant, mainly because it was al-Assad’s first visit to an Arab country since the beginning of the uprising. The visit can be analyzed from various points of view, such as future investments, the possibility of the regime’s return to the Arab League, and Iran’s influence.

The possibilities of reinstating the Syrian regime in the Arab League

In terms of support for the Syrian regime, not all of these countries are equally committed to Syria’s return to the Arab League in order to normalize the country’s relations with the world, but we can see some differences. In late January this year, Arab League Secretary General Ahmed Aboul Gheit said that Syria’s return to the Arab League was not discussed at the consultative meeting of Arab foreign ministers in Kuwait. He later added that Syria’s return to the Arab League depends on consensus among Arab countries. These are indications that a return is unlikely at the next summit.

The irony is that Egypt is playing a role in the Syrian regime’s return to the Arab League but has not yet fully normalized its relations with the Asaad regime, which could happen in the near future. As mentioned earlier, Egypt sided with the Syrian regime under President Abdel Fattah al-Sisi, and the two countries have since restored consular relations.

The UAE changed its stance on Syria after 2015 until it normalized its relations with the regime. After that, they began to support the Assad regime and promote the normalization of their relations with other countries in the region. They went even further by calling for the lifting of sanctions imposed on Syria.

In Jordan, however, we see a different approach that accepts the current status quo in Syria as a reality. For example, Jordan does not fully side with the regime in the Syrian conflict, but rather seeks to benefit from the opening of its relations with the Syrian regime on an economic level and restore the situation to what was before the border between the two countries. In doing so, it advocates its approach to Syria “step by step” as a comprehensive plan for dealing with the regime.

Ultimately, these approaches are similar in some respects, but they are not identical. This means that not all of the approaches these countries are taking have the same goals. Moreover, not all countries approaching the Syrian regime can be considered allies of the regime; rather, it is about their needs.

Finally, these approaches are similar in some respects, but they are not identical. This raises the question of which of these approaches will be successful and how this will affect the situation on the ground. To what extent these approaches will be able to bring the Syrian regime back to the Arab League.

So far, these approaches have not been able to change the position of Riyadh and Doha in terms of normalizing relations with the Syrian regime, which may show how effective these processes have been so far. On another level, will the relations between the Syrian regime and the international community remain the same? Will we see some changes in the position of some countries like the U.S., or could other approaches be taken?

Establishing a National Farmers’ Association (NFA) in Opposition- Held Areas

Introduction

In opposition-held territories, the agricultural sector suffers from a variety of complex challenges. Among those challenges is that supply exceeds demand due to poor planning, absence of refrigerated storage facilities, weak purchasing power, absence -or limited- presence of food production factories, and the absence of export channels. Although some exports have moved from Syria to Turkey, they remain limited in quantity and continuity. Most sellers were left with no choice but to sell their products at unfairly low prices, with a high cost of production and export logistics, leaving them with little if any margins of profit. Such challenges have prevented agricultural production from employing the necessary workforce and strengthening the food cycle throughout the years. The current governance dynamics prevents farmers from securing effective solutions, and therefore the farming community continues to endure losses. This has drastically affected the development of the agricultural sector within these regions.

The following paper covers some of the agricultural sector's challenges and proposes recommendations to empower its sustainable growth. The outlined recommendations may offer some solutions to achieve the minimum level of recovery of costs and create a plan of action.

Accumulated Challenges

The problems faced by the agricultural sector, whether in terms of supply or demand, can be summarized as follows:

Governing bodiesignored the calculations of the absorptive market capacity (demand) of agricultural crops, which increased the financial losses and caused a weak valuation of the sector. For example, based on a 2020 study by the General Organization of the Seed, for onions and potatoes crops, the General Organization for Seed Multiplication estimated the surplus local onions production at 25% and local production of potatoes at 19%. The percentage was estimated without considering the worker's wages, as farmer hardly earns $100 per hectare of onions, while their loss is $1,668 per hectare of potatoes.

In addition to inaccurate calculations, farmers also endure difficulties in exporting produce. Exporting agricultural products from opposition areas to regime-held districts is neither easy nor feasible because of the high transportation costs and bribes to guards at regime-held checkpoints. For example, a kilo of onions in al-Bab area is estimated at the writing of this paper at 200 Syrian Pounds but reaches 500 S.P in Damascus' markets(1) There are also high costs and difficulties in exporting produce from opposition-held territory to Turkey. In June 2018, the opposition areas exported only 4,000 tons of potatoes to Turkey, even though the local production of potatoes was around one million tons. Among the difficulties is the local council’s low capacity to facilitate exports with Turkey. Usually, Turkish authorities show interest in importing commodities from the opposition area, requesting lentils, chickpeas, pistachios, pomegranates, cherries, potatoes and onions, according to their needs in cooperation and coordination with local councilswho mediate between the Turkish government and local Syrian fermers(2)

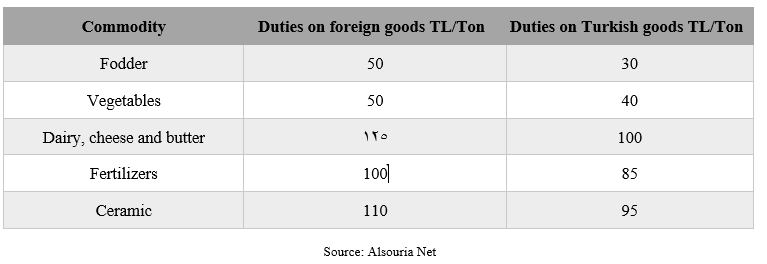

Furthermore, current procedures implemented by Syrian Interim Government do not accurately facilitate the market balance between goods imported from abroad and those produced locally. This leads to the dumping of produce by the local market due to imported items creating a surplus in the market. This became relatively frequent after March 2021, when the Syrian Interim Government reduced customs costs for Turkish goods entering the areas of Aleppo countryside through the Al-Salama, Al-Ra'i, Jarablus, Al-Hamam, Tal Abyad and Ras Al-Ain crossings, as the following table shows(3)

It is evident that the agricultural sector is suffering for a multitude of other reasons. These reasons include the negative impact of the industrial sector, high costs of raw material, lack of accessibility to energy sources such as water, electricity, and fuel, the low purchasing power of citizens, and the unstable security environment. Water has become an issue across the region, but Al-Bab in particular, has suffered from lack of water due to the digging of random wells and draining of the strategic water reserves.

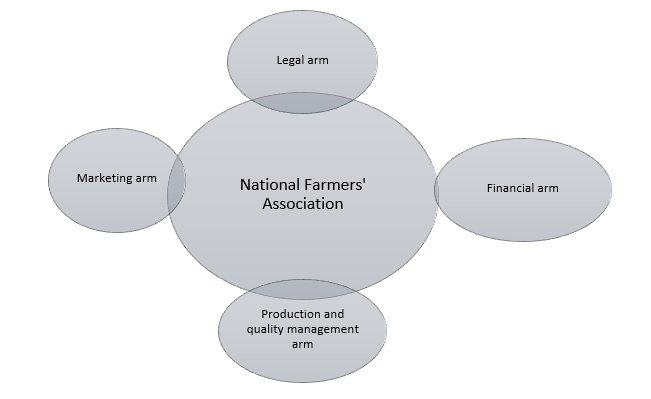

Establishing a National Farmers’ Association (NFA) as a First Step

In order to understand the issues and minimize its negative impacts, there needs to be direct communication and support with non-governmental civil bodies in the agricultural sector. Among those bodies are farmer cooperatives. Communication with both official and non-official institutions to create a strategic plan to regulate agricultural production would achieve national interests and local production and agricultural capital sustainability. To achieve that, the area may establish a National Farmers’ Association (NFA) as a non-profit, non-governmental, agricultural association that brings together local farmers’ associations and agricultural societies and unions scattered in the region outside the government control. The NFA would employ experts and build communication networks across institutions and organizations, such as the Directorate of Agriculture in the Syrian Interim Government, the Organization for Seed Multiplication, local councils, and the Federation of Chambers of Commerce and Industry, and relieforganizations. It will also be tasked to develop an integrated plan to help such institutions to better manage the agricultural sector in terms of quantity and quality, supply and demand while adopting a trademark for local agricultural crops, health specifications, and quality management that conform to international standards.

To enhance communications, the NFA may issue quarterly reports that include an economic index to measure the growth of the agricultural sector to enhance the values of transparency.

As shown in the figure below, the NFA would be a public body comprised of farmer unions/ associations from every city and town who select a national entity. This new entity would then establish the supporting offices that include: (1) a Legal Office to consider the affairs of agricultural licenses and property rights, control the investment process, issue instruments, and control violations. (2) Marketing Office promotes products and projects to investors and investment entities, negotiates with governments, and signs memorandums of understanding and work protocols to promote agricultural crops and secure consumption channels. (3) Production Management Office that will adapt the production plan to the market needs of food, industry, storage, export and other needs, (4) Financial Office that will be responsible for the transactions, financial liquidity, and the funding and crediting process.

The NFA can preliminarily work in four tracks:

A. Trademarking for Syrian Agriculture

This track includes structuring the agricultural process as a whole and attaining a certificate of confidence from farmers in their willingness to work with the NFA. This process will allow farmers to be included in a registry that will be followed up with regularly.

The other step is to stamp the crop with the NFA's “stamp” to indicate that the product conforms to international health and agricultural specifications. This will enhance the NFA’s control and trust in Syrian communities and abroad. These two steps will motivate the farmer to return to his land and gain greater confidence in both his/her work and product.

B. Regulation of the production process

The failure to consider the balance between supply and demand has led significant increases or decreases in prices. The NFA would intervene to advance the calculations around production to determine the quantity of production, demand, and whether consumption, manufacturing, or exporting, are the necessary response. Through these proper calculations, the NFA would be better able to manage the production process costs and prevent financial losses for farmers eventually.

C. Policy Recommendations to Local and International Actors

Through its reach and capacity, the NFA will be able to issue recommendations on the agricultural sector in Syria to key stakeholders. The NFA would submit recommendations to the Syrian Interim Government, communicating them to relevant governance bodies. This will help enact protectionist policies that limit the import of any product similar to the specifications of the local one, thus reducing the dumping of local produce and harm to farmers. Recommendations may include imposing taxes and duties on every imported product similar to the local product. This will protect the local product, raise its competitiveness, and diversify markets.

D. Product Marketing

For the marketing process, the NFA should focus on two aspects: (1) the legal basis of contracts and covenants for agreements between two parties. The agreement documents will be in accordance with the international legal framework, and (2)the NFA will strengthen the assets of power and negotiation with Turkey on imports and exports to and from opposition areas, including the transit of local products through Turkey’s territory for exports abroad.

E.Developing the Finances surrounding the Agricultural Sector

The lack of financial institutions, such as banks, in opposition areas, has contributed to decreased sources of credit and created a fragile environment for funding and payments. The exchange rate and prices are constantly fluctuating. The NFA can design a financial program that regulates the credit and funding process based on the environment and situation. This includes signing work protocols with organizations, companies and banks, opening bank credits in Turkey and other countries to facilitate the payment and receipt process, and issuing special farming financial instruments(4) to be sold to Syrian investors at home and abroad with the guarantee of the NFA. The NFA can also direct funds to support the food industries sector and various industries in the agricultural sector.

Conclusion

Although establishing a new body is difficult for the local community, it is fairly necessary. The costs of establishing the NFA is minimal compared to the depletion witnessed by Syria’s agricultural sector. The region will reap the fruits of this work, not only by finding nearby and far markets for selling products but also by increasing confidence in the Syrian product, organizing the production process of agriculture, funding food facilities and factories, enhancing the local supply chain, and finally pushing the process of early economic recovery forward. This will present an opposition governance model capable of creating “stability” within a particular aspect

([1]) The farmer sells a kilo of onions for 200 pounds, and the cost of transporting it to Damascus is 300 pounds, Syria TV, 26-01-2021, link: https://bit.ly/3CSLdyA

([2]) Turkey starts importing potato from war-torn Syria, 27-6-2018, link: https://cutt.ly/zRC8lhw

([3]) “The Interim Government” announces a reduction of customs duties of Turkish goods, Alsouria Net website: 14-03-2021, link: https://cutt.ly/XRC3zs3

([4]) Sukuk: Securities from the Islamic Sharia-compliant financing tools. The instrument is linked to specific projects and investment opportunities that are already existed or under construction. The instrument is equal to the value of a share in an ownership, and the holder of the instrument takes profits and has the right to participate in the management, capital, and trading. There are many types of instruments in Islamic Sharia, known as Sukuk (instruments),such as al-Mudaraba, al-Murabaha, al-Istisna’a, al-Musakah, al-Muzara’a, Ijara, services, and others.

Navvar Saban | Will Syrian regime launch new battles in opposition regions?

Navar Saban, expert in military situation at the Omran Center for Strategic Studies in Istanbul talking with Enab Baladi about the recent military developments in southern Idlib and mainly near the M4 and the possible scenario for the M4 agreement.

Briefing on Latest Developments in Idlib

I. Introduction

Both Turkey and Russia agreed to a ceasefire in Idlib starting at midnight on March 5th,2020. At the time, both sides saw this agreement as representing the least worst case scenario to preserve its interests on the ground and prevent further escalation between different actors. On one side, the Russians and regime forces heavily escalated systematic attacks on civilians and basic infrastructures driving over 1.1 million civilians towards the Turkish borders, hence putting pressure on Turkey and indirectly on Europe. The regime aided by the Russian airforce regained control over vacated villages in the Idlib province and was advancing on more heavily populated areas. On the other hand, after several attacks by the regime against Turkish military forces, the Turkish army heavily escalated its presence and equipment in southern Idlib and broke away with previously agreed “rules of engagement” by attacking regime and Iranian backed forces to stop its advance and prevent further displacement of the civilian population. The agreement hence, was a temporary freeze of operations by all sides. It included the following core elements:

• A ceasefire from the morning of March 6, 2020 along the frontline.

Regime artillery continued to target several locations in the vicinity of the new buffer zone north of the M4, Sources confirmed that 56 violations done by the Regime March 6 to March 31 of the same month.

• Establishing a security corridor six kilometers north and six kilometers south of the main international highway in Idlib "M4," which links the cities controlled by the Syrian Regime in Aleppo and Lattakia, and open an internal crossing between the Regime and Opposition held areas.

Because of the new Corona (COVID19) and the fear of an outbreak of the disease, the interm government in Idlib decided to close all the internal and external borders in Idlib and western Aleppo, but in April 17, 2020 HTS announced its intention to open a commercial crossing with the regime that links both Saraqib and Sarmin, which met with widespread disapproval among civilians and demonstrated near Sarmin objecting to the matter.

• Joint Russian-Turkish patrols to be deployed along the M4 road, starting March 15.

As of April 18, 2020, no full joint patrols were conducted for the entire route for security and logistical reasons. A group of civilians built tents along parts of the road, refusing the passage of Russian patrols, while some military factions took advantage of the situation and worked to further destabilize the security situation. Sources of the Information Unit at Omran Center confirmed that these factions are affiliated with HTS. HTS has been taking steps to indirectly create problems and then present itself as part of the solution in an attempt to legitimize its presence in any future security architecture.

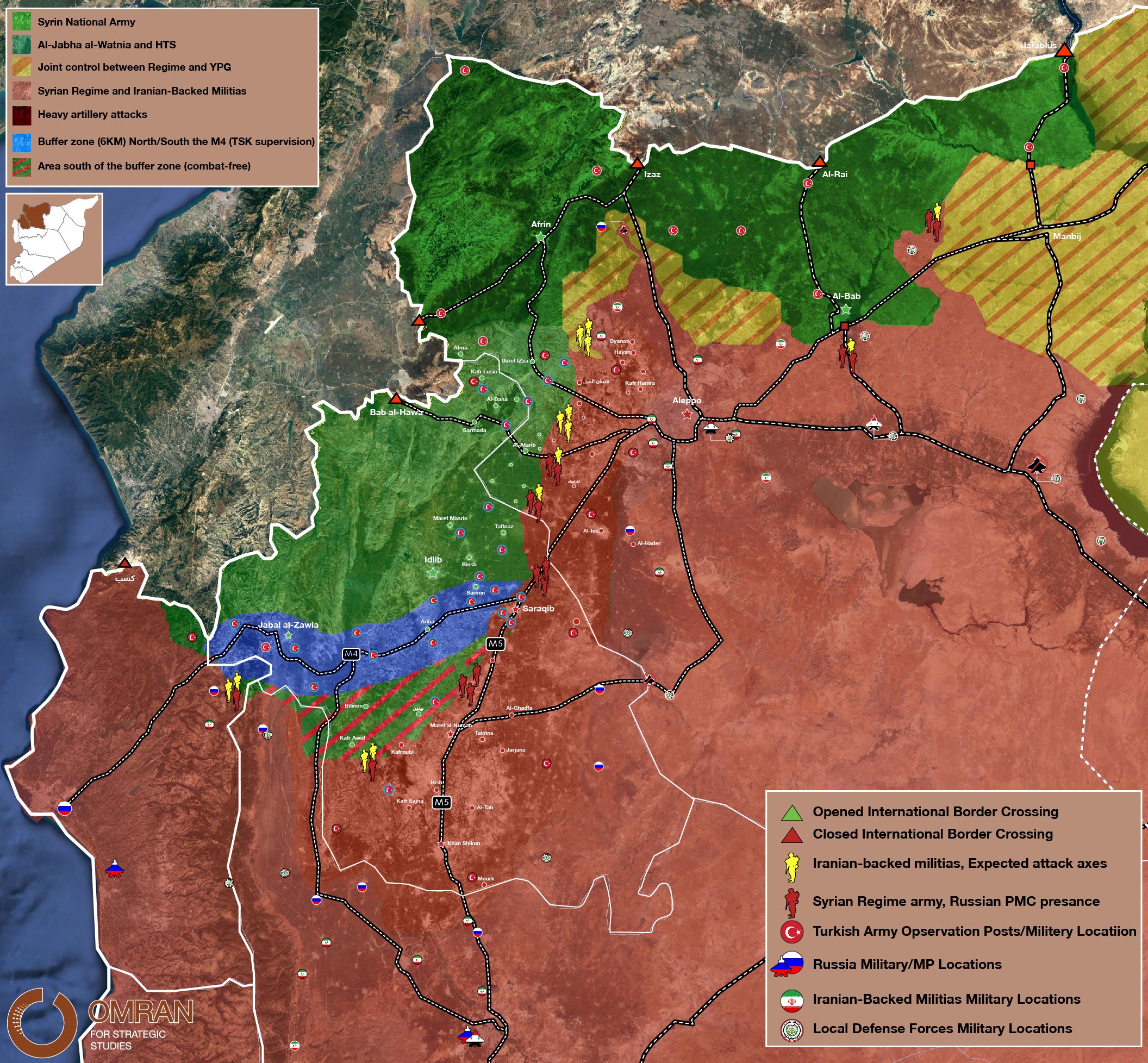

II. Updated map of control in Idlib and its surrounding areas

Updated Control map of Control in Idlib by Information Unit in Omran Centre – 18 April 2020

III. Major developments of the "M4" agreement

A. Turkey’s four current goals

1. Preventing the threat of Corona (COVID19) especially in IDP camps. This can be observed through the strict measures at border crossings, reducing to the maximum interactions with locals, pushing IHH organization to improve its plans, as well as high engagement by AFAD.

2. Increasing Turkish Military posts defense and sending more vehicles and soldiers in the past weeks to establish new posts in Jabal al-Zawyie and al-Ghab Plain.

3. Opposition factions: restructuring National Liberation Front (NLF) by arresting and demoting corrupt commanders, requesting from each faction to call fighters to training camps to compare numbers of fighters and ending any possible connection between groups and other countries in order to ensure order and containment.

4. The M4 agreement with Russia: Turkey is pushing hard for the joint patrols on M4, which has been facing obstacles through sit-in demonstrations by some local actors with direct threats from HTS sub-entities. Turkey is carefully trying to end this situation without using force and by negotiating with the locals. Resolving this situation is a top priority before May in order to prevent any Russian military acts.

B. Positions of local and international actors in Idlib

1. The joint patrols along the M4 highway is Russia’s main priority. There were little if any statements by Russia calling upon Turkey to implement the agreement during February-April, unlike early January. Russia is focusing on dealing with the Corona pandemic and countering increased ISIS threats in eastern Homs, Daraa, and Deir Ezzor.

2. Several news sources indicated that the UAE is pushing the regime to launch a new attack on Idlib and giving promises to fund such an operation. Russia asked the regime not to launch any attack after regime unilaterally and without consulting the Russians sent reinforcements to Idlib.

3. The presence of Iranian-backed militias in Idlib is less than other areas in Syria. However, for Iran to establish a foothold it needs to send more fighters and to launch a limited attack. IRGC-affiliated militias are present in Kafrnabel but are not the main attacking force. Once again, Iran is using its old methods: initial expansion in new areas followed by provision of basic services for local communities.

4. The recent Turkish/Russian agreement put further pressure on HTS by pushing it to re-share power in Idlib with NLF. Furthermore, the Turkish heavy military presence and the deal with the Russians is making Jihadist inside HTS angry and pushing them to breakout. This can be seen in the resignation of Abu Malek al-Talli, and the sit-in protests on the M4 by offshoot members of HTS.

5. HTS has been taking steps to restructure itself, and started by forming 3 new divisions and mixing the hardcore jihadist groups with other less radical members under the leadership of local members.

6. HTS seems to attempts to contain and weaken the more extreme elements within its ranks in order to reduce the risks of possible defections and ensure a future smooth transition from a Jihadi group to a political Islamist group. It is also taking steps to continue its local control over governing bodies such as the Salvation Government.

IV. Future directions

1. There will most likely not be a major regime attack in the near future and even from the opposition side too.

2. May is the month of action for the Turkish sides in order to get ready of the difficult situation surroundings the M4 agreement.

3. The area is witnessing more Iranian-backed militias activities, those activities will increase I. The future in different levels (Economic, Security and military)

4. COVID19 is not the main concern for the local and international actors in Idlib; positive reading is confirmed from the Opposition held areas in Idlib.

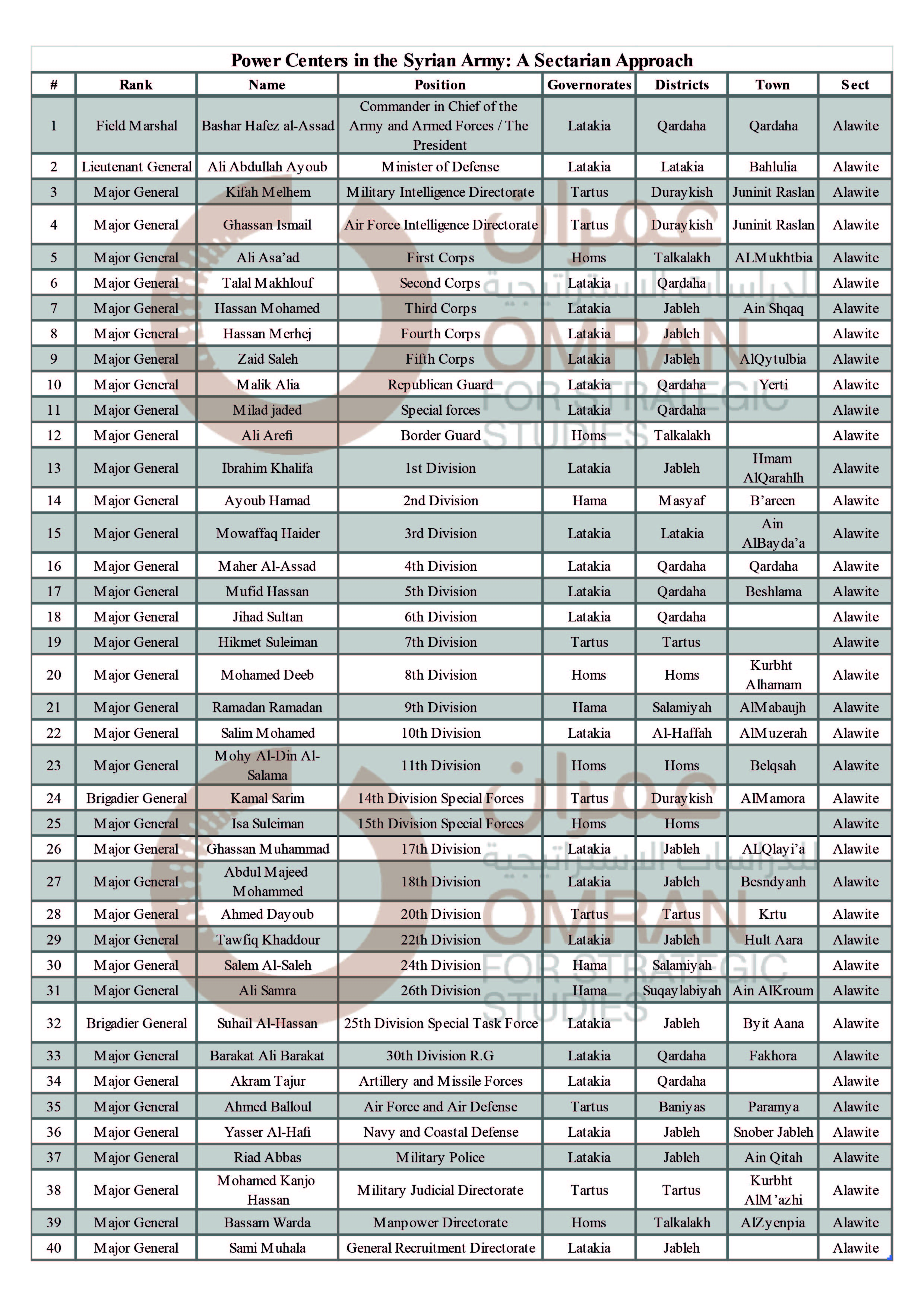

Power Centers in the Syrian Army: A Sectarian Approach

Executive Summary to Original Arabic Paper:

- Within the "Trinity of Leadership" approach which employed a sectarian balancing act, Hafez Al-Assad engineered the Syrian army’s centers of power in a manner that ensured loyalty to his regimes while preventing it from becoming a political tool against his authority. Post 2011 revolution, however, the sectarian engineering of the Syrian army tilted in favor of more Alawite officers assuming most leadership positions within the various layers of the army’s command.

- This paper examines the sectarian and territorial distribution of the most powerful 40 positions in the Syrian army as of March 2020. The paper concludes that those who occupy these sensitive positions are officers from the Alawite sect, including the Commander in Chief and the Minister of Defense, the commanders of the Military Corps, and the leaders of the intelligence branches of the Ministry of Defense.

- Latakia officers control 58% of leadership positions, Tartous officers control 17%, Homs officers 15%, while Hama officers control 10% out of these leading positions.

- There are undisclosed quotas between officers from Qardaha, Jableh, and Duraykish, where officers from Jableh command three corps and several powerful divisions. While Qardaha officers take command of a corps and an officer from Homs leads another corps.

- Qardaha officers take on the most powerful and varied of the military divisions. Whereas, two officers from the same village near Duraykish town, in the Tartous countryside, command the most powerful intelligence branches in Syria.

- The central powerful positions of the army are mainly occupied by officers from Latakia governorate, more specifically, from Jableh and Qardaha.

The following table shows the sectarian and territorial distribution of the most powerful forty positions in the Syrian army nowadays. The table also contains the names and regions of those high ranking officers including the Commander in Chief, the Minister of Defense, the Corps commanders and leaders of the formations and military division, in addition to some security and sensitive leading positions within the Syrian army:

For More in Arabic: http://bit.ly/39QaU42