Media Appearance

Salary Increases A Syrian Regime Policy Driving the Militarization of Society

Executive summary

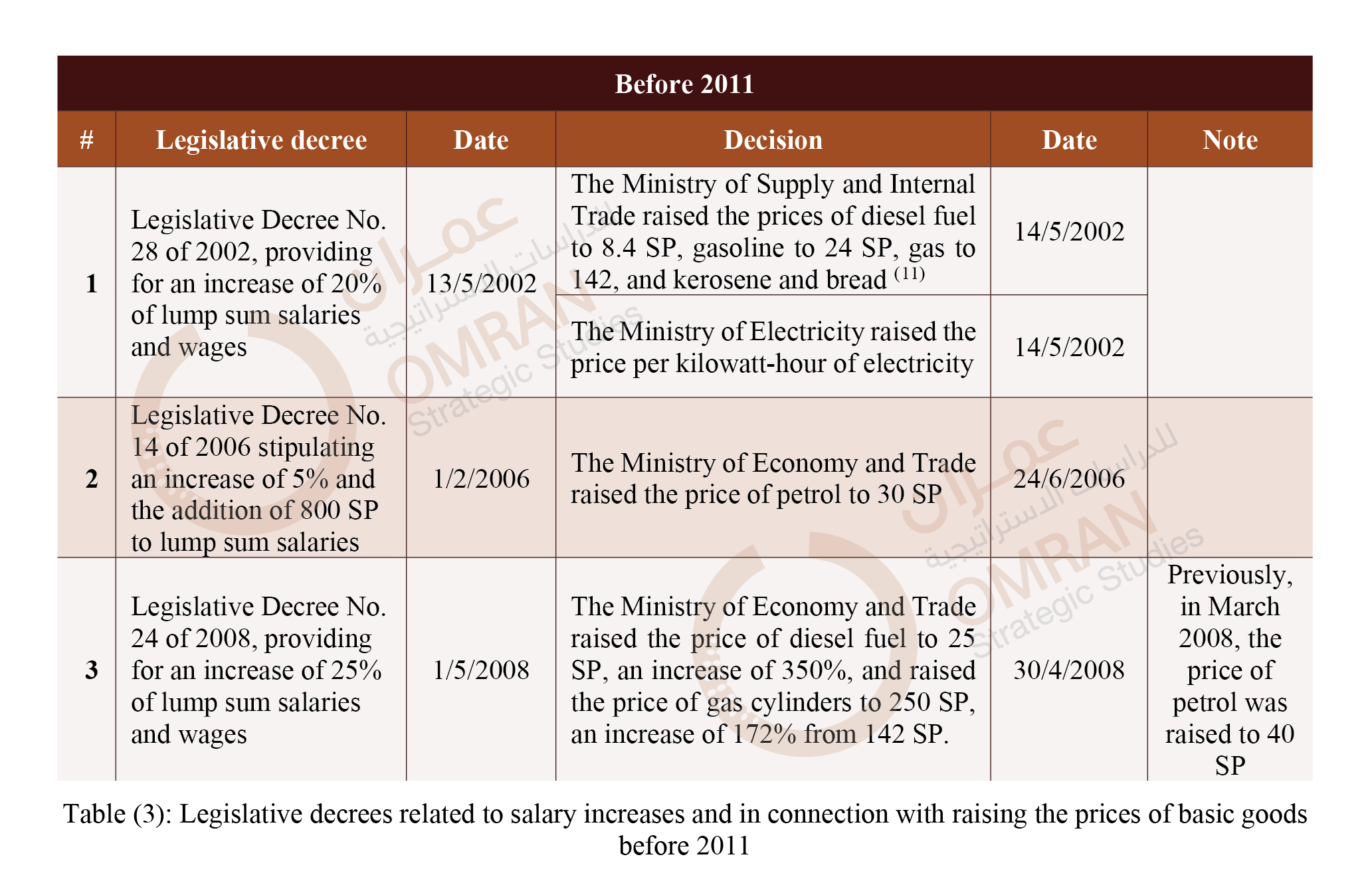

- There is a prevailing pattern in salary increase process in syria along two main trends: Pricees of subsidized basic goods are increased by the regime’s government and soon after the head of the regime increases salaries, or vice versa, so that when salaries are increased by the head of the regime, then the government increases the prices of goods. In both cases the price of basic goods or salary increases happen within a very short time frame.

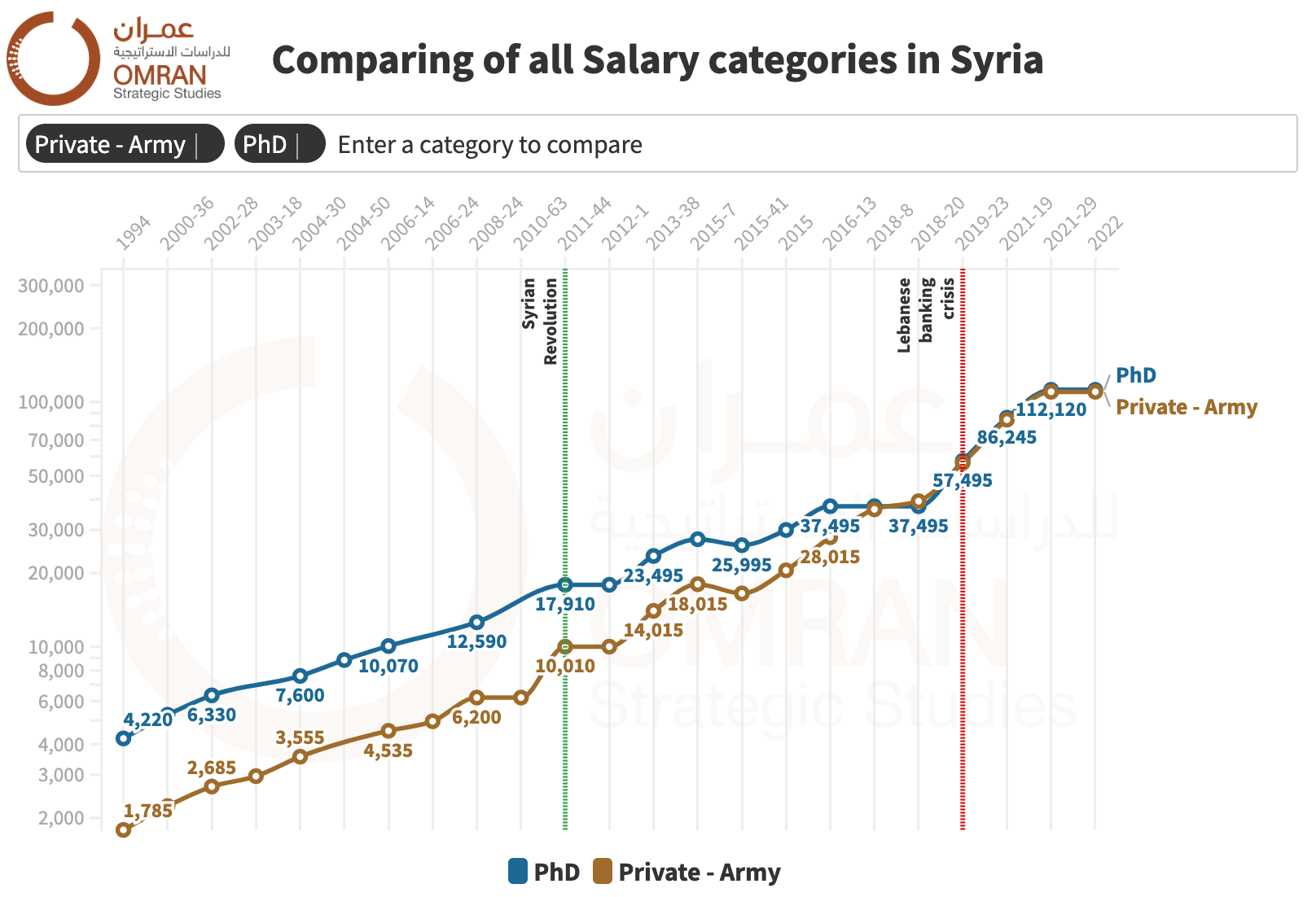

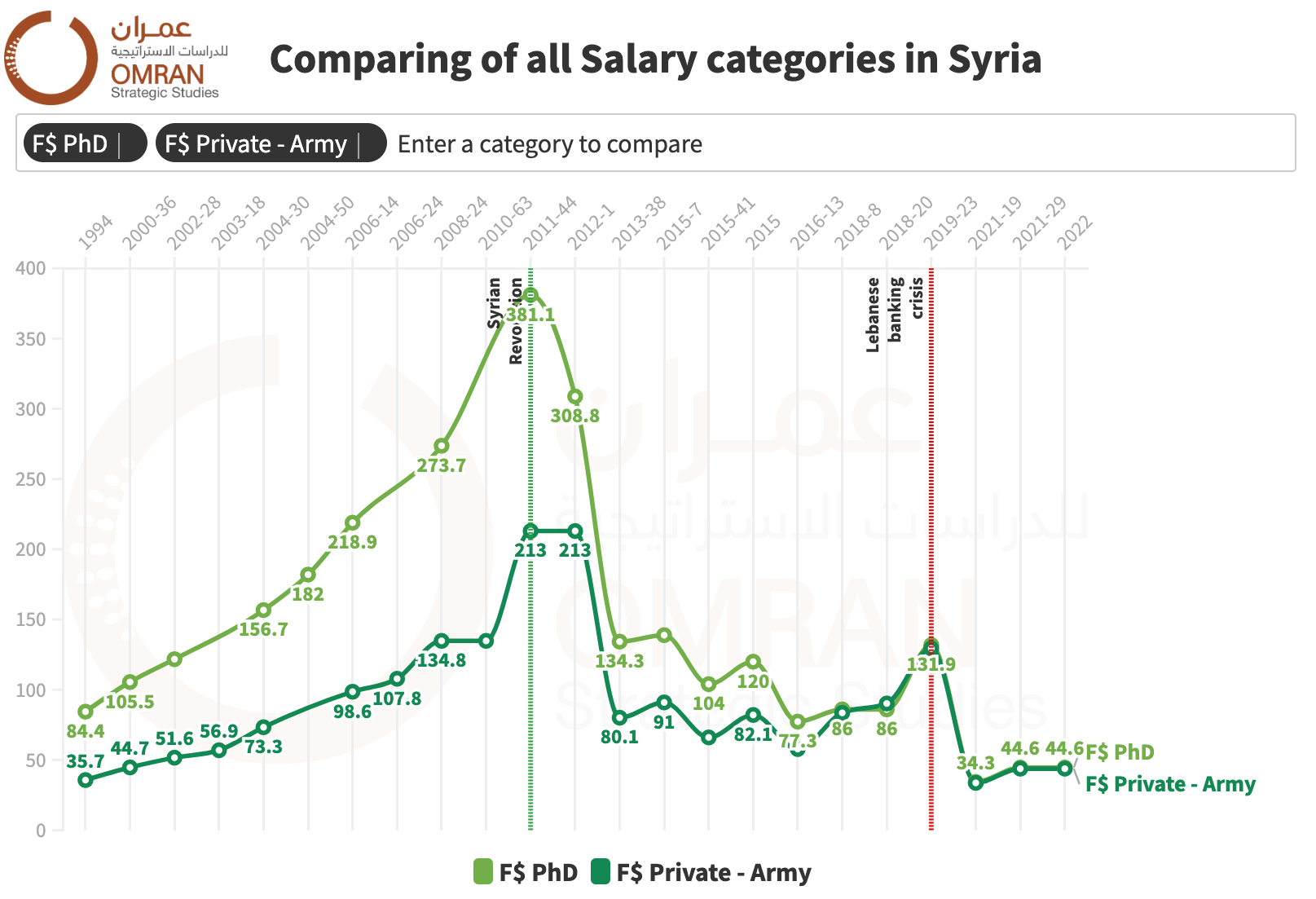

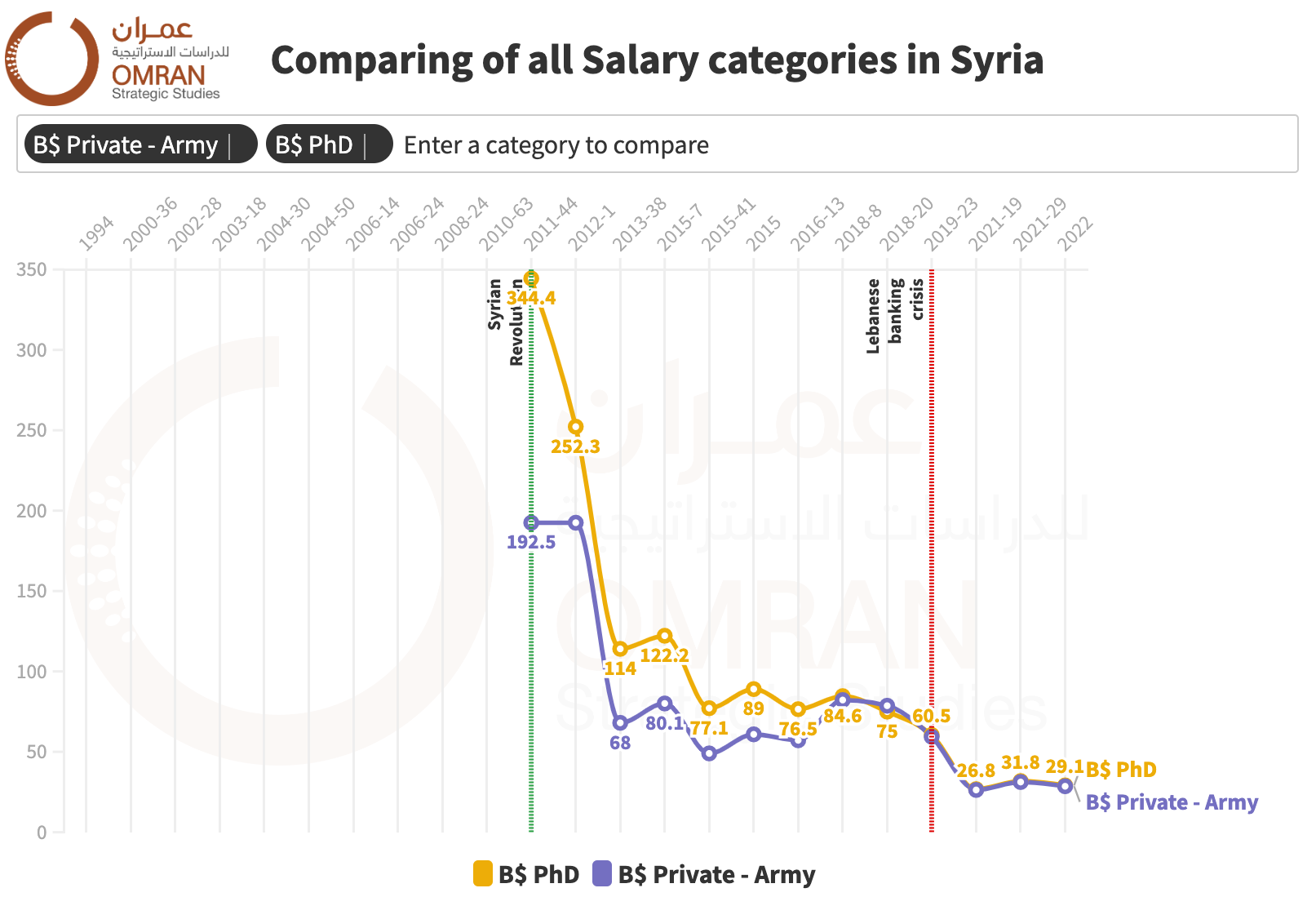

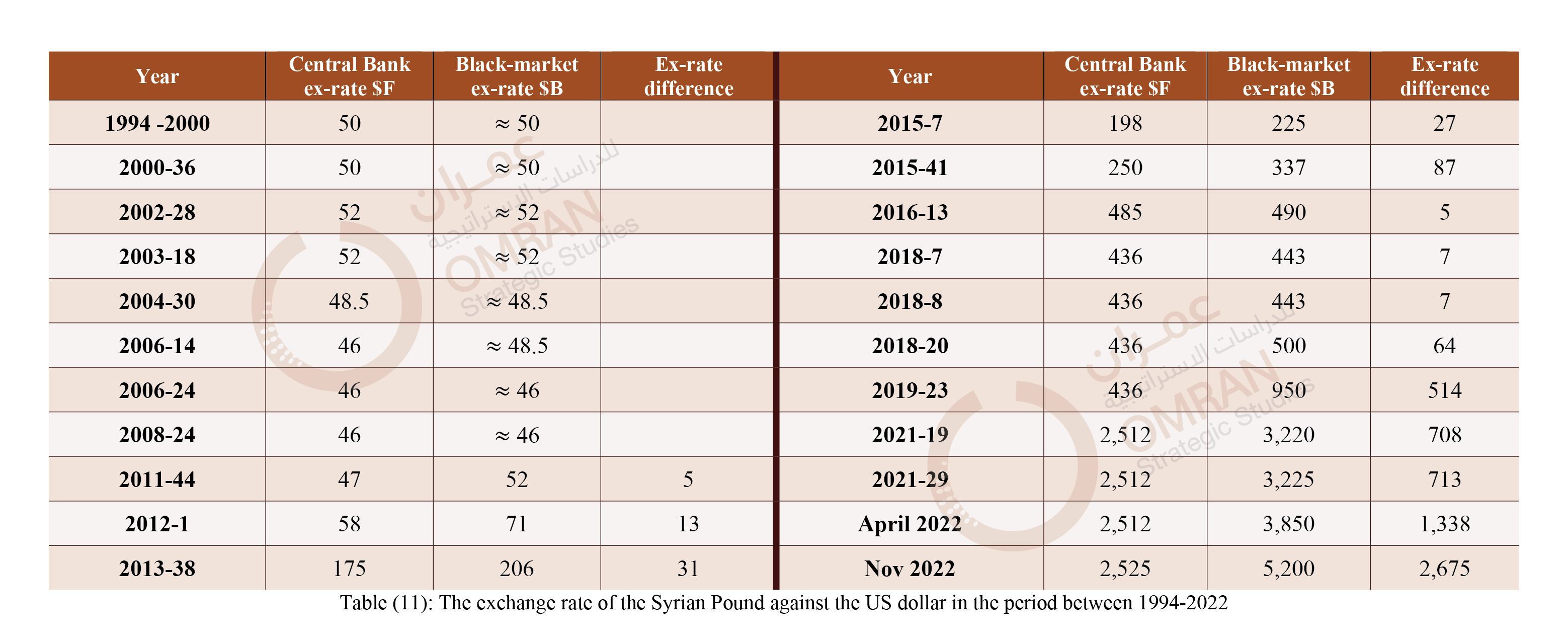

- Salaries reached their peak against the dollar in April 2011, before shrinking against it despite the successive increases in salaries. Today, salaries have reached lowest levels against the dollar since 2000.

- Salary increases were decided in equal proportion between the civil and military sectors until 2018 when Bashar al-Assad exclusively increased the salaries of army soldiers several times, while civilian salaries were not increased.

- Salaries are shrinking compared to the cost of living, as the minimum salary of 92,970 Syrian Pound is barely enough to cover expenses three days a month due to the deteriorating economic conditions in the country.

- Salary values denominated in dollars indicate a clear impact of the Lebanese banking crisis that began in 2019. This crisis was reflected in the depreciation of the value of the Syrian Pound against the dollar, and thus the value of salaries.

- The salary increase policy is one of the leading factors in the further militarization of society, by pushing young people to join the military or join militias and become mercenaries operating both inside and outside the borders of the country. This became an additional factor driving migration.

- The salary increase policy was adopted by the regime because it needed to motivate large groups of people to join official military institutions or militias. That is done by ensuring that the salary of the lowest ranking soldier in the military sector is greater than the salary of the highest income earners in the public sector.

Introduction

The problem of syria's public sector salaries, both civilian and military, is one of the chronic problems with historical roots extending back half a century. During the era of Hafez al-Assad, public sector employees experienced long consecutive years of deterioration of the value of their salaries as a result of the government’s economic policies, which continued into the era of Bashar al-Assad. This was despite his "attempts" to improve the living conditions of public sector employees at the expense of supporting other sectors such as agriculture and industry.

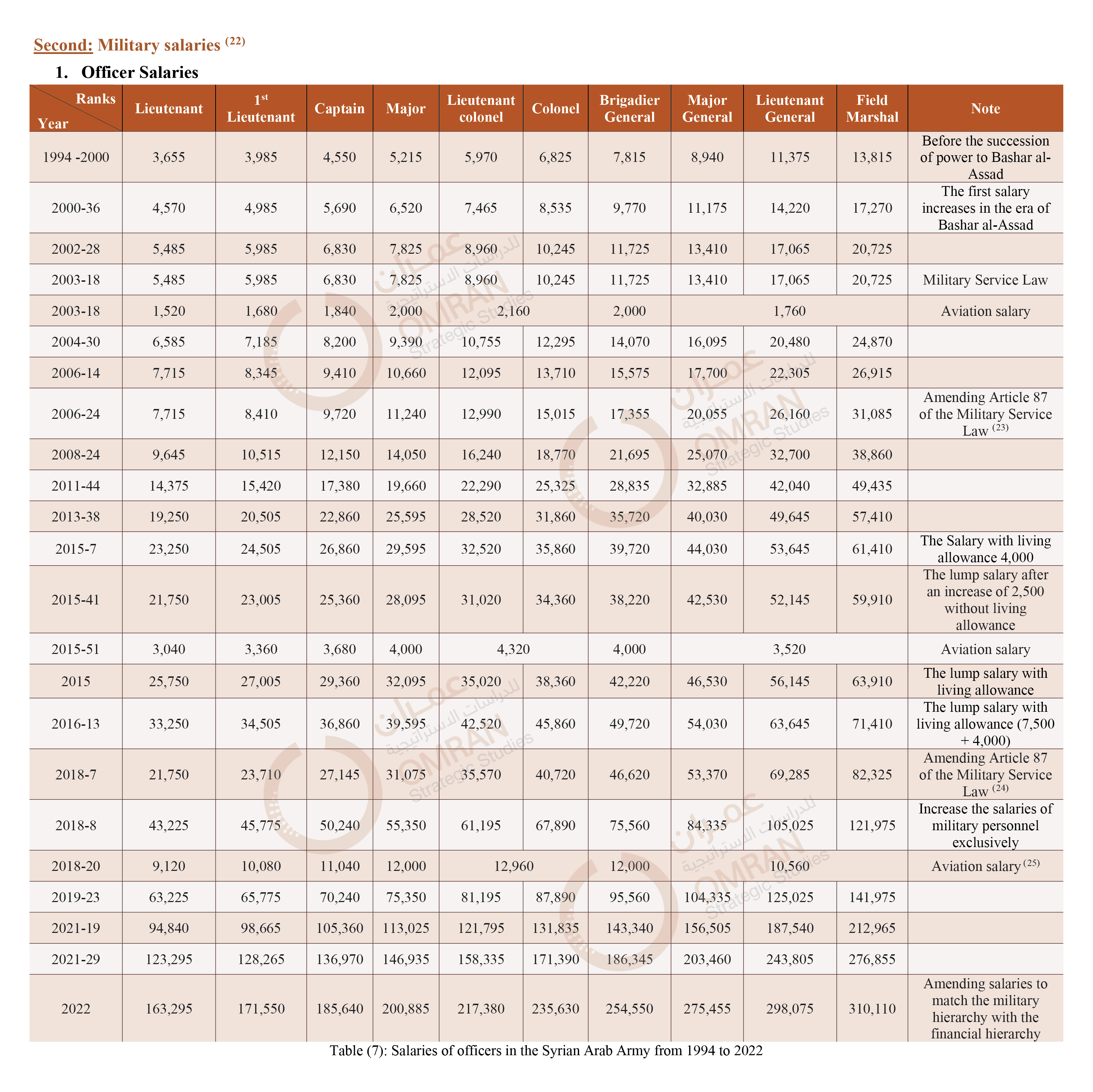

The difference between the salaries of civilians and the military personnel was of little importance, as the overall goal was to pay attention to the salaries of the public sector as a whole, including the military. However, developments since 2011, have shed light on the various aspects of the state, including how it disperses salaries. However, until now the information has not yet been properly detailed nor has a proper comparison that accurately assesses the differences in civilian and military salary increases in Syria been attempted.

Civilian public sector salaries are determined based on the state’s basic labor system(1). while military salaries are determined based on the Military Service Law for army soldiers(2),and the Internal Security Forces Service Law for members of the Internal Security Forces. Their executive instructions are issued by the Commander-in-Chief for the army and armed forces(3).

Historically, salary increases were issued by legislative decrees from the head of the regime during both the eras of Hafez and Bashar al-Assad. Salary increases have never been issued by the relevant state institutions; nor have there ever been any successful calls or pressures to increase salaries; neither the parliament nor the trade unions have any role since they were under direct command of Hafez al-Assad in the 80’s.

Salary increases have always been associated with an increase in the prices of basic goods; the prices of which are set by the government. These increases also included an increase in equal proportions in both the civilian and military sectors. As for the increases that took place after 2011, they came as a result of the increase in inflation and the decrease in the exchange rate of the Syrian Pound. The latter were accompanied by steady increases in the prices of basic goods in light of the deteriorating living conditions.

By 2018, military salaries were raised exclusively without any relation to increases to civilians in the public sector. In some cases, only certain groups of military personnel received raises while others were excluded. In addition, a pay gap started to appear in favor of military personnel over the Internal Security Forces even though by law they had an equal salary scale. The Internal Security Forces’ suspicions were not in vain since a legislative decree contained in Article 87 of the Military Service Law annulled the current salary scale and replaced it with a new scale that includes higher salaries without being determined by a specific percentage.

This paper assesses all public sector salaries in Syria starting in 1994, the last year in which salaries were increased by Hafez al-Assad, until 2022. The paper analyzes the trends of increases in general to detect patterns in the policy approaches of the regime regarding salary increases between the civilian and military sectors; to provide a comparison of civilian and the military salaries, find their values and what they are equivalent to in dollars according to the central bank and the black-market rates, as well as the value of income taxes imposed on them. The paper provides an interactive tool that helps make comparisons between different salary categories in the Syrian Pound and the US dollar, through the use of quantitative analysis tool, relying on official sources and mathematical equations to reach the value of salaries and ensure their validity(4).

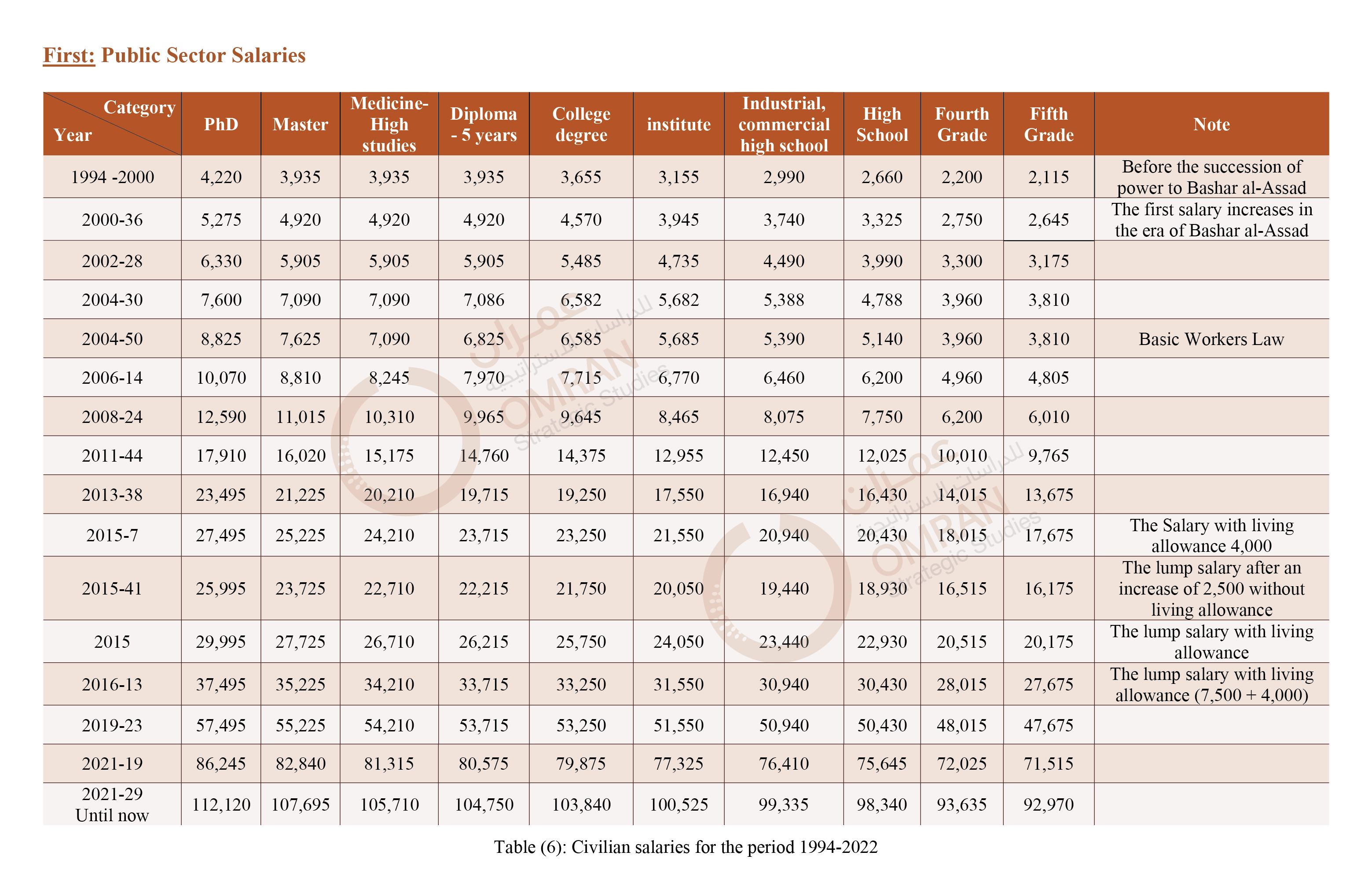

Salary Increases Since 1994

It is customary in Syria for public salaries to be raised biennially, at a rate of 25%, while the inflation rate exceeded 30% annually - before 2011. Thus, workers and employees lose 17% of the value of their salaries annually as a result of the decline in the purchasing power of the Syrian Pound(5). The last increase in salaries during the era of Hafez al-Assad was executed through Legislative Decree No. 3 of 1994 (6). There were no more increases for six years until after the succession of power by Bashar al-Assad in 2000. By that time salaries steadily eroded, and their proportion in the national GDP decreased. The state sought to stabilize salaries and wages through a clear policy to reduce the volume of aggregate demand on the one hand; and to reduce costs through a policy of cheap wages on the other hand.

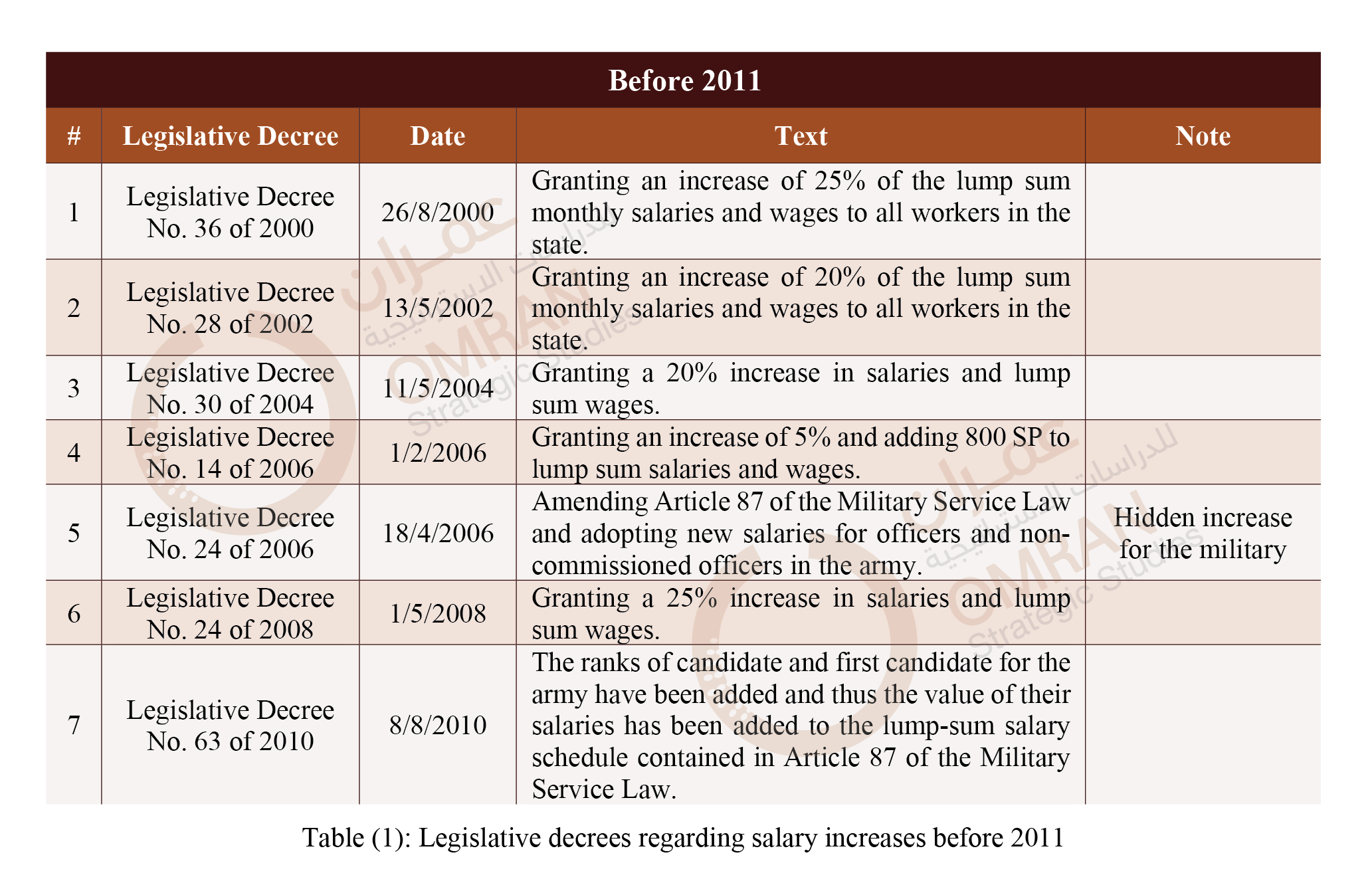

Less than two months after the succession of power, Bashar al-Assad issued the first salary increase since 1994, in an attempt to send a clear message that "economic recovery is near and that the state of economic stagnation from 1995-2000 has ended". However, the salary increase policy remained the same as before, salaries were increased approximately every two years, except for the period between 1994-2000. During the period between 2000 and 2010, 7 legislative decrees related to salaries were issued. Some of the increases included the entire sector of state workers; while other increases were specific to the military - as explicit increases - such as amending their salary schedule, or a special case like re-working at the rank of Candidate and 1st Candidate. (Murashah)

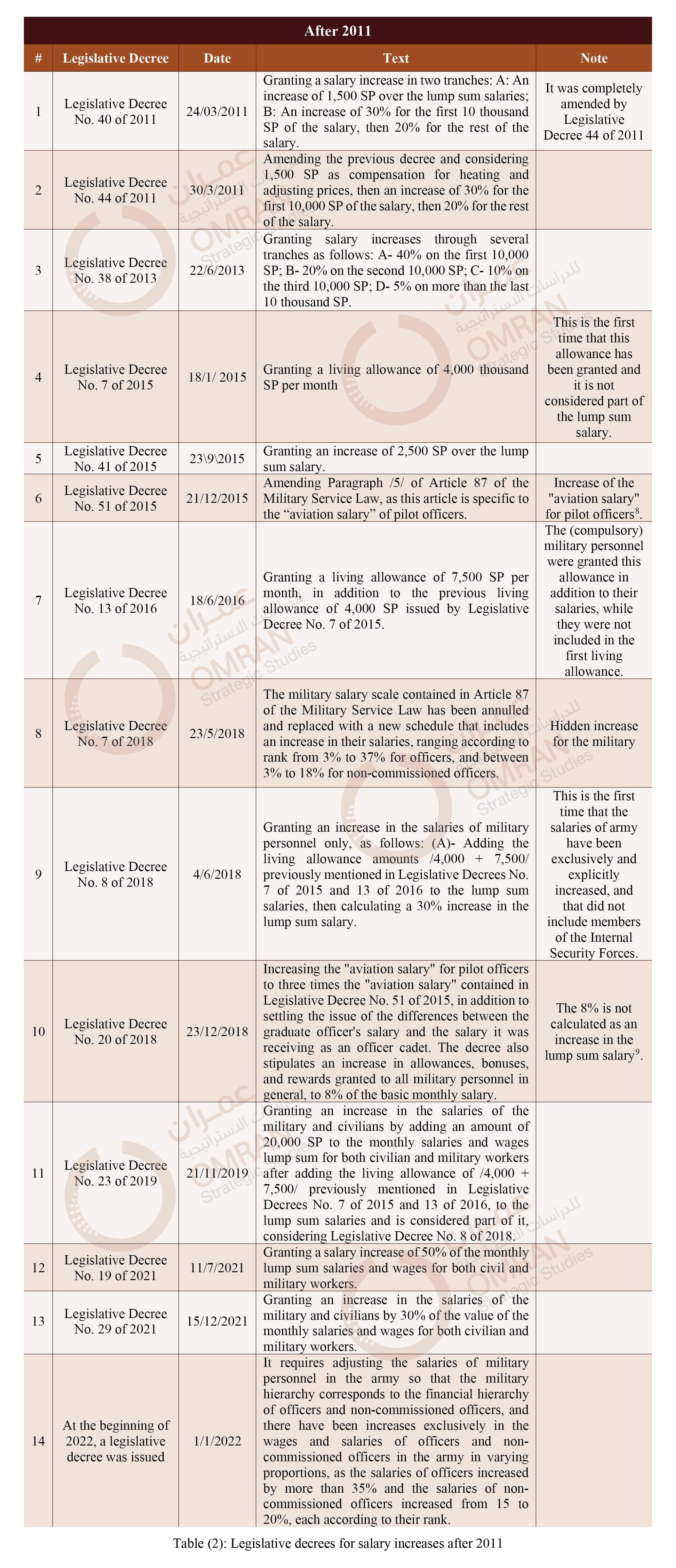

On the other hand, there were a greater number of legislative decrees related to salaries during the period between 2011-2022. 14 legislative decrees have been issued since March 2011. some of which included exclusive increases for the military. The period after 2011 witnessed double the number of legislative decrees related to salaries compared to the previous period; in an attempt by the regime to bridge and repair the gap between the price of the Syrian Pound and the US Dollar. The following table shows the referenced legislative decrees and percentages of salary increases from 2000 to 2022(7):

A Reading of Salary Increases Methods and its Effects

The regime used a method of indirect taxation to finance the increase in salaries and wages. Taxes on petroleum products, cement fertilizers, and mineral oils are increased under a pretext of “price differences” As aresult, the price of basic goods and services. increases and become less competitive in domestic and regional markets(10) .

This general pattern in the increase of salaries and wages closely coincides with a rise in the price of basic goods, an economic pattern prevailing for decades. However the rising price of basic goods and services is not always accompanied by an increase in salaries and wages, as the regime's government may raise the price of basic materials several times before salaries and wages are increased. This indicates “ adeep economic flaw” in the state management of the industrial and manufacturing sector. These unrealistic increases attempt to control prices, and encourage inflation as well. The following are salary increases that coincided with a rise in the price of basic goods:

Comparing Civilian and Military Salary Scales

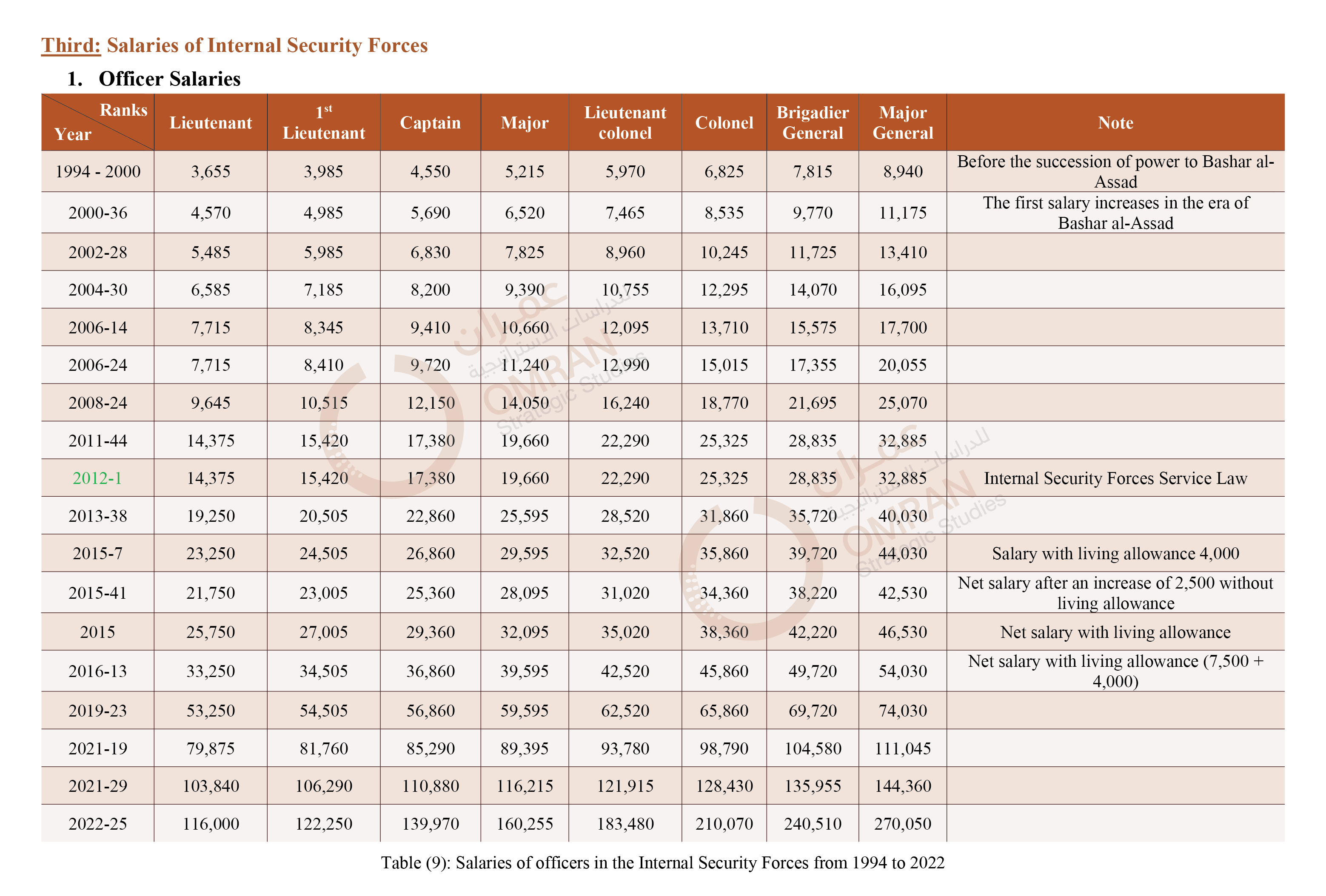

2018 was the first time a major change in the balance of salary increases appeared.between civilian and military public employees For the first time a legislative decree was issued including an explicit increase in the salaries of army soldiers excluded other public sector employees, including the Internal Security Forces.(police) Those increases came as a reward for the military’s efforts in preventing the fall of the regime in the face of the revolution. It was also an attempt to equate the salaries of the military to the salaries granted by militias to its members. Making a comparison between salaries and privileges of different armed factions in the state pushed society further towards militarization and encouraged civilians to join militias or the military institution (13). People preferred salaries granted by militias because they are greater than those officially granted in the state military institution. The salaries of the latter are greater than those of the civil sector, noting that there are official and unofficial privileges granted to members of the army, armed forces, and militia members that increase their total monthly income. It is a common misconception that the exclusive salary increases for military personnel in 2018 was a result of a Russian request, but instead stems from the regime’s need to militarize society. (See the appendix for the salaries of employees in the state including public and military sectors; and the internal security forces in the period between 1994 - 2022)

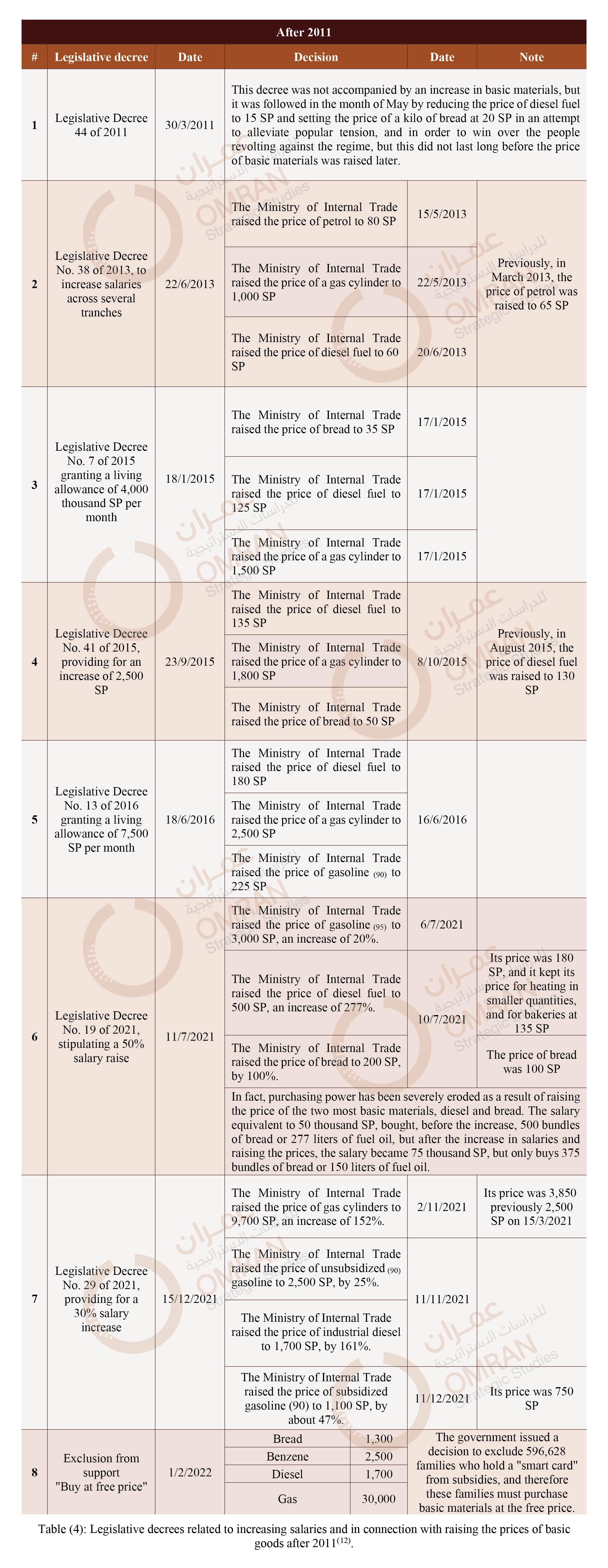

The comparison is between civilian and military personnel at entry- level pay scale and between the highest category among a civilian employee that hold a Ph.D degree and the starting scale of military personnel, (soldier).(14)The reasons for this comparison are due to two things: The aforementioned salaries are the start-up salaries, i.e., the salary of a Ph.D degree holder cannot be compared with the salary of a Captain ranking in the army, because a captain has 10 years of experience in public service. The differences between the salaries of these two categories are limited, however, there is a preponderance of military salaries over civilians of the same entry level scale(15).

A) Based on the Syrian Pound

It is noted that the gap in Syrian Pound between entry-level salaries of a soldier(rank: private) and a civilian holding a Ph.D degree has declined even further after 2011 until it became very small following Legislative Decree No. 8 of 2018. The percentage of the difference between the salaries in both categories in 2000 was 236% in favor of a civilian whth a Ph.D degree holder’s salary. This percentage fell to 178.9% in 2011, and reached 1.9% in 2022. This is assumes counting gross salaries before income tax is calculated.

Figure (1): Comparison of salaries according to the Syrian pound for both doctoral and soldier ranks

B) Based on the US Dollar

prices of goods and services are often indexed on the US dollar and converted to syrian pound at the time of contracting . salaries reached their peak value in US dollars by the end of March 2011, after the issuance of Legislative Decree No. 44 of 2011, coinciding with the beginning of the Syrian revolution. In the meantime, the price of the dollar was equal to 47 SP according to the official exchange rate and 52 SP according to the black-market price(16). Later, with the declining value of the Syrian Pound, the salary value against the dollar gradually declined, as the successive increases in salaries from March 2011 to 2022 could not prevent this decline or even flatten its loss in value against the US dollar at the very least. It is also noted that the Lebanese financial crisis in 2019 affected the SP, which led to a further decline in the value of salaries on the basis of the dollar.Starting salaries for Ph.D holders, when measured in dollars between 2000 and 2022, shrank by a very large percentage, approximately 360.8%. While the salary of a soldier witnessed only a 156.3% decline in starting salaries during the same period due to the consecutive increases of exclusively military salaries.

Figure (2): Salaries are denominated in dollars, according to the official rate from the Central Bank

Figure (3): Salaries are denominated in dollars according to the black market

Note:The following interactive Chart provides comparisons between the different salary categories, with each other, and with the Syrian pound and the US dollar

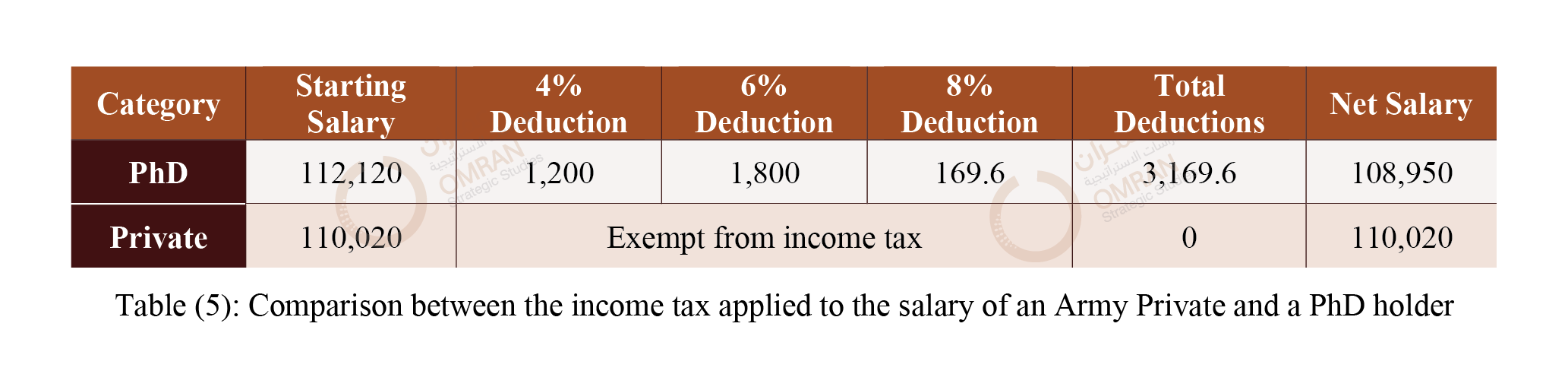

Income: Tax collection and Military Exemption

The income tax law has undergone several amendments since Bashar al-Assad came to power. In 2001, he issued Legislative Decree No. 8 exempting the first 1,000 SP of the monthly salary from income tax. Later, the first 5,000 SP of the salary was exempt from income tax under the new income tax law No. 24 of 2003. The income tax law was be amended several times, the most recent of which was Legislative Decree 24 of 2020(17), which included an exemption of the first 50000sp of the salary from income tax by amending Articles 68 and 69 and abolishing Legislative Decree 46 and 48 of 2015.

The main point here is that the income tax law exempted, in Article 67, “military personnel of the armed forces, members of the internal security forces and firefighting personnel,” in addition to other categories, from income tax. This was not applied to public and private sector employees. Legislative Decree No. 18 of 2003, which includes the Article 81 of the Military Service Law, confirmed that military personnel benefit from a set of exemptions, including exemption from income taxes and various compensations and allowances. Legislative Decree No. 1 of 2012, which includes Article 155 of the Internal Security Forces Service Law, gave the Internal Security Forces the same exemptions granted to army soldiers. Thus, if the starting gross salaries of both a Ph.D holder and the lowest ranking soldier in the army are compared before and after-tax deductions, we find that the net salary of the soldier is greater than the net salary of a Ph.D holder(18):

Salary Increases and the cost of the cost of Living According to cost of living

figures in Syria provided by the "Kassioun Index" consistently for many years, current salaries do not cover the expenses for three days of living(19). The cost-of-living index in September 2022 for a Syrian family consisting of five members reached 3.6 million SP,This is an unprecedented rise during a record period that threatened millions of Syrians who live in a catastrophic widening gap between the cost of living and the minimum salary for an entry - level public employee.The biginning monthly salary scale remains at the threshold of 92,970 SP (less than half the cost of the minimum monthly nutrition needs per worker alone)(20).This economic reality has left 90% of Syria’s population living below the poverty line; many of them forced to make very difficult choices to cover their expenses(21)The cost of living over the years compared with the minimum salary is illustraated the following figure:

Conclusion

Public sector employees do not depend solely on their salaries, which are barely sufficient to cover the cost of living for several days. Instead, they depend on various sources of income, such as financial transfers coming from abroad, or having a second job in the private sector. In addition, their supplemental income may be sourced in illegal forms of income as a result of financial corruption and bribery in government offices and institutions. As for the military, despite their salary increases, they have alternative sources of income, all of which are illegal; through looting, extortion, racketeering, and checkpoint taxes; Additionally, financial corruption related to purchases, contracts, and tenders of the Ministry of Defense that are supervised by procurement committees in military units are carried out in an exclusive manner only benefiting specific groups of officers and non-commissioned officers.

The foregoing is nothing but a natural product of a dictatorial state that puts all its resources at the service of its own military machine. It does not work to create a well-developed civilian state. It is a product of a country torn by war waged by the regime against the Syrian people. The regim's salary increase policy can be summarized as follows:

- A policy that incentivize the militarization of society and the transformation of military duty into a profession like any other profession. This was done through contracting with civilians or military personnel as mercenaries within the militias or sending mercenaries to areas of armed conflict under Russian supervision.

- Creating a repellent unstable environment:

- The policy led to increased migration waves , especially by educated classes, because even those who have higher degrees in the public sector are unable to make more money than the starting salary of the lowest grade military personnel that has an elementary school education. The regime’s message to young people is, “Don’t learn, go and work in the army.”

- The regime’s policy also aimed to send young people abroad in order for them to send remittances to their families later. Thus, the regime benefits from the foreign exchange transferred to the areas under their control in addition to these young people paying huge sums of money in order to be exempt from compulsory or reserve military service, which costs each person 5-10 thousand dollars as a fee according to the type of military service and the duration of their stay outside the country.

This policy is a warning to countries hosting refugees, given that returning them to regions controlled by the regime, while taking their safety into account, will force the majority of them into the predetermined fate of “engaging” in the military institution or joining an armed militia. The reality is that working in such jobs in the military sector is the only promising career option for young Syrians in regime-controlled areas.

Appendix: Salary Scale in Syria

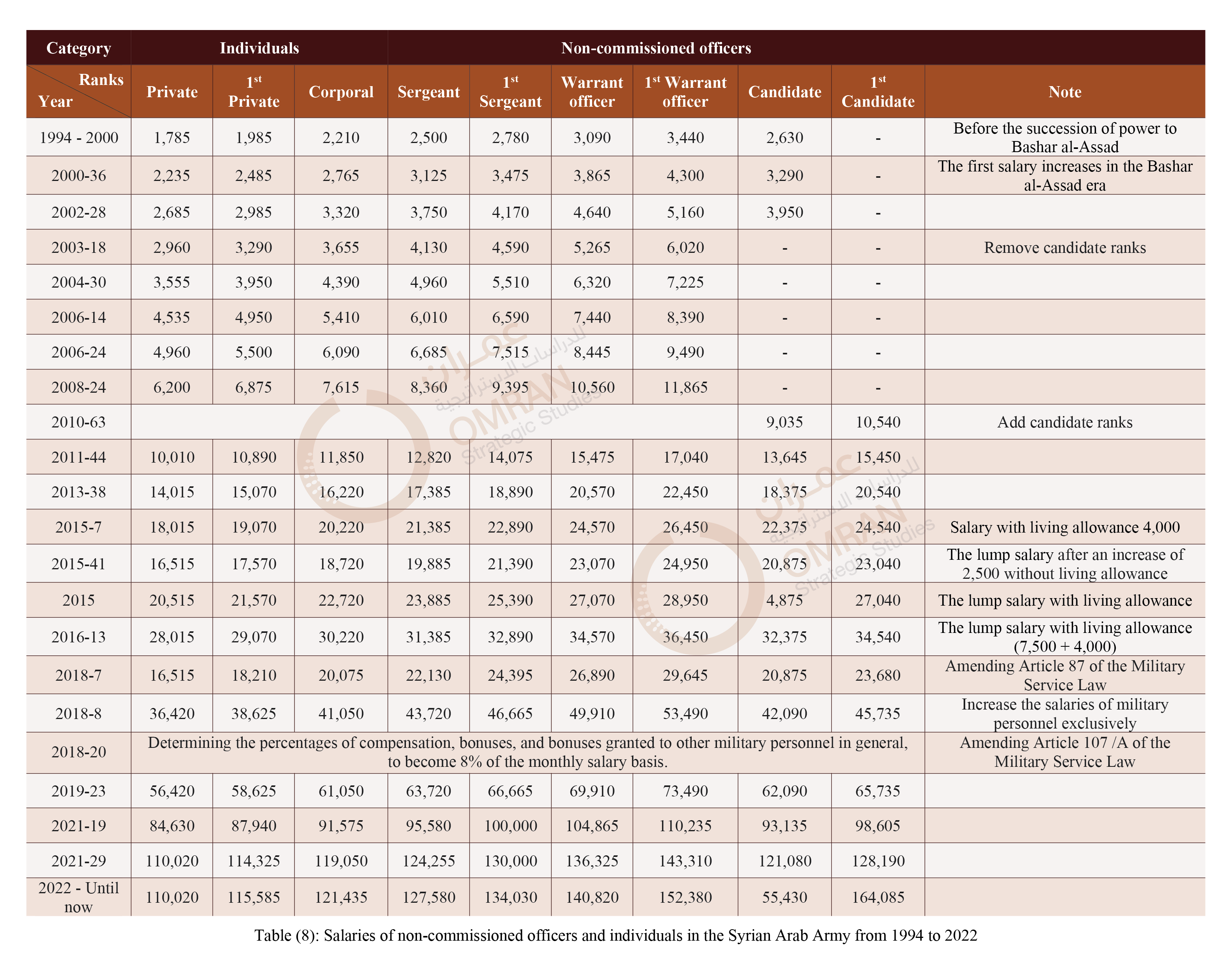

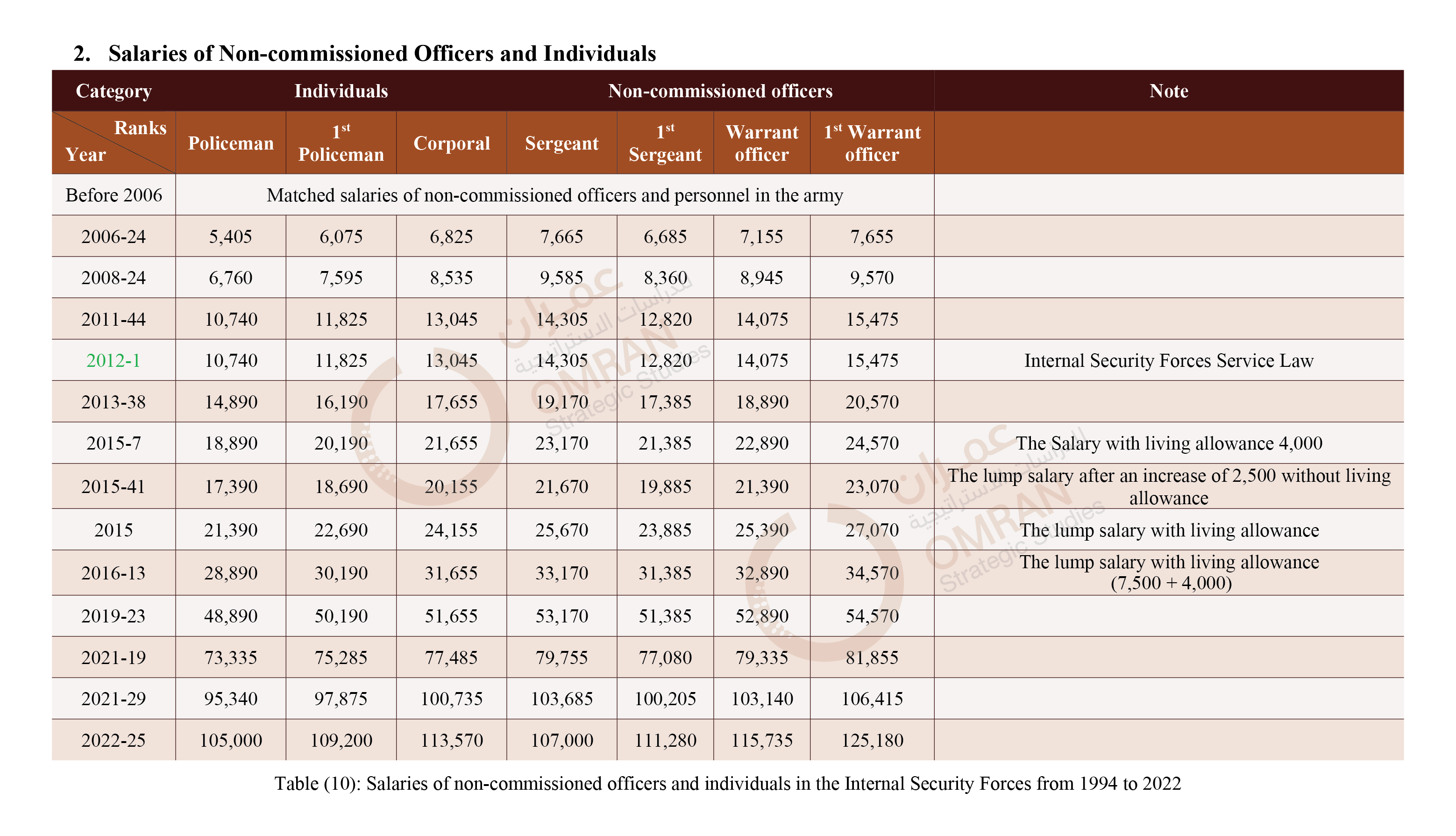

The following is the salary scale for civilians, military personnel, and internal security forces, starting from the last increase during era of Hafez al-Assad in 1994 until 2022:

2- Salaries of Non-commissioned Officers and Individuals

Note:

- During the translation of this paper into English and after the publication of the Arabic version of this paper in mid-November, Bashar al Assad issued Legislative Decree 25 of 2022 on December 27, 2022, that includes an increase in the salaries of the Internal Security Forces (police). This modification is included in the English version only.

- From mid-November to the end of December, the ex-change rate of the Syrian Pound was dropped from 5,200 to 7,300 SP against the US dollar.

Exchange Rates Between Official and Black Market

The exchange rates against the dollar were almost constant before 2011. Later, they began to vary with the passage of time, and a real difference began to appear between the exchange rate of Pound, according to the central bank, and the black-market rate. The Syrian Pound has lost its value against the dollar exponentially since 2011, and this has negatively affected the purchasing power, in addition to the increase in inflation rates. It is noted that the gap between the exchange rate of the Pound according to the central bank and the black market is relatively increasing steadily(26). The following are the exchange rates of the Pound against the dollar on the date of the issuance of the legislative decree to increase salaries.

(1) “Law 50 of 2004, the basic system for workers in the state”, Syrian parliament, date of publication: 06 December 2004, date of access: 20/10/2022, link: https://bit.ly/3hqpqbF.

(2) “Legislative Decree No. 18 of 2003, Military Service Law”, Syrian parliament, published: April 21, 2003, Accessed: 14/01/2022, Link: https://bit.ly/3GyL0Cq.

(3) “Legislative Decree 1 of 2012, Internal Security Forces Service Law”, Syrian parliament, date of publication: January 2, 2012, date of access 16/05/2022, link: https://bit.ly/3lbG5hA.

(4) One of the mathematical equations used to calculate salaries after Legislative Decree 44 of 2011: where (J7) refers to the salary value in 2008: =CEILING(IF((J7+1500)>10000;((((J7+1500)-10000) * 20%)+(10000*30%))+(J7+1500);((J7+1500)* 30% +(J7+1500)));5)

(5) Ali Kanaan, “Stagnation in Syria”, Mafhum website, link: https://bit.ly/3Cocmdu.

(6) Legislative Decree 3 of 1994 issued on 30/4/2000, which includes granting an increase of 30% from the monthly lump sum salary or wage to the lump sum monthly salaries and wages for both civil and military workers in the state.

(7) Legislative decrees do not include increases in pensions.

(8)“Aviation salary” is an additional salary allocated to pilot officers, added to the lump sum salary and not considered part of it. It was mentioned in Article 87 of the Military Service Law, Ibid.

(9)The amount of 8% granted to the military is not an increase on the basic salary, but rather a determination of the number of allowances, bonuses and rewards on the basis of the monthly salary, and it constituted a mistake in this regard when it was published.

(10) Ali Kanaan, Ibid.

(11)The name of the ministry changed several times after 2000.

(12)The prices of basic materials that coincided with the increase in salaries were monitored, without tracking all the increases in the prices of those materials that were constantly rising without there being an increase in salaries.

(13 ) Muhsen AlMustafa: “The Comparison between Militias and the Army: Indicators of an Increase in Mercenaries,” Omran Center for Strategic Studies, publication date: October 06, 2022, access date: 20/10/2022, link: https://bit.ly/3DiG3gy.

(14) The rank of soldier in the army is granted to those who volunteered based on a basic education certificate.

(15 ) The interactive tool included on the website enables the user (reader) to carry out the comparisons he wants for all military classes and ranks in the appropriate manner.

(16 )The exchange rate according to the central bank is indicated by $F, while the exchange rate according to the black-market is indicated by $B.

(17) Article 68:

A: The tax rate, including national defense additions, school fees, the municipality’s share, and the cash contribution to support sustainable development, is determined as follows:

| 4 % of the part of the monthly net income that falls between the exempted minimum and 80,000 SYP. | 12 % of the part of the monthly net income between 170,001 and 200,000 SYP. |

| 6 % of the part of the monthly net income between 80,001 and 110,000 SYP. | 14 % of the part of the monthly net income between 200,001 and 230,000 SYP. |

| 8 % of the part of the monthly net income between 110,001 and 140,000 SYP. | 16 % of the part of the monthly net income between 230,001 and 260,000 SYP. |

| 10 % of the part of the monthly net income between 140,001 and 170,000 SYP. | 18 % of the part of the monthly net income that exceeds 260,000 SYP. |

B: The tax rate is set at 10% for each gross payment.

Article 69: A tax-exempt minimum of 50,000 SP per month shall be deducted from the net income.

(18 ) Compensations and bonuses were not calculated for both categories, given that the focus is on gross salaries and income tax.

(19 ) Kassioun Index: A cost-of-living index issued periodically by Kassioun magazine affiliated with the Popular Will Party headquartered in Damascus.

(20 ) “3.5 million, the average cost of living for the Syrian family at the gates of winter,” Kassioun Magazine, date of publication: September 26, 2022, access date: 1/10/2022, link: https://bit.ly/3fN2SBl.

(21) “Griffiths to the Security Council: 90% of Syrians live below the poverty line,” Al-Jazeera Net, date of publication: October 28, 2021, date of access: 25/03/2022, link: https://bit.ly/3RUnLaK.

(22 ) The salaries of the army include the salaries of the first grades only, as each rank has a salary grade to which the military personal is promoted while he remains in the rank for a certain period.

(23) Hidden increase for the military.

Syria along