Omran News

The situation in Daraa is dire. Here’s how it might play out.

In a symbolic blow to the anti-government uprising born in Daraa in 2011, the Bashar al-Assad regime and Iran-backed militias are once again attempting to violently subdue the Syrian provincial capital, which is considered the birthplace of the revolution that began a decade ago.

The most recent round of clashes was sparked by Syria’s May 31 illegitimate presidential elections. Several of Daraa province’s cities refused to participate in the elections and civilians took to the streets in protest.

On the day of the elections, the Syrian regime was forced to move the election center from the Baath Party Division building in Nawa city to the district center in the middle of the security square, where branches of the regime security agencies are located. This prompted the flight of most of the working members of the party’s division to the capital, Damascus, for fear of being targeted.

As a result, several neighborhoods in Daraa province were placed under a brutal siege. In late June, the Fourth Division of the Syrian army and other regime forces encircled the city and cut off all roads leading to Daraa al-Balad in the south, preventing the entry of food and medicine as well as the entry or exit of civilians. The regime and its allies proceeded to cut off electricity, water, and communications. One checkpoint remains open for residents, but it is under the control of the Military Security Branch and the Mustafa al-Kassem militia—a troubling scenario for civilians.

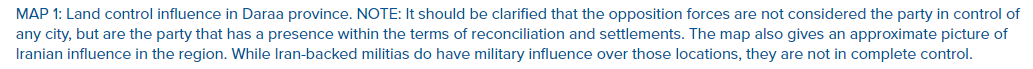

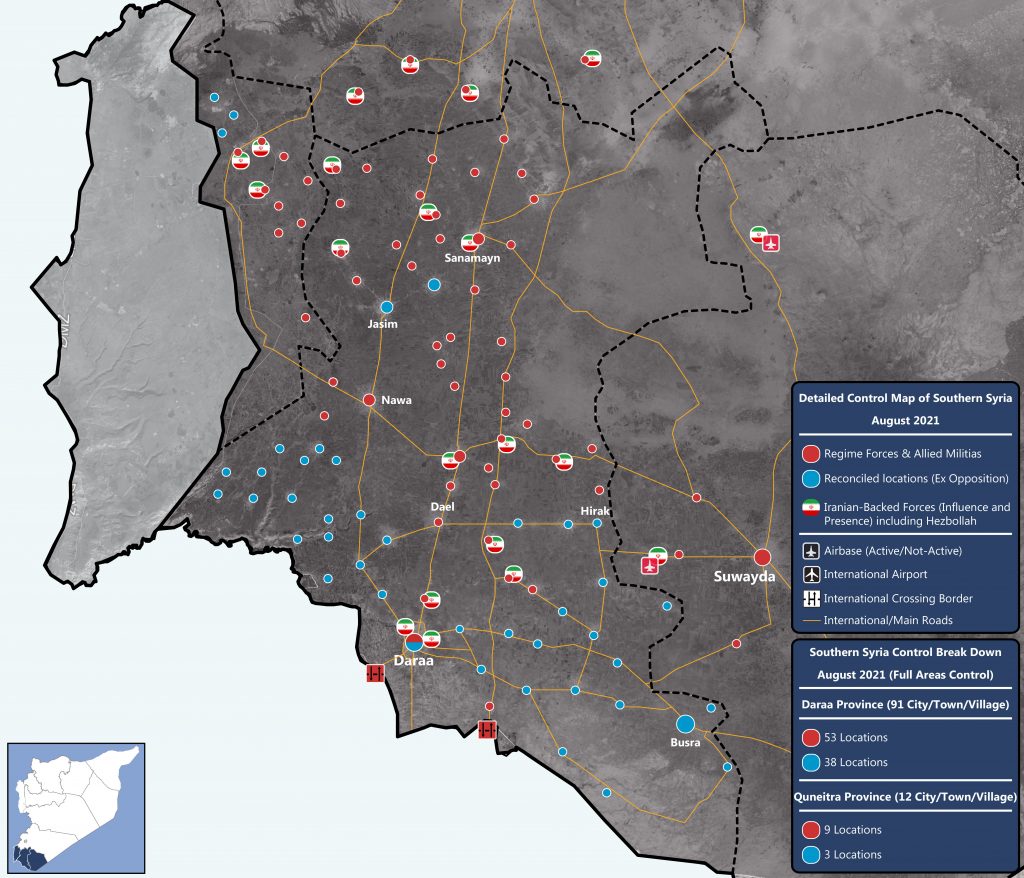

Daraa hasn’t witnessed a military campaign like this since the regime took control of the province in July 2018. Following that takeover, the region was divided into settlement areas, as happened in Daraa al-Balad, Busra al-Sham, Tafas, and other areas under regime control (MAP 1). Members of the Free Syrian Army (FSA) remained, forming sleeper cells, such as the Popular Resistance in the south—an armed group from Daraa province that was formed in November 2018—in several towns that refused the terms of a settlement with the regime, which exposed them to attacks. Other formations of the FSA joined the Fifth Corps—a volunteer-based force—under direct Russian control. The most prominent outgrowth was the Sunni Youth Forces, which now forms the forces of the Eighth Brigade in the Fifth Corps.

The complex reality of influence and control after the 2018 settlement

Despite the Assad regime’s control over Daraa since the 2018 settlement, the reality on the ground indicates that there are three spheres of influence in the province. The first is the area considered the center of negotiations between the opposition and regime, which is under direct Russian supervision. In this area, the regime maintained institutional control but was denied a security presence. The second sphere of influence comprises of settlements where the regime has all-out military control, such as Bosra al-Harir, al-Harak, Saida, and surrounding towns, as well as western areas like Jassem and Newa. Lastly, the third includes areas seized by the regime without signing a settlement agreement, such as Dael, Inkhil, and al-Hara.

Iran’s consolidation of influence in Daraa is one significant implication of this power diffusion. Via the Fourth Division, the Islamic Revolutionary Guard Corps, and militias deployed in Daraa, Iran has successfully expanded its influence in the south and established a military presence in strategic locations near Syria’s southern border. Recent developments are further evidence of Russia’s failure to contain Iran in Daraa. While the Russians led the initial negotiations, Iran subsequently upended the process, empowering local allies to take military control of the province.

Daraa developments in light of the regime’s army being dispersed between Russia and Iran

Beginning on June 25, regime forces imposed a complete siege on the neighborhoods of Daraa al-Balad (inhabited by approximately fifty thousand people): the internally displaced camp, Palestinian refugee camp, al-Sad Road, and the farms in the areas of Shiah, al-Nakhla, al-Rahiya, and al-Khawani. The siege is meant to punish civilians for ongoing demonstrations since 2018 and the refusal of Dara al-Balad residents to participate in the voting process. As the dispute escalated, the Central Committee of Daraa al-Balad met with Russian General Assad Allah, who threatened to storm dissenting neighborhoods but agreed to prevent Iran-backed forces from taking military action in the city.

After several meetings between the Central Committee and regime, the two parties agreed to hand over the remaining light weapons of former FSA fighters who are not part of the Fifth Corps in exchange for lifting the siege imposed on Daraa al-Balad and an end to the regime’s military campaign there. The two sides also agreed to construct a new settlement to clarify missing or gray areas in the 2018 settlement.

However, the agreement has not been implemented so far due to several obstacles created by Major General Husam Louka, the head of General Security Directorate, Brigadier General Ghaith Dalah, commander of the Fourth Division, and Syrian Defense Minister Ali Ayoub—all of whom have stated that the regime’s goal is absolute control over the entire neighborhood of Daraa al-Balad. This proclamation upset the Russians, who know Iran is escalating the conflict and attempting to strengthen the control of its local allies near the Syrian and Jordanian borders.

It is possible to deduce several important points from the rapid developments in Daraa al-Balad during the past week:

- The non-interference of the Russians during the military operation via airstrikes gave ex-FSA fighters ease of movement. The Russians’ lack of intervention may also explain their unwillingness to complicate the situation of the opposition-held areas in the north, and not to assist the Iranian allies on the ground to advance in a way that would hurt the fragile agreement between Russia and Turkey there.

- The fall of many regime military points and checkpoints within hours to the hands of ex-FSA using only light weapons indicates the fragility of the regime army’s structure in these locations. This fragility is due to their dependence on untrained fighters and/or a collapse of the soldiers’ morale.

- The rapid response of other settlement locations—blocking roads and attacking regime security points—in the eastern and western countryside of Daraa contributed greatly to the dispersal of the regime’s focus on a specific geographic area.

- The media campaign that started at the beginning of the siege on Daraa al-Balad incited international responses. The United States and the European Union issued several official statements condemning the campaign and calling for an immediate ceasefire.

Amidst this military escalation on Daraa al-Balad and the eastern and western countryside and the continuation of negotiations between the Central Committee and the regime, Daraa faces several scenarios.

A new settlement and forced displacement

The way the Assad regime dealt with the cities of Tafas and al-Sanamayn could foreshadow what happens in Daraa al-Balad in the coming days. After the regime attack on the city of al- Sanamayn in March, Russia intervened through the Fifth Corps to resolve the conflict and imposed a truce that ended with the deportation of fighters to the north; those who stayed have had to hand over weapons. In January, the same scenario occurred in Tafas, after the regime demanded that the people hand over light and medium weapons and that those who wished to leave Daraa go north.

According to this scenario, Russia may intervene to end the attack on Daraa al-Balad, put an end to the military operation, and sign a new agreement. However, the details and terms depend on the size of the Assad regime’s losses in the coming days. This seems to be the most realistic scenario for the regime, considering its accelerated losses and negotiations with the Central Committee of Daraa.

The area under the shadow of the Fifth Corps

The FSA’s recent success will give it an upper hand at the negotiating table. The Central Committee may negotiate a stop to the escalation in all towns and cities in return for stopping the military campaign, lifting the siege, and deploying checkpoints for the Fifth Corps in Daraa. Although this scenario is possible, it requires the approval of Russia and Jordan and it is unlikely that Iran and the regime will accept this scenario, which would threaten their control in the south.

Return to the 2018 settlement

If the Russians do not intervene in the coming days to stop the regime’s military campaign and the FSA continues to maintain the military escalation line and preserve its gains on the ground, the regime may turn to pre-June 25 conditions to prevent further losses and the further bolstering of the opposition. The situation at the time gave the regime full administrative control over the area but with very limited security control.

Worst case scenario: absolute control by the regime without any reconciliations or settlement

This scenario is best for the Assad regime and its ally Iran, which does not favor Russia. It depends on launching a vast military campaign on the neighborhood and imposing absolute control without referring to any new settlements, which will result in a massive campaign of arrests for the residents and will not even allow them to flee to the north of Syria. This scenario is preferable for Iran because it will create a large vacuum in the region that can be exploited by local allies at the administrative, military, and security level, which will therefore pose a major challenge to Russia in regard to controlling the Iranian presence near the Syrian and Jordanian borders.

In the long run, this scenario will enhance the fragility of the security situation in the region for an array of reasons. This includes: an increase in assassinations against Iran’s allies in the region; the high incidence of clashes between members of the Eighth Brigade and Iran’s allies; and an increase in the number of Israeli attacks on Iran-backed forces. In sum, this scenario is considered the worst for Daraa and its people because it serves only Iran and its local allies from the regime.

Briefing on Latest Developments in Idlib

I. Introduction

Both Turkey and Russia agreed to a ceasefire in Idlib starting at midnight on March 5th,2020. At the time, both sides saw this agreement as representing the least worst case scenario to preserve its interests on the ground and prevent further escalation between different actors. On one side, the Russians and regime forces heavily escalated systematic attacks on civilians and basic infrastructures driving over 1.1 million civilians towards the Turkish borders, hence putting pressure on Turkey and indirectly on Europe. The regime aided by the Russian airforce regained control over vacated villages in the Idlib province and was advancing on more heavily populated areas. On the other hand, after several attacks by the regime against Turkish military forces, the Turkish army heavily escalated its presence and equipment in southern Idlib and broke away with previously agreed “rules of engagement” by attacking regime and Iranian backed forces to stop its advance and prevent further displacement of the civilian population. The agreement hence, was a temporary freeze of operations by all sides. It included the following core elements:

• A ceasefire from the morning of March 6, 2020 along the frontline.

Regime artillery continued to target several locations in the vicinity of the new buffer zone north of the M4, Sources confirmed that 56 violations done by the Regime March 6 to March 31 of the same month.

• Establishing a security corridor six kilometers north and six kilometers south of the main international highway in Idlib "M4," which links the cities controlled by the Syrian Regime in Aleppo and Lattakia, and open an internal crossing between the Regime and Opposition held areas.

Because of the new Corona (COVID19) and the fear of an outbreak of the disease, the interm government in Idlib decided to close all the internal and external borders in Idlib and western Aleppo, but in April 17, 2020 HTS announced its intention to open a commercial crossing with the regime that links both Saraqib and Sarmin, which met with widespread disapproval among civilians and demonstrated near Sarmin objecting to the matter.

• Joint Russian-Turkish patrols to be deployed along the M4 road, starting March 15.

As of April 18, 2020, no full joint patrols were conducted for the entire route for security and logistical reasons. A group of civilians built tents along parts of the road, refusing the passage of Russian patrols, while some military factions took advantage of the situation and worked to further destabilize the security situation. Sources of the Information Unit at Omran Center confirmed that these factions are affiliated with HTS. HTS has been taking steps to indirectly create problems and then present itself as part of the solution in an attempt to legitimize its presence in any future security architecture.

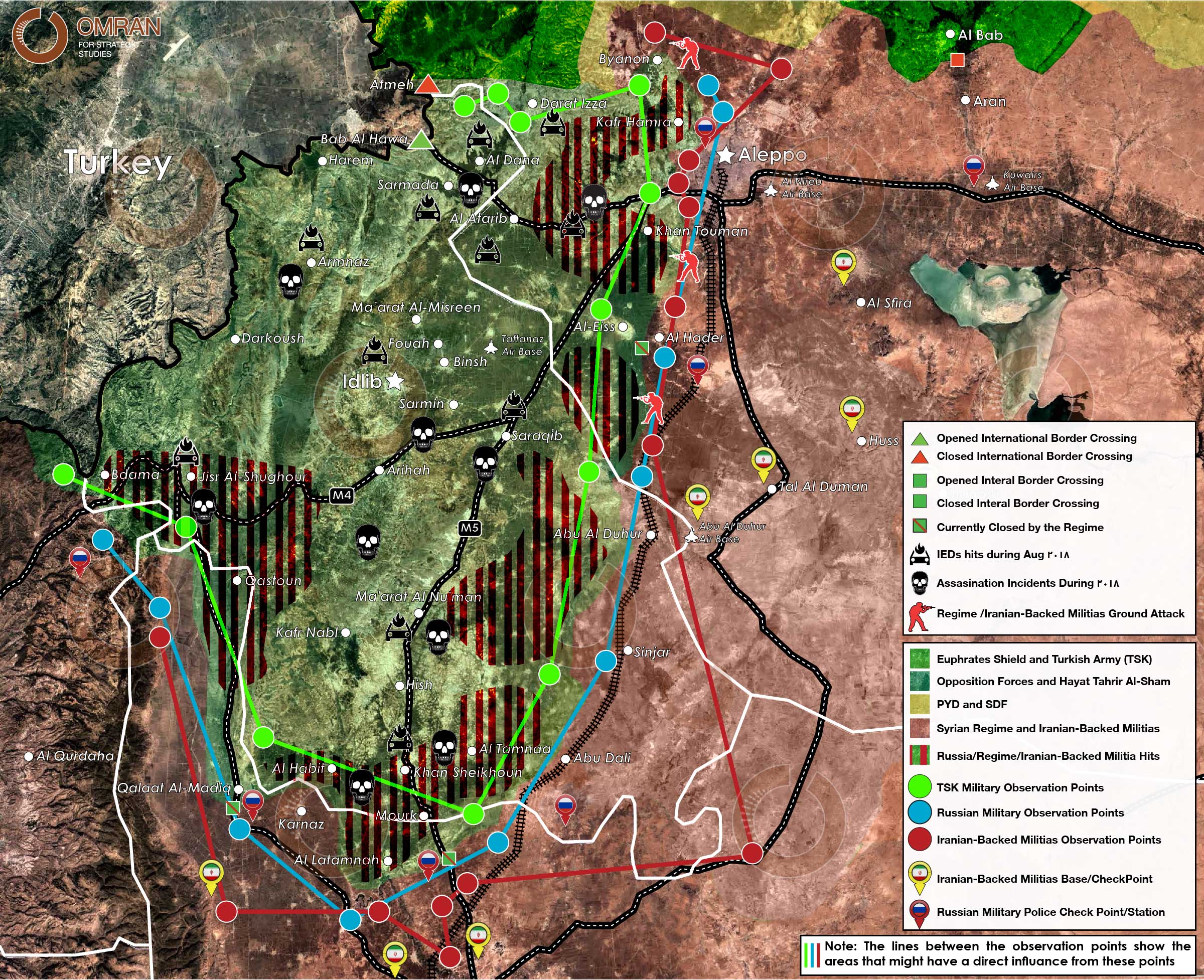

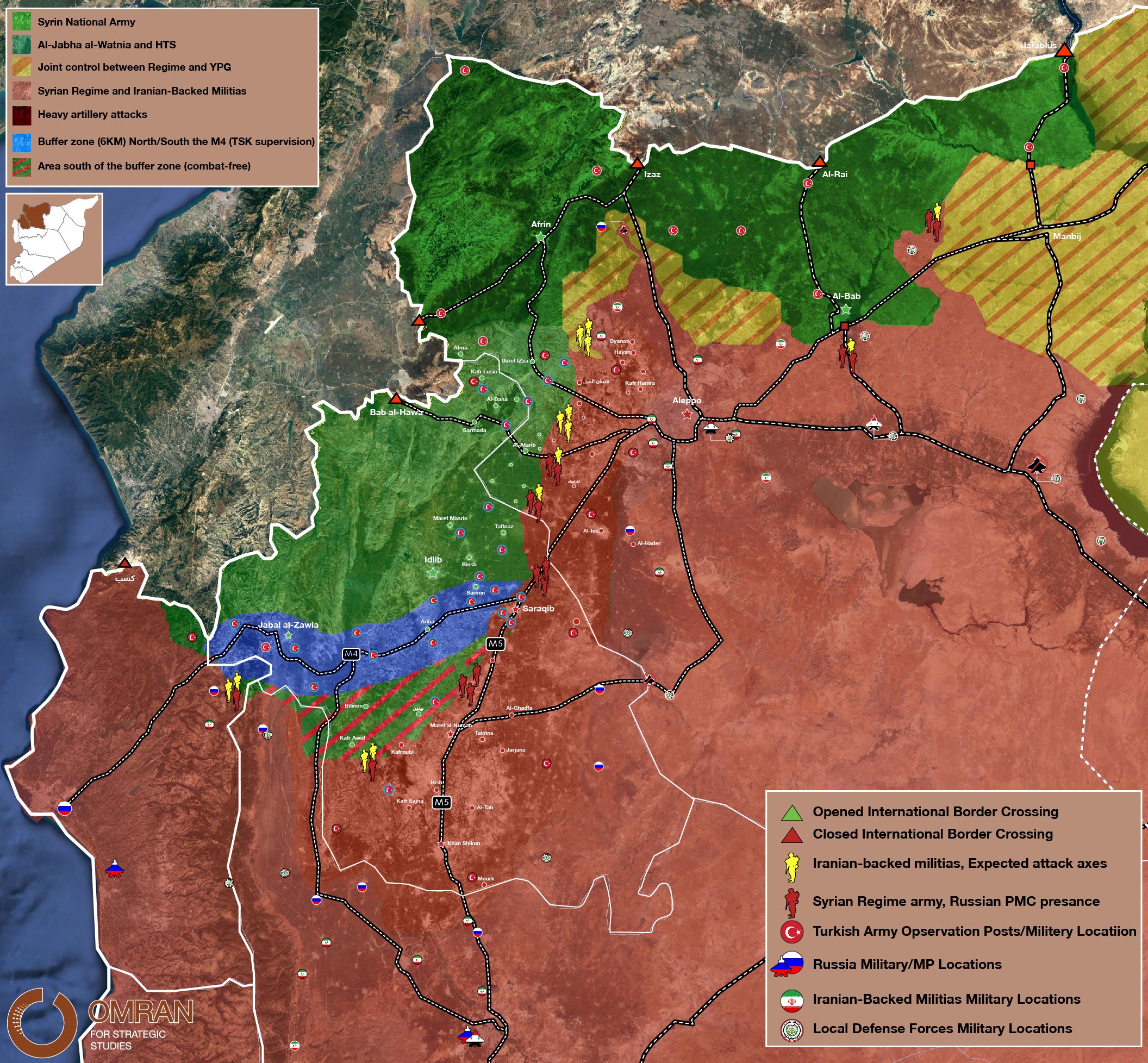

II. Updated map of control in Idlib and its surrounding areas

Updated Control map of Control in Idlib by Information Unit in Omran Centre – 18 April 2020

III. Major developments of the "M4" agreement

A. Turkey’s four current goals

1. Preventing the threat of Corona (COVID19) especially in IDP camps. This can be observed through the strict measures at border crossings, reducing to the maximum interactions with locals, pushing IHH organization to improve its plans, as well as high engagement by AFAD.

2. Increasing Turkish Military posts defense and sending more vehicles and soldiers in the past weeks to establish new posts in Jabal al-Zawyie and al-Ghab Plain.

3. Opposition factions: restructuring National Liberation Front (NLF) by arresting and demoting corrupt commanders, requesting from each faction to call fighters to training camps to compare numbers of fighters and ending any possible connection between groups and other countries in order to ensure order and containment.

4. The M4 agreement with Russia: Turkey is pushing hard for the joint patrols on M4, which has been facing obstacles through sit-in demonstrations by some local actors with direct threats from HTS sub-entities. Turkey is carefully trying to end this situation without using force and by negotiating with the locals. Resolving this situation is a top priority before May in order to prevent any Russian military acts.

B. Positions of local and international actors in Idlib

1. The joint patrols along the M4 highway is Russia’s main priority. There were little if any statements by Russia calling upon Turkey to implement the agreement during February-April, unlike early January. Russia is focusing on dealing with the Corona pandemic and countering increased ISIS threats in eastern Homs, Daraa, and Deir Ezzor.

2. Several news sources indicated that the UAE is pushing the regime to launch a new attack on Idlib and giving promises to fund such an operation. Russia asked the regime not to launch any attack after regime unilaterally and without consulting the Russians sent reinforcements to Idlib.

3. The presence of Iranian-backed militias in Idlib is less than other areas in Syria. However, for Iran to establish a foothold it needs to send more fighters and to launch a limited attack. IRGC-affiliated militias are present in Kafrnabel but are not the main attacking force. Once again, Iran is using its old methods: initial expansion in new areas followed by provision of basic services for local communities.

4. The recent Turkish/Russian agreement put further pressure on HTS by pushing it to re-share power in Idlib with NLF. Furthermore, the Turkish heavy military presence and the deal with the Russians is making Jihadist inside HTS angry and pushing them to breakout. This can be seen in the resignation of Abu Malek al-Talli, and the sit-in protests on the M4 by offshoot members of HTS.

5. HTS has been taking steps to restructure itself, and started by forming 3 new divisions and mixing the hardcore jihadist groups with other less radical members under the leadership of local members.

6. HTS seems to attempts to contain and weaken the more extreme elements within its ranks in order to reduce the risks of possible defections and ensure a future smooth transition from a Jihadi group to a political Islamist group. It is also taking steps to continue its local control over governing bodies such as the Salvation Government.

IV. Future directions

1. There will most likely not be a major regime attack in the near future and even from the opposition side too.

2. May is the month of action for the Turkish sides in order to get ready of the difficult situation surroundings the M4 agreement.

3. The area is witnessing more Iranian-backed militias activities, those activities will increase I. The future in different levels (Economic, Security and military)

4. COVID19 is not the main concern for the local and international actors in Idlib; positive reading is confirmed from the Opposition held areas in Idlib.

Significant Economic Cooperation Between The Syrian Regime and Iran During 2018-19

Executive Summary

Iran, a major ally and enabler of the Syrian regime, is increasingly engaged in competition over access to the Syrian economy now that there are new opportunities for lucrative reconstruction contracts. This report sheds light on the economic role played by Iran in Syria through its local representatives and Iranian businessmen. It also explores the (limited) impact of the European Union and U.S. Treasury sanctions on Iran's economic instruments in Syria.

Introduction

Iran has invested heavily in the protection of the Syrian regime and the recovery of its territories. Iran’s main objectives in Syria have been to secure a land bridge between its territory and Lebanon, and to maintain a friendly regime in Damascus. Much of Iran’s investment has been military, as it has financed, trained, and equipped tens of thousands of Shi’a militants in the Syrian conflict. But Iran has also made major financial and economic interventions in Syria: it has extended two credit lines worth a total of USD 4.6 billion, provided most of the country's needs for refined oil products, and sent many tons of commodities and non-lethal equipment, notwithstanding the international sanctions imposed on the regime. In exchange for its commitment to ensuring Assad’s survival, Tehran has expected and demanded large concessions in terms of access to the Syrian economy, especially in the energy, trade, and telecommunications sectors.

Key Iranian Companies

Iran has provided crucial economic assistance to the Assad regime in order to prevent its fall and to ensure that it can meet its fuel needs. In return, Iran demanded access to significant investment opportunities in key sectors of the Syrian economy, notably: state property, transportation, telecommunications, energy, construction, agriculture, and food security.

Since 2013, the Iranians have aided Assad through two main channels. First, it extended two lines of credit for the import of fuel and other commodities, with a cumulative value of over USD 4.6 billion. In order to position itself strategically as the lynchpin of the Syrian economy, Iran restricted the benefactors and implementers of these credit lines to its own national companies. It can thus continue to provide the regime with a lifeline in terms of goods and energy supplies, but in return it can control key parts of the Syrian economy.

The following list includes major Iranian companies that have announced a return to business-as-usual in Syria. Each brief overview gives a description of the company’s involvement in Syria, followed by basic information about the company.

Khatam al-Anbia Construction Base

Has demonstrated an interest in carrying out reconstruction work on Syria infrastructure.

Khatam al-Anbia Construction Base is involved in construction projects for Iran's ballistic missile and nuclear programs. It is listed by the UN as an entity of the Iranian Revolutionary Guard Corps (IRGC), with a role “in Iran's proliferation-sensitive nuclear activities and the development of nuclear weapon delivery systems” (Annex to U.N. Security Council Resolution 1929, June 9, 2010). The company is under the command of Brigadier General Ebadollah Abdollahi.

Khatam al-Anbia conducts civil engineering activities, including road and dam construction and the manufacture of pipelines to transport water, oil, and gas. It is also involved in mining operations, agriculture, and telecommunications. Its main clients include the Ministry of Energy, Ministry of Oil, Ministry of Roads and Transportation, and Ministry of Defense.

Since the company’s founding in 1990 it has designed and implemented approximately 2,500 projects at the provincial and national levels in Iran. It currently works with 5,000 implementing partners from the private sector. An IRGC official recently revealed that a total of 170,000 people currently work on Khatam al-Anbia’s projects and that in the past 2.5 years it has recruited 3,700 graduates from Iran’s leading universities.

Company officials for Khatam al-Anbia include IRGC General Rostam Qasemi and Deputy Commander Parviz Fatah. Other personnel reportedly include Abolqasem Mozafari-Shams and Ershad Niya.

MAPNA Group

- Supplying five generating sets for gas and diesel operations (credit line)

- Construction of a 450 MW power plant in Latakia (credit line)

- Implementation of two steam and gas turbines for the power plant supplying the city of Baniyas (credit line)

- Rehabilitation of the first and fifth units at the Aleppo power plant (credit line).

MAPNA is a group of Iranian companies that build and develop thermal power plants, as well as oil and gas installations. The group is also involved in railway transportation, manufacturing gas and steam turbines, electrical generators, turbine blades, boilers, gas compressors, locomotives, and other related products. The Iran Power Plant Projects Management Company (MAPNA) was founded in 1993 by the Iranian Ministry of Energy. Since 2012, the group has been led by Abbas Aliabadi, former Iranian Deputy Minister of Energy in Electricity and Energy Affairs.

In 2015, MAPNA sealed a USD 2.5 billion contract, Iran’s largest engineering deal to date, to supply Iranian technical and engineering services for the construction of a power station in Basra in southern Iraq.

Mobile Telecommunication Company of Iran (MCI)

A contract to build Syria’s third mobile network (suspended).

MCI is a subsidiary of the Telecommunication Company of Iran (TCI), which is partially owned by the IRGC. MCI brings in approximately 70 percent of TCI’s profits. MCI provides mobile services for over 1,000 cities in Iran and has approximately 66 million Iranian subscribers. It provides roaming services through partner operators in more than 112 countries.

Iranian Companies Active in Syria in 2019

Table 1: List of all Iranian companies with ongoing contracts in Syria - 2019

| Name | Arabic Name | Main Activity | Agreement | Headquarters Address |

| Safir Noor Jannat | سفير نور جنات | Food industries, detergents, and electronics | An old MOU dating back to 2015 to supply Syria with flour | No. 8, Mohamadzadeh st., Fat-h- highway 4Km. Tehran |

| Behin Gostar Parsian | بهين كستر بارسيان | Food industries | No information | Unit 5. No 14. Shahid Gomnam Street. Fatemi Sq. Tehran |

|

Peimann Khotoot Gostar Company جزء من مجموعة PARSIAN GROUP |

بيهين غوستار بارسيان | Electrical power, electronics, and technology | 2017 MOU with the batteries companies in Aleppo, the General Company for Metallurgical Industries in Barada, and Sironix, to carry out electricity projects in several locations in Syria. | Tehran Province, Tehran, District 22, No: 5, Kaj Blvd, 14947 35511, Iran |

| Feridolin Industrial & Manufacturing Company | شركة فريدولين | Electrical appliances | No information | ----- |

| Tadjhizate Madaress Iran. T.M.I. Co. | ---- | Decor and furnishings | No information | No. 198, Dr. Beheshti St., After Sohrevardi Cross Rd., 157783611, Tehran, Iran, Tehran |

| Trans Boost | ترانس بوست | Electricity | Electrical transformer station (230 66 20 kV) in the Salameh, Hama area | ---- |

| B.T.S Company | بي تي سي | Import and export, and commercial brokerage | No information | ------ |

| Nestlé Iran P.J.S. Co. | شركة نستله | Food industries | Supply of milk to Syria for the time being | 6th Floor, No.3, Aftab Intersection, Khoddami St., Vanak Sq., Tehran, Iran |

Recruiting Local Partners (Iran vs. Russia)

Iran and Russia have been competing over the reconstruction of Syria and the potentially lucrative investment opportunities that come with it because both countries hope to recoup some of their outputs from years of supporting the Assad regime and also because both hope to maintain their influence in the post-war era. Both Tehran and Moscow are therefore striving to win over major players in the Syrian political and economic spheres whom they hope to rely on to facilitate their business deals and ensure their respective interests. Consequently, both countries have established economic councils to oversee their ventures and to organize relations with their respective Syrian partners.

The following descriptions of the Syrian-Russian and Syrian-Iranian business councils cover their structures, the total number of members, the most prominent players, and the companies affiliated with their members.

The Syrian-Russian Business Council

The Syrian-Russian Business Council (SRBC) includes 101 Syrian businessmen and a number of Russian counterparts. It is divided into seven committees covering the main sectors of the economy:

- Engineering

- Oil and gas

- Trade

- Communications

- Tourism

- Industry

- Transportation

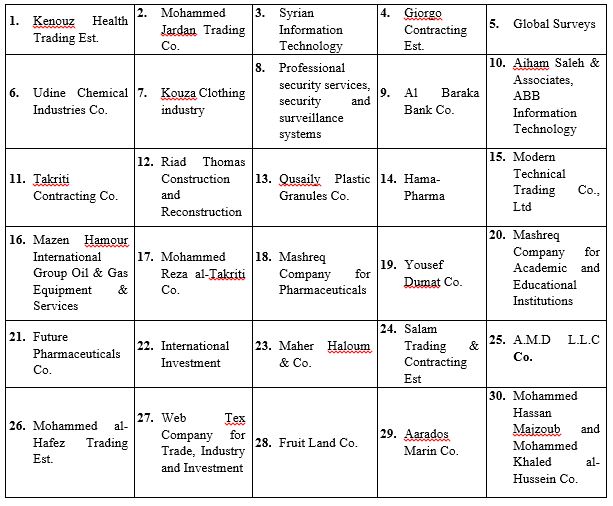

The Syrian membership of the SRBC includes many influential names, as shown in Table 2.

Table 2: Members of the Syrian-Russian Business Council

| Notable Names | Total Number of Businessmen |

| Samir Hasan (Chairman, SRBC) | 101 |

| Jamal al-Din Qanabrian (Deputy Chairman, SRBC) | |

| Mohammed Abu al-Huda al-Lahham, (Secretary, SRBC) | |

| Fares al-Shehabi (Businessman) | |

| Mehran Khunda (Businessman) | |

| Bashar Nahad Makhlouf (Businessman) |

Of these figures, three are particularly prominent:

- Jamal al-Din Qanabrian has served as a member of the Consultative Council of Syria’s Council of Ministers since 2017 (the Council presents proposals and consultations to the government on economic and legislative affairs). He is also a member of the Damascus Chamber of Commerce and Industry.

- Samir Hassan, the chairman of the Syrian-Russian Business Council, is a partner in Sham Holding Company, which is owned by Rami Makhlouf.

- Mohammed Abu al-Huda al-Lahham, also a member of the Damascus Chamber of Commerce, is believed to have strong ties with Dhul-Himma Shalish, the powerful Syrian construction mogul and cousin and personal guard of Hafiz al-Assad.

The SRBC also employs a number of Syrian businessmen of Russian nationality, most notably George Hassouani, who was formerly involved in oil and gas deals with ISIS.

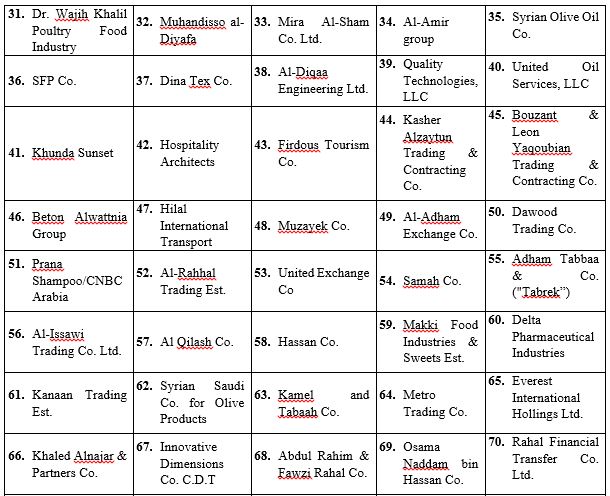

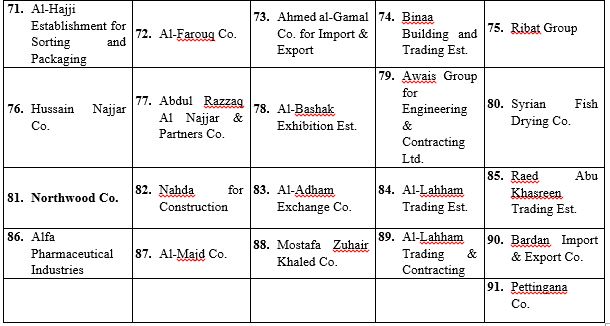

The number of Syrian companies included in the Syrian-Russian Business Council is estimated at 91. These companies are involved in import and export, general trade, textiles, clothing, petrochemicals, energy, and, in a small number of cases, private security operations (see Table 3).

Table 3: Companies in the SRBC

The Syrian-Iranian Business Council

By comparison, Iran has had less success with its business council venture than Russia. The Syrian-Iranian Business Council (SIBC) was established in March 2008, and was initially led by Hassan Jawad. It was reconstituted in 2014 with nine members, as shown below in Table 4.

Table 4: Members of the SIBC

| Notable Names | Total Number of Businessmen |

| Samer al-Asaad (President, SIBC) | b |

| Iyad Mohammed (Treasurer, SIBC) | |

| Mazen Hamour (Businessman) | |

| Osama Mustafa (Businessman) | |

| Hassan Zaidou (Businessman) | |

| Khaled al-Mahameed (Businessman) | |

| Abdul Rahim Rahal (Businessman) | |

| Mazen al-Tarazi (Businessman) | |

| Bashar Kiwan(Businessman) |

Some of these figures have significant economic influence:

- Mazen al-Tarazi is a prominent businessman with investments in the tourism sector as well as in real estate (including the project to redevelop Marota City in western Damascus). He has founded a number of companies in Syria, Kuwait, Jordan and elsewhere that offer services in oil well maintenance, advertising, publishing, paper trading, and general contracting. He also owns a number of newspapers, including Al-Hadaf Weekly Classified in Kuwait, Al-Ghad in Jordan, and Al-Waseet in Jordan.

- Iyad Mohammed is the Head of the Agricultural Section of the Syrian Exporters' Union.

- Osama Mustafa is a member of the People's Assembly, where he represents Rural Damascus Governorate. He served as Chairman of the regime’s Rural Damascus Chamber of Commerce between 2015-2018.

The number of companies owned by Syrian businessmen who are members of the SIBC board is estimated at 10 (see Table 5).

Table 5: Companies Owned by SIBC Members

|

Abdul Rahim & Fawzi Rahal Co. |

Al-Sharq Bank |

| Al-Shameal Oil Services Co. |

National Aviation, LLC |

| Rahal Money Transfer Co. |

Ebdaa Development & Investment Co. |

|

Mazen Hamour International Group |

Development Co. for Oil Services |

|

Dagher & Kiwan General Trading Co. |

Concord al-Sham International Investment Co. |

Because of the relatively small number of Syrian members of the SIBC, Iran is making additional efforts to woe Syrian businessmen. According to private sources, Syrian businessmen are seeking contracts with Iranian companies in return for being granted a share of the value of the contract. Table 6 shows key Syrian figures engaged with Iran.

Table 6: Syrian Businessmen Engaged with Iran

| Name | Position | Name | Position |

|

1.Faisal Talal Saif |

Head of the Suweida Chamber of Commerce and Industry |

2.Mohamed Majd al-Din Dabbagh |

Head of the Aleppo Chamber of Commerce |

|

3.Jihad Ismail |

Head of the Quneitra Chamber of Commerce and Industry |

4.Abdul Nasser Sheikh al-Fotouh |

Head of the Homs Chamber of Commerce |

|

5.Tarif al-Akhras |

Head of the Deir Ezzor Chamber of Commerce and Industry |

6.Osama Mostafa |

Head of the Rural Damascus Chamber of Commerce |

|

7.Adeeb al-Ashqar |

Merchant from the Damascus Chamber of Commerce |

8.Kamal al-Assad |

Head of Latakia Chamber of Commerce and Industry |

|

9.Albert Shawy |

Merchant |

10.Hamza Kassab Bashi |

Head of Hama Chamber of Commerce |

|

11.Amal Rihawi |

Director of International Relations at the Commercial Bank of Syria |

12.Mohammed Khair Shekhmous |

Head of the Hasaka Chamber of Commerce and Industry |

|

13.Elias Thomas |

Merchant |

14.Wahib Kamel Mari |

Head of the Tartous Chamber of Commerce and Industry |

|

15. |

Merchant |

16.Qassem al-Maslama |

Head of the Daraa Chamber of Commerce and Industry |

|

17.Saeb Nahas |

Merchant |

18.Aws Ali |

Merchant |

|

19.Ghassan Qallaa |

Head of the Federation of Chambers of Commerce |

20.Iyad Abboud |

General Manager of MOD |

|

21.Louay Haidari |

Merchant |

22.Ayman Shamma |

Merchant |

|

23.Mohamed Hamsho |

Secretary-General of the Damascus Chamber of Commerce |

24.Bassel al-Hamwi |

Merchant |

|

25.Mohamed Sawah |

Head of the Syrian Exporters Union |

26.Khaled Sukar |

Merchant |

|

27.Mohamed Keshto |

Head of the Union of Agricultural Chambers |

28.Sami Sophie |

Director of the Latakia Chamber of Commerce and Industry |

|

29.Marwa al-Itouni |

Head of Syrian Businesswomen |

30.Salman al-Ahmad |

Union of Syrian Agricultural Chambers |

|

31.Mustafa Alwais |

Rami Makhlouf 's partner |

32.Samir Shami |

Syrian Exporters Union |

|

33.Nahed Mortadi |

Merchant |

34.Gamal Abdel Karim |

Merchant |

|

35.Nidal Hanah |

Merchant |

36.Zuhair Qazwini |

Merchant |

|

37.George Murad |

Merchant |

38.Mohammed Ali Darwish |

Merchant |

|

39.Ghassan al-Shallah |

Merchant |

40.Nasouh Sairawan |

Merchant |

|

41.Mousan Nahas |

Merchant |

42.Anwar al-Shammout |

Owner of Sham Wings Co. |

|

43.Mounir Bitar |

Merchant |

44.Bashar al-Nouri |

Merchant |

|

45.Abdullah Natur |

Merchant |

46.Sawsan al-Halabi |

Director of a construction company |

|

47.Tony Bender |

Merchant |

48.Manaf al-Ayashi |

Foodco for Food Industries |

|

49.Maysan Dahman |

Merchant |

50.Khaled al-Tahawi |

Merchant |

|

51.Samer Alwan |

Blue Planet Energy Co. |

52.Saied Hamidi |

Oil and gas sector |

|

53.Roba Minqar |

Clothing industry |

54.Randa Sheikh |

Clothing industry |

|

55.Harout Dker-Mangi |

Merchant |

56.Alya Minqar |

Merchant |

Iran’s Role in Key Sectors

Iran seeks to obtain lucrative investment opportunities in different sectors of the Syrian economy, whether through tenders or monopolies. The main sectors in which Iran is trying to get full access are: agriculture, tourism, industry, reconstruction, and private security.

Agriculture

- Iran’s ability to match Russia’s investments in the Syrian agricultural sector has been significantly limited by the international sanctions imposed upon it. Since 2013 Iran has extended Syria two credit lines with the total value of USD 4.6 billion, aimed mostly at agriculture. Here is a list of Iranian investments in the sector:

- Supply of wheat since 2015 through the Safir Nour Jannat company"سفیر نور جنت".

- An agreement with the Syrian government to establish a joint company to export surplus Syrian agricultural products.

- An investment of USD 47 million for the second phase of implementation of the Iranian credit line to establish a plant to produce animal food, vaccines, and poultry products.

- A contract to build five mills in Syria at a cost of US 82 million in the provinces of Suweida and Daraa.

- A Memorandum of Understanding (MOU) with the Syrian General Organization of Sugar (Sugar Corporation) to establish a sugar mill and a sugar refinery in Salha in Hama in 2018.

- A 2018 MOU between the Federation of Syrian Chambers of Agriculture and the Iranian companies Nero and ITM for the import and distribution of 3,000 tractors.

Tourism

The tourism sector is considered one of the most vital sectors in the Syrian economy: it constituted a 14.4 percent share of Syria’s GDP in 2011 (US 64 billion). It has of course been heavily affected by the war, and tourism revenues decreased from SYP 297 billion (around USD 577 million) in 2010 to SYP 17 billion (around USD 33 million) in 2015, while tourism infrastructure suffered a loss of nearly SYP 14 billion (around USD 27 million) over that same period.

Tehran’s investment in Syria’s the tourism sector has been mostly in religious tourism. For instance, the Syrian Minister of Tourism signed a MOU with the Iranian Hajj Organization in 2015 to bring Iranians and others into Syria for religious tours. There are now estimated to be 225,000 religious tourists from Iran, Iraq, and the Gulf countries visiting Syria each year, and they bring in around SYP two billion (around USD 3.9 million) in revenue.

Industry

The industrial sector contributed 19 percent of Syria’s GDP in 2011, and has suffered losses estimated at USD 100 billion during the war. Iran has several industrial facilities in Syria. These are concentrated in the automobile sector, where they include the Syrian-Iranian International Motor Company and Siamco. Iran has also invested in the glass industry in Adra industrial city. The Iranian Saipa group announced a growth in sales of 11 percent in 2017 in Iraq, Syria, Lebanon, and Azerbaijan. Car sales in Syria reached a significant level: although it was a third of 2018 sales in Iraq so far, 50,000 cars were sold in Syria last year.

Iran has tried to obtain contracts from the Syrian government in the industrial sector, and a number of MOUs have been signed. They include:

- A 2017 MOU between the Iranian company Bihin Ghostar Persian and General Organization for Engineering Industries to rehabilitate several companies: General Company for Metallic Industries–Barada (located in al-Sabinahis a town in southern Syria, administratively part of the Rural Damascus Governorate), SYRONICS (located in Damascus) and the battery factory in Aleppo.

- A 2017 MOU between the Syrian Cement and Building Materials Company in Hama and the Yasna Trading Company of Iran for the supply of spare parts.

In 2018, the Syrian-Iranian Business Council submitted a proposal for the participation of Iranian companies in the rehabilitation of Syria’s public industrial sector. In addition, the Iranian Ministry of Industry has expressed a wish to establish a cement production company in Aleppo as part of the second phase of implementation of the Iranian credit line.

Reconstruction and Infrastructure

The construction sector contributed 4.2 percent of Syria’s GDP in 2011 and then suffered a losses of USD 27 billion over the next six years. Syrian infrastructure has taken a similarly heavy hit as a result of the conflict, with losses valued at around at USD 33 billion, including over three million destroyed houses or housing units.

Iran’s interests in reconstruction—as with tourism—have a religious tinge and are mainly focused on the areas around sacred Shi’a shrines. For instance, Iran has been asking the Syrian regime for large concessions in Daraya, the old city of Damascus, Sayida Zainab, and Aleppo. Thus far Iran has mostly relied on Syrian intermediaries to purchase real estate, businessmen such as Bashar Kiwan, Mazen al-Tarazi, Mohammad Jamul, Saeb Nahas, Muhammad Abdul Sattar Sayyid, Daas Daas, Firas Jahm, Nawaf al-Bashir, and Mohammad al-Masha'li. Tehran has also relied on Syrian associations such as Jaafari, Jihad al-Binaa, the al-Bayt Authority, and “the Committee for the Reconstruction of the Holy Shrines" to expand and acquire new land in or near the holy sites in Damascus, Deir Ezzor, and Aleppo.

Sanctions against Syria and their Effect on Iran

The ongoing conflict in Syria has prompted international outcry and condemnation, as well as a long list of "red lines" and sanctions. The sanctions currently in place against Syria include an oil embargo, restrictions on certain investments, a freeze of the Syrian central bank's assets within the European Union, and export restrictions on equipment and technology that might be used for repression of Syrian civilians.

The problem with the sanctions on Syria is that they are ill suited to address the situation, in which sanctions are unlikely to work due to the ongoing war. The EU took significant steps very early in the Syrian conflict, essentially deploying its entire sanctions toolbox in less than one year, in contrast to its more common step-by-step sanctions approach. After a few years, the EU realized that this approach was rushed and ineffective and was forced to backtrack on some measures. This learning process showed the EU that an arms embargo is not necessarily the best first way to address a conflict situation.

Appendix

Syrian Companies Affiliated with Iran

| Name | Arabic Name | Main Activity | Agreement |

|

Abdul Rahim & Fawzi Rahal Co. |

شركة عبد الرحيم وفوزي رحال | معمل مواد بناء، تجارة عامة، استيراد وتصدير | حماة/طيبة الإمام، سوريا. |

| Ebdaa Development & Investment Co. | شركة إبداع للتطوير والاستثمار | تجارة عامة، استيراد وتصدير | ريف دمشق |

|

Development Co. for Oil Services |

شركة التنمية لخدمات النفط | الخدمات النفطية | ------ |

| Obeidi for Construction & Trade | شركة عبيدي وشريكه للتجارة والمقاولات | تجارة عامة، استيراد وتصدير، المقاولات | فندق الداما روز بدمشق |

| Talaqqi Company | شركة تلاقي | تجارة عامة، استيراد وتصدير، مستحضرات التجميل | دمشق، كفرسوسة، عقار رقم 2463/ 87 |

| Nagam al-Hayat Company | شركة نغم الحياة | تجارة عامة، استيراد وتصدير، الخدمات الاستشارية | ريف دمشق، يلدا/ دف الشوك/ العقار رقم 507 |

| IBS for Security Services | ---- | --- | --- |

| Al-Hares for Security Services | شركة الحارس للخدمات الأمنية | خدمات الأمن والحماية الشخصية | دمشق |

| Mobivida L.L.C | شركة موبي فيدا | تجارة الأجهزة الإلكترونية، الهواتف المحمولة والإكسسوار، وتطوير خدمات الهواتف والإنترنت | دمشق |

| Al-Mazhor Company for Construction | شركة المظهور التجارية | تجارة عامة، استيراد وتصدير، المقاولات | دير الزور |

| Al Najjar & Zain Travel & Tourism Company | شركة النجار وزين" للسياحة والسفر | السياحة الدينية | نبل، مقابل مستوصف نبل عبارة الضرير / محافظة حلب |

Top Syrian Businessmen Affiliated with Iran

| Under EU Sanctions? | Under U.S. Sanctions? | Visited Abu Dahbi(UAE) in Jan 2019? | Main Position | Closeness of Relationship with Iran | Name in Arabic | Name |

| - | Yes | Yes | Secretary-General of the Federation of Syrian Chambers of Commerce | High | محمد حمشو | Mohammad Hamsho |

| - | - | - | Member of Syrian Parliament | High | حسين رجب | Hussein Ragheb |

| - | - | - | Businessman | High | حسان زيدو | Hassan Zaidou |

| - | Yes | Yes | Member of Syrian Parliament | High | محمد خير | Muhammad Kheir Suriol |

| - | Yes | Yes | Member of Syrian Exporters Union | High | إياد محمد | Iyad Muhammad |

| - | Yes | Yes | Manager of the Federation of Syrian Chambers of Commerce | High | فراس جيكلي | Firas Jijkli |

| - | - | - | Chairman of the Supreme Committee for Investors in the Free Zone | High | فهد درويش | Fahd Darwish |

| - | - | - | Syrian Ambassador to Iran | High | عدنان محمود | Adnan Mahmoud |

| - | - | - | Businessman | Medium | عامر خيتي | Amer Khiti |

| - | - | - | Businessman | High | علاء الدين خير بيك | Alla Ed din Khair Bik |

| - | - | - | Businessman | Low | جورج مراد | George Murad |

| - | Businessman | Low | منير بيطار | Munir Bitar | ||

| Yes | Yes | - | Works in SDF-controlled area and has relationship with Samir al-Foz | High | محمد القاطرجي | Mohamed al-Qtrji |

| - | - | - | Businessman | High | علي كامل | Ali Kamil |

| - | - | Yes | Al-Matin Group General Manager | Medium | لبيب إخوان | Labib Ikhwan |

| - | - | - | Businessman | High | سامر علوان | Samir Alwan |

| - | - | - | Businessman | Medium | ناهد مرتضى | Nahid Murtda |

| - | - | - | Businessman | Medium | مصان النحاس | Musan al-Nahas |

| - | - | Yes | Businessman | High | ربى منقار | Ruba Munqar |

| - | - | - | Businessman | Low | هاروت ديكرمنيجان | Harot Dikrmnjyan |

Nawar Oliver | Russian Truce in Idlib and Hama and the initial reaction

Nawar Oliver, Omran Center military expert and the Information Unit manager on 2nd of Aug 2019, gave his remarks to the AFP about Russian Truce in Idlib and Hama and the initial reaction of some Opposition factions.

Oliver added, “Russia will continue to bomb civilians locations and carry out massacres, and keep on supporting the Regime ground attack during this ceasefire , The Russian has a long bad history when it comes to ceasefires with the oppositions faction, such as in Eastern Ghouta, Northern Homs, and Daraa.

Source: https://yhoo.it/2Yrc3NW

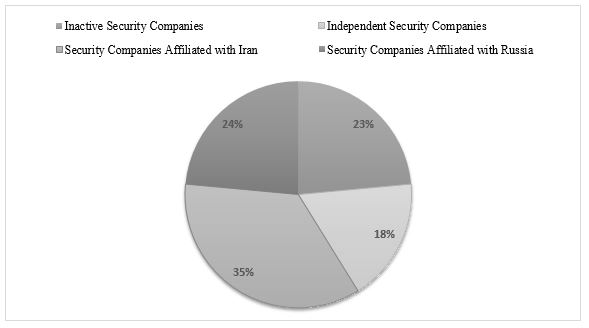

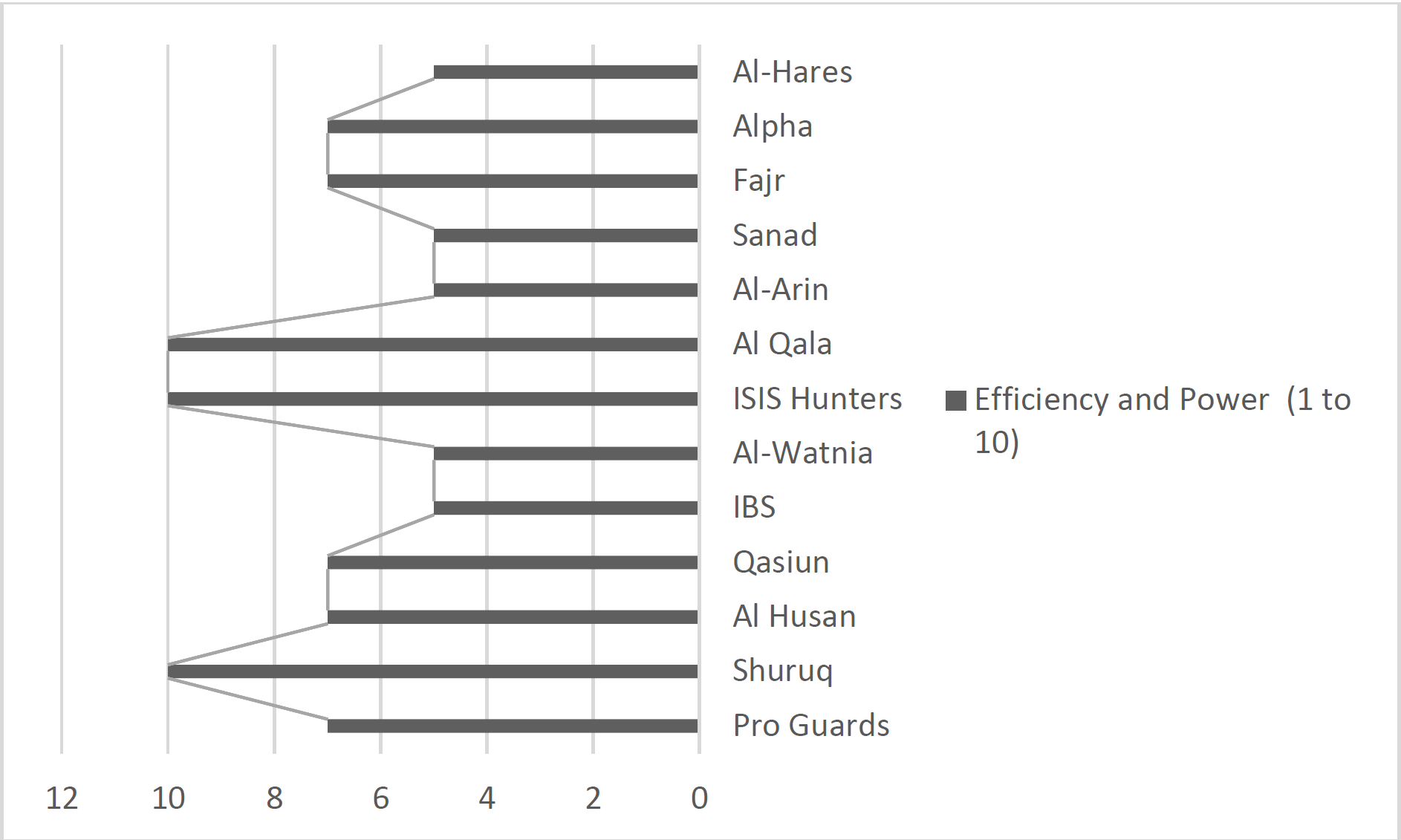

Profiling Top Private Security Companies in Syria

Executive Summary

- Before May 2013, private security companies’ tasks and activities in Syria were basically limited to securing shopping malls, banks, and concerts.

- The growing need for legal armed forces not bound by government regulation led to the issuance of Legislative Decree No. 55.

- The Syrian regime’s international allies (Iran and Russia) found what they were looking for in the private security companies.

- Iran used private security companies to institute Iranian presence and influence in sensitive areas in Syria without worrying about whether they can maintain this presence in the future, because private security companies are part of a registered Syrian company.

- Iran used these security companies to maintain presence on the strategic (Baghdad-Damascus) highway in the eastern desert of Syria.

- Russia used private security companies to legalize some local militia fighters that it recruited due to the lack of Syrian army manpower.

- After the reconciliation of some ex-Free Syrian Army (FSA) factions with the Syrian government, Russia had limited choices regarding how it could use these reconciled fighters. At first, Russia used the 5th Corps, which created issues because many Syrian army forces refused to fight alongside ex-FSA fighters. That pushed the Russian military to use these private companies such as the “ISIS Hunters” in order to mobilize and take advantage of the ex-FSA manpower.

Introduction

There are many private security companies in Syria. These companies provide special protection for anyone who needs security services. Some of these companies provide types of services that do not fall under the category of “security” and are instead more like private military operations, such as role played by the “ISIS Hunters” against ISIS in the Syrian desert.

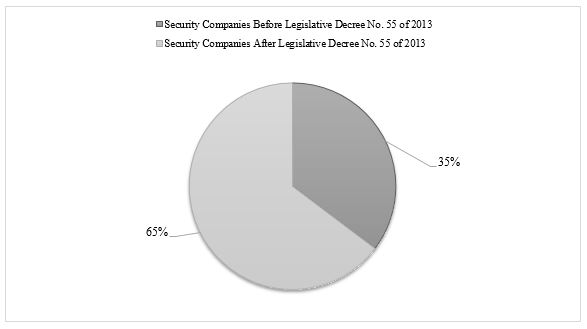

On 5 August 2013, the Syrian president issued Legislative Decree No. 55 regarding licenses for private protection and security companies. Before Decree No. 55, the number of the private security companies in the country was limited. The few private security companies that did exist were primarily funded by well-known businessmen and their main duties were providing security to banks, shopping malls, and sometimes musical concerts. Starting in early 2017, new private security companies began to emerge with much important tasks as well as stronger international allies or even foreign indirect ownership.([1])

Legislative Decree No. 55 of 2013

Agencies and sectors that are concerned with Legislative Decree No. 55:

- Ministry of Interior

- National Security Office

- Companies working in the field of protection, private custody, and the transfer of valuables such as money, jewelry, and precious metals.

In order to receive a license, a private security company must meet the following conditions:

- Be fully owned by holders of Syrian Arab nationality.

- Have capital of no less than fifty million Syrian pounds (SP).

- Its headquarters must be in the same area of operations.

- Be registered in the Commercial Register.

Additionally, the owners, partners, and management of the company shall be required to:

- Have been an Arab-Syrian for at least five years.

- Be at least 35 years of age.

- Have at least a high school certificate.

- Have no expulsion or dismissal from public service on their record.

Private security companies are classified into three categories:

1st category: companies that have 801 guards and above.

2nd category: companies that have between 501-800 guards.

3rd category: companies that have between 300-500 guards.

Top Private Security Companies and their International Allies

| English Name | Arabic Name | License Date | HQ | International Relations |

| Professionals Company | شركة المحترفون | 29 April 2012 | Damascus | Independent |

| Shorouk | شركة شروق | 12 November 2012 | Damascus | Independent |

| Al-Husn | شركة الحصن | 23 March 2013 | Latakia | Independent |

| Qasioun | شركة قاسيون | 28 October 2013 | Damascus | Iran |

| IBS | IBS | 27 November 2013 | Damascus | Iran |

| Al-Watania | شركة الوطنية | 28 March 2016 | Damascus | Russia |

| ISIS Hunters | صيادين الدواعش | 16 March 2017 | Hama | Russia |

| Al-Qalaa | شركة القلعة | 10 October 2017 | Damascus | Iran |

| Al-Areen | شركة العرين | 19 October 2017 | Damascus | Russia |

| Sanad | شركة سند | 22 October 2017 | Damascus | Russia |

| Fajr | شركة فجر | 02 January 2018 | Aleppo | Iran |

| Alpha | شركة ألفا | 15 February 2018 | Aleppo | Iran |

| Al-Hares | شركة الحارس | 08 May 2018 | Damascus | Iran |

The power of each company is related to the number of secured locations it has, the type of operations it does, and the weapons and armored vehicles that it owns.

Shorouk Company for Security Services (Independent)

Shorouk was established on 12 November 2012. It is run by retired state security officers and its guards have played a major role in suppressing many demonstrations in Damascus. The company has maintained its independence despite the fact that Iran has made several offers to the company’s board members to try and gain their loyalty. Shorouk’s headquarters is in the governorate building in al-Zahra, Damascus.

| Shorouk Company Board Members | |

| Retired Brigadier | General Gamal el-Din Habib |

| Retired Brigadier | Brigadier Ragheb Hamdoun |

| Retired Lieutenant | Colonel Ali Younis |

These officers, known for their good relations with Hafez Makhlouf and Yasser Qashlq, played an essential role in the events of Hama in 1982. The most important of these officers is Ali Younis, who was the most powerful figure in state security before retiring as a lieutenant.

| Main Contracts in 2017/2018 | |

| Name | Location |

| Al-Khair markets | Ein Tarma - Damascus countryside |

| Restaurant and nightclub Areas | Bab Touma in Damascus city |

| Sham City | Kafr Suseh in Damascus city |

| Cusco Mark | Restaurant chain in Damascus and Aleppo cities |

| Ski Land | Shami Village |

| Al-Badia Cement Factory | Abu Shammat area in al-Dumayr |

Shorouk has more than 2,000 employees, including the administrative and security personnel, and they all wear a special uniform with a logo of the company.

The security personnel are paid according to their specific tasks, with a salary range between 1,500 to 4,000 SP per day.

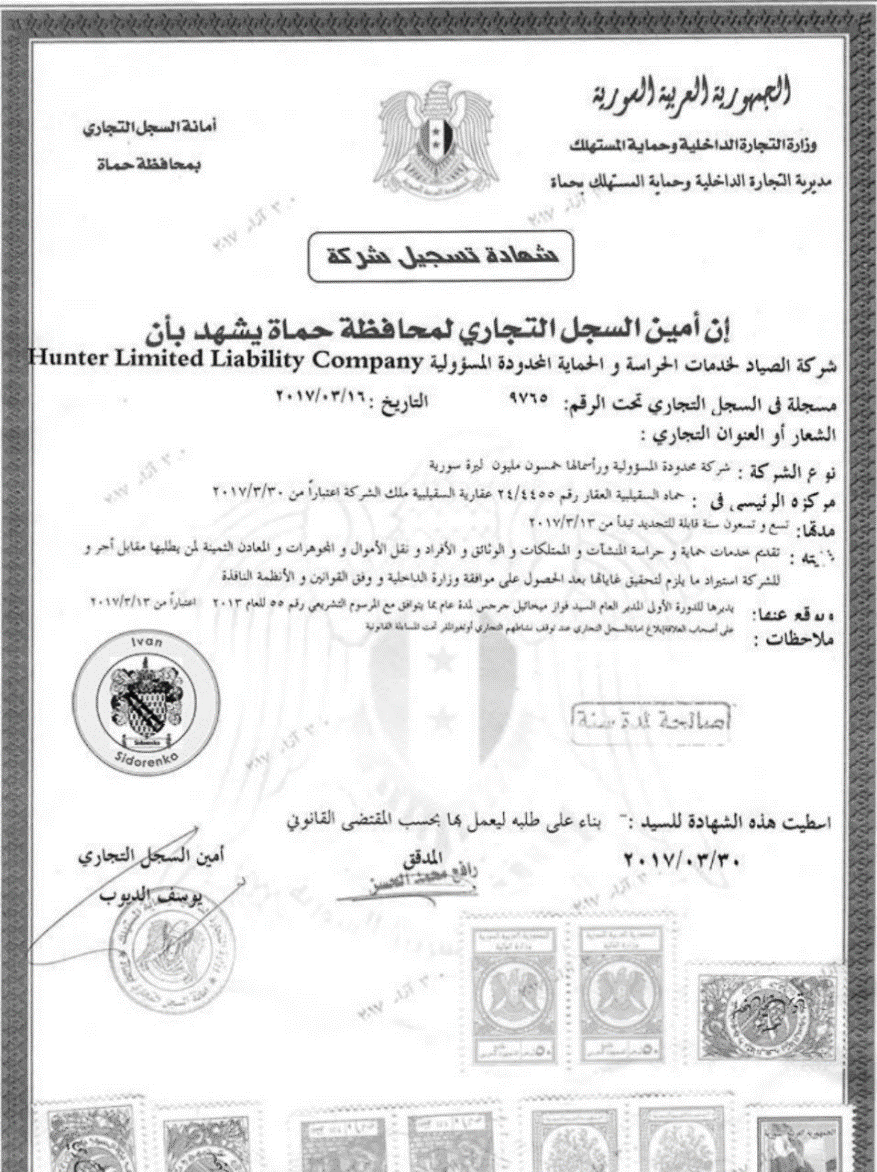

ISIS Hunters (Affiliated With Russia)

ISIS Hunters is a private security company formed, funded, and trained by the Russian military in Latakia to fight ISIS in the Syrian desert on the beginning of 2017, and after that the Wagner group took over responsibility for their training. ([2])

Originally, the ISIS Hunters’ main task was protecting the liberated gas and oil fields in western Palmyra, along with the weapons storage facilities near the T-4 Military Airport.

However, the activities of the ISIS Hunters quickly expanded into combat engagements including the liberation of the city of Palmyra and then crossing the Euphrates to clear ISIS from its eastern bank.

In its initial stages, the ISIS Hunters served more as a private entity within the Syrian Army (Russian military advisor in Khmeimim airbase instructed that) and its only task was to fight ISIS. This role changed after the company’s official registration in March 2017 under Decree 55.

In 2018, ISIS Hunters became more like a private security company but they maintained special privileges to use the army’s equipment because of their initial role fighting ISIS.

After the Syrian military and its allies captured Palmyra in 2017, the Russian-backed ISIS Hunters were tasked with guarding the town against the return of ISIS, clearing the environs, retaking the Palmyra gas fields, and keeping roads such as the Homs-Palmyra highway open. When the Syrian military and its allies lifted the siege of the Deir Ezzor military airport on 10 September 2017, the ISIS Hunters were occupied with clearing the area around Kusham on the east bank of the Euphrates, around 15 kilometers southeast of Deir Ezzor city. On 17 November 2017, the ISIS Hunters announced that they had fully secured Kate Island north of the city of Deir Ezzor and captured 250 ISIS fighters.

Currently, the ISIS Hunter main tasks include: securing the pipelines in eastern Homs, maintaining a presence in al-Talaa Camp in Deir Ezzor, and securing all the checkpoints between the Syrian regime and Syrian Democratic Forces (SDF) in Deir Ezzor province. Their most recent military activity was a very limited role in the battles of Eastern Ghouta in 2018.

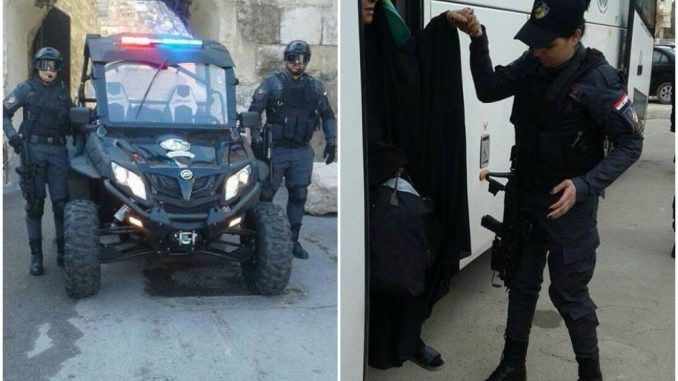

Al-Qalaa Company for Security Services (Affiliated with Iran)

Al-Qalaa Company was established on 10 October 2017 and is managed by the Syrian businessman Mohammed Dirki. Like several other similar companies, in the beginning al-Qalaa had a very limited scope of work. In February 2018, a group of security men and women from al-Qalaa in black uniforms equipped with small machine guns were spotted in the Sayyida Zainab Distract of Damascus. Their main role was to secure a Shi’ite convoy from Iran, Lebanon, and Iraq that was visiting the Shi’ite holy sites. Iran’s main reason for creating and funding al-Qalaa was to protect these pilgrimage convoys, after several incidents in which Shi’ite convoys were targeted by in improvised explosive devices (IEDs) in Damascus city.

After the Syrian military and its allies recaptured more of the Syrian desert and Eastern Homs Desert they simply required more forces to secure these areas, in April 2018 the Syrian Interior Ministry (and Russia) approved al-Qalaa to be equipped with advanced weaponry in order to assist other groups such as the ISIS Hunters in securing the road, pipelines, and other locations in the desert.

Immediately after al-Qalaa was granted this contract, they received 25, 4x4 advanced trucks equipped with heavy machine guns, and were deployed to eastern Homs, southern Raqqah, and parts of the main Deir Ezzor-Homs highway.

Short Promotion video published on April 2018, https://goo.gl/c9ErhM

During the 2018 Damascus International Fair, al-Qalaa general manager talked about how the company had expanded their services and starting in May 2018, they provided the following:

- Protection of facilities.

- Protection of Shi’ite convoys.

- Protection of commercial convoys.

- Engineering Unit.

- Anti-Narcotics Unit.

- Emergency Unit.

- Support Unit for military operations.

([1]) Indirect ownership: the company only provides security tasks for Iran and Russia, despite being owned and managed by Syrians.

([2]) "Wagner group" is a Russian paramilitary organization associated with Yevgeny Prigozhin, a Russian oligarch and close associate of President Vladimir Putin. Vagner commanders have fought for the company both in Syria and, before that, in support of Russia-backed separatists in eastern Ukraine.

Area of influence Map of Idlib and its surroundings

Map 1: Updated situation map of Idlib, western Aleppo and northern Hama

- Iranian-backed militias’ military bases.

- Russian military police checkpoints around Idlib province.

- International Highways crossing Idlib province (M4 and M5).

- International border crossings with their current operating status and internal border crossings with their current operating status.

- Areas targeted by regime forces, Russian air force, and Iranian-backed militias’ artillery in August 2018.

- Sites of IEDs and assassination incidents that occurred in Idlib and western Aleppo Province in August 2018.

Notes:

- M4 and M5 highways are considered one of the main strategic targets for any possible attacks from the Regime and his Iranian allies.

- Internal border crossings are trading hubs between areas under regime control and areas under opposition control. Currently these borders are closed by the regime for different reasons, except "Qalat Al-Madiq" in Sahel Al-Ghab was partially opened in the last few days to allow the last IDPs convoy from the south to enter Idlib.

- On 13 August, Russian Military Police took over both "Qalat Al-Madiq and Mourek" corresponding internal border crossing sites in regime areas replacing the Syrian Army’s 4th Division (Affiliated with Iran).

Navvar Saban talking about a major problem for the Russians, especially in the southern of Syria

Navvar Saban "Oliver" at Omran for strategic Studies Military Expert and the Information Unit manager, recent interview entitled "Syrian refugees are unwelcome in the Israeli-occupied Golan Heights" by TRTWorld via lcmporter, in the article Saban talked the following points:

1- 1. Russia is pushing for reconciliation – they want people and fighters to stay in their cities

2- 2. They don’t want to create some kind of a gap that will be filled by Iran-backed militias.

3- 3. Whenever there is a gap because of evacuation, Iran-backed militias are expert now in filling this gap.

That is a major problem for the Russians right now, especially in the south.

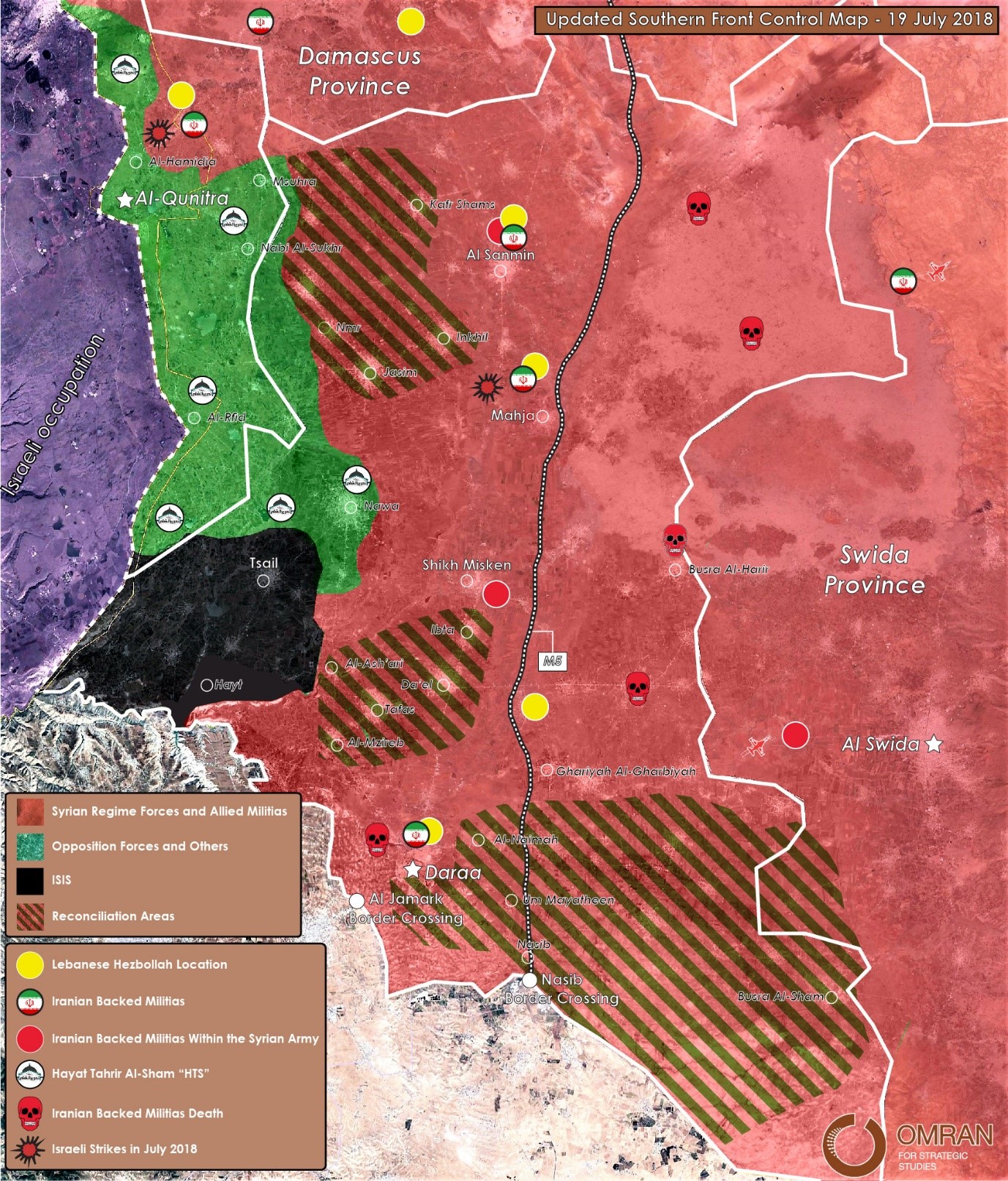

Iranian Involvement in Syria’s Southern Front

This report presents a brief account of latest developments in southern Syria, covering the Daraa and Qunaitera fronts with a specific focus on Iranian involvement from late May until July 17. Prior to the latest escalation along the southern border of Syria, there were reports of an initial agreement between Israel and Russia to push back Iranian and Iranian-backed forces along Syria’s border with Israel. The Iranians reacted by incorporating many of its militias and forces into the Syrian army to continue fighting in the area. Photographs and videos posted on pro-regime media as well as accounts belonging to some of the Iranian-backed militias confirm their involvement. In the final agreement between opposition forces and Russia involving parts of Eastern Daraa and Daraa city, green buses headed to the area to prepare the transportation of a small number of the opposition members to Idlib, while other areas concluded reconciliation agreements. Other areas to the west of Daraa are still going through negotiations to finalize the terms of their agreements. The Russians are pushing for an agreement where minimum number of residents are displaced to Idlib, as a deal to receive them was not concluded with Turkey. At the same time, Iranian forces are pushing for the escalation of attacks to take full control of all southern regions.

Background

In late May 2018, Israel and Russia agreed that Iranian and Iranian-backed forces would vacate areas in southwestern Syria near the Israeli border([1]). Russian President Vladimir Putin stated that due to the Syrian army’s recent advances, foreign forces should withdraw from Syria and mentioned Turkish, American, Iranian and Hezbollah soldiers specifically when asked to clarify. Iranian Foreign Ministry representative Bahram Qassemi responded that Iran would remain in Syria while terrorism exists and for as long as the Syrian government wants Iranian forces there([2]). Nevertheless, in order to reduce pressure from Israel, Iranian-backed forces – including some of Hezbollah members – withdrew from areas in southern Syria only to return as integrated units within the Syrian Army structure. Examples of Iranian-backed forces within the Army include the following:

- 313th Brigade: This brigade is stationed at the Cultural Center in the city of Azra. Brigade fighters withdrew from the city of Daraa in the first week of June and went back to their main base in Sa'Sa.

- Quneitra Hawks: This force is comprised of 200 fighters and was affiliated with Lebanese Hezbollah. It was initially de-mobilized in Khan Arnabeh and then immediately regrouped and joined the 7th Division of the Syrian Army.

- Iranian-backed militias are now stationed in the hills surrounding the towns of Tel Musabah, Tel Arabad, Tel Marz, Tel Ghassem and Tel Ghashim, before they were divided into three units and re-deployed.

- A group of Lebanese Hezbollah fighters were deployed to the town of Khan Arnebeh as part of the 5th Division.

- Al Ghith Forces: This force is affiliated with the 4th Division and was deployed in Khdir Village, on the west side of Majdal Shams.

- Abu al-Fadl al-Abbas Brigade: This brigade withdrew from Eastern Ghouta and moved towards Damascus, only to return after a few days. It is now stationed at Khan Aranbeh and Al-Baath City in Quneitra, at the base of the 10th Brigade in Qantara. Information Unit Sources confirmed the existence of a training camp for the fighters of Abu al-Fadl al-Abbas in Qalmoun, which includes Afghan and Pakistani fighters. The objective of the camp is to send them to the southern front until the Syrian government prepares new identity cards for these fighters as Syrian citizens.

In early June, Russia began deploying troops near territories occupied by Israel, indicating Moscow’s preference for decreased Iranian presence in Syria and despite the dominant presence of Hezbollah in the area. Sources confirmed that Hezbollah was not happy with Russian moves and would demand Russian withdrawal, similar to what happened in Al-Qusir, Homs in the first week of June. Conveying Iranian opinion, Brig. Gen. Masoud Jazayeri told Lebanon’s al-Manar, “Iran and Syria enjoy deep relations that would not be influenced by the propaganda measures of anyone,” adding also that Lebanese militias would not leave Syria([3]).

Attack Stage

The following is a list of top Iranian-backed militias and forces involved in the escalation of violence in the southern front:

| Militia Name | Origin | Situation in Syria |

| Imam al Baqir Brigade | Syria | Part of LDF |

| Lebanese Hezbollah | Lebanon | Special Forces |

| Saryaa Al-Arin | Syria | Military Security Branch |

| Zu Al-Fiqar Brigade | Iraq | Republican Guard |

| Imam Hussein Brigade | Iraq | Militia |

| Al Quds Brigade | Palestine | Militia |

| Abu Fadl Al-Abba | Iraq | Republican Guard |

| A Taha Regiment | Syria | Tiger Forces |

| Arab National Guard | Mix | Militia |

| Salah Al-Assi groups | Syria | Tiger Forces |

| IRGC | Iran | Military supervision |

At the end of June, Syrian regime and Iranian-backed forces – with the support of the Russian Air Force – began the attack on Daraa, quickly capturing a number of cities in a matter of days. Following this rapid advance, various towns throughout Daraa accepted reconciliation agreements with the Syrian regime, including the towns of Um Oualad, Saida, Um Mayazin, Taybah, Nassib, Jabib, Ibta, and Da’il. By the first week of July, Syrian regime and Iranian-backed forces along with the Russian military police had surrounded Nasib border crossing after capturing the city itself. According to Information Unit Source, the presence of Russian military police is part of an undeclared agreement between Russia and Jordan to ensure that Iranian-backed militias do not enter through the Nasib Crossing. However, as these militias integrated themselves into different Syrian army groups, it is difficult to monitor their presence in Daraa.

Map (1): Updated Southern Front Control Map - 19 July 2018

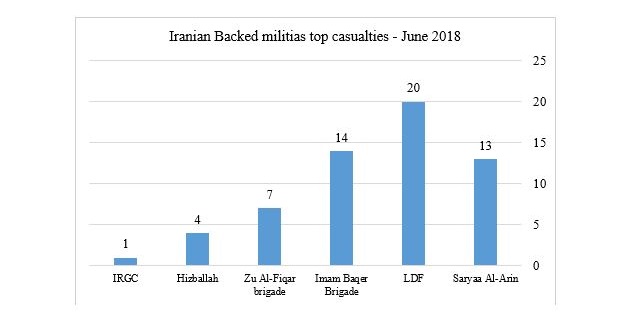

Iranian-backed forces suffered a number of casualties during the attack on Daraa, losing more than 50 top-level fighters – among these fighters were those from Hezbollah, as well as Khalil Takhti Nejad, a fighter for the IRGC. Nejad was deployed to Syria as a member of the Imam Sajjad IRGC Hormozgan Provincial Unit and commanded an operation from an unnamed base in a southwestern Syrian city of Daraa, approximately 32 km from Israel’s northern border.

Note: chart only indicates the number of dead among top Iranian-backed militias who participated directly in the recent Daraa battle; information obtained from monitoring pro-regime websites and official militia accounts.[4]

By the second week of July, Syrian regime and Iranian-backed militias announced that they had captured 520 km2 in Daraa province; 290 km2 from military operations and the remaining 230 km2 following a deal between Russia and the opposition factions. Syrian regime and Iranian-backed militias continued to advance along the Syrian-Jordanian border and reached the town of Khrab al-Shahm, facing no resistance from the opposition as most opposition forces had withdrawn from the borderline earlier.

Footage from Daraa battle of Iranian participation

The images below were taken from official media accounts of the participating militias and from pro-regime accounts.

Eastern Daraa Agreement and Western Daraa ongoing Negotiation

The situation in Daraa remains unclear. Four major events that are underway include:

- Green buses are waiting in pro-regime areas in Izra to transport a small amount of the opposition to Idlib as part of Friday’s 6th of July reconciliation agreement.

- Opposition commanders in the east and west are divided about what to do next. A commander([5]) in the east stated that opposition fighters would be responsible for the security situation in east Daraa for six months alongside Russian military police. At the same time, opposition forces in western Daraa rejected the agreement that took place in the east and announced they would hold their ground for now. A number of commanders escaped from Daraa to Jordan, including Bashar al-Zu'bi, Abu Omar Zaghloul, Raed Radi, Emad Abu Zureiq, Morhaf Al-Aboud, Anas Al-Zaeym, Ziad Al-Ghorani, Iyad Kaddour, Ziad Hariri Al-Bardan, and Abu Sidra Mashhour Canacry.

- Jordanian military commander Gen. Khaled al-Massa’id said reopening the Nasib border crossing would benefit both countries, in both security and economic aspects([6]).

- On 15 July, the first batch of civilians and fighters displaced from Daraa city arrived to Qalaat al-Madiq in Northern Hama. This batch consisted of 9 buses and 2 ambulances carrying at least 430 civilians and fighters.

About 20 buses are expected to depart with hundreds of civilians and fighters of Islamic factions with their families. There were about 1400 people expected to depart but the committees which are close to Russia are trying to persuade people to stay instead of evacuating to the north for the following reasons:

- Russians do not want Aleppo and Deir Ezzor experience to repeat itself, and allow Iranian backed forces to fill the gap in any displaced area.

- Russians tried to preserve the solid security situation in Daraa by transforming some of the opposition forces into local security forces responsible of protecting their own cities.

Note: In regards to Quneitra, there is no agreement until now and no initial negotiation between the Russian and any faction of the opposition forces. Russian negotiators want HTS to leave its post before starting any kind of negotiations.

The situation is being continually monitored in order to maintain an eye on what changes occur. The opposition’s divided actions will continue to leave it exposed to manipulation by outside forces. The Syrian regime will further its presence in the south by playing off the Israel-Russia-Iran trio; and Jordan will observe silently without exerting much effort in terms of actual fighting with or against any of the parties involved. With Russian forces gaining more ground in Syria whether at the behest of the Syrian regime or by making unilateral moves, it will be crucial – albeit difficult – to observe how Iran proceeds to protect itself and its assets in Syria.

([1]) 29 May 2018 – Telegraph - https://goo.gl/Z5jFUh

([2]) 8 July 2018 – Fares News - https://goo.gl/3KdLpU

([3]) 10 June 2018 – Daily Sabah - https://goo.gl/noyzPV

([4]) These number from monitoring Pro Regime and Iranian backed militias account, and also by special report from the Information Unit Ground Sources

([5]) 10 July 2018 – Skype Interview by the Information unit with a commander from the Southern Front

([6]) 16 July 2018 – Al Masder News - https://goo.gl/zyKA28

Nawar Oliver talking to The Daily Star about the Americans strike and how Iran is a big target of it

On the 14th of April 2018 (The Daily Star) published "Gemma Fox" recent article entitled "Strike a chance for ‘dissed’ Trump to hit back", in the article Nawar oliver Omran Center Military Expert mentioned, he Addressed the possible American strike on Syrian Regime military Site and how Iran military presence might be one of the major targets of American's strike:

- The Strike would not be about chemical weapons but rather “an excuse” to target Iran, which the country’s leaders have wanted to do for some time.

- Iran now has at least nine key military bases and seven observation posts throughout Syria – an indication of Tehran’s growing influence in the country.

- An attack on an Iranian target, may therefore satisfy the need for a response while not necessarily upsetting Russia to the point of military retaliation, even though angry public statements will be inevitable.

- Such a strike, for the U.S., U.K. and France, means “they can hit two birds with one stone,” he said, striking Russia and Iran while “showing to the world that they care.”

*Important Note: The Article was published before the U.S., U.K. and France strike in Syria.

Original Link: https://goo.gl/zJTKBy

Territorial Control Map - Qunitra - 21 Dec. 2017

Iran has continued its attempts to expand in southern Syria despite international agreements aimed at curbing its role in the area. Russian and American the influential countries in southern Syria consider the arrival of Iranian militias to the Jordanian-Syrian border and the border of the Israeli-occupied Golan Heights to be “a red line,” which has necessitated direct interventions. Despite this, Iran has continued its expansion as part of the encirclement, which it has pursued in recent months.

Quneitra Front and Western Ghouta Battle Timeline (November – December)

- November 3, Regime Forces and Hezbollah repelled a large attack of HTS, in "Hadr" city in the northern side of the Golan Heights.

- 17 November, Israeli tank attacks Hezbollah “Qars Nafal” position between "Hadr" & "Ain Teenah" position, in the western side of Quneitra.

- 23 November, Hezbollah takes control of South "Beit Tima" after taking control of "Halef shor" and "Tell Al Teen."

- 30 November, Hezbollah and Regime forces established full control over the strategic hills of "Taloul Barda’yah" near the occupied Golan Heights.

- 10 December, Hezbollah and Regime forces have secured their recent gains in the Beit Jinn pocket in southern Syria.

- 13 December, According to pro-regime Medias, Regime forces, and allies will continue their operations in the area until they liberate the entire pocket or local militants accept a withdrawal agreement to Idlib.

- 17 December, Members (HTS) have reportedly started withdrawing from the village of "Maghr Al Meer" to the town of "Beit Jinn" in southern Syria.

- 19 December, According to pro-regime sources, Regime Forces, and Allies reached the eastern entrance to the village of "Maghar Al Meer." However, they were not able to enter the village because they failed to capture the nearby height – Tal Marwan (Marwan Hill).

Brigade 313 "IRGC New Military Formation"

In November 2017, Daraa province has witnessed surprising competition between Iran and Regime forces around the conscription of Syrian young men from the province, as well as the formation of a new force, Brigade 313, which is under the authority of the Iranian Revolutionary Guard.

Despite the Iranian-led brigade only being around for a number of months, it has attracted more than 200 young men; members who were conscripted for the formation were young men from Daraa who were known to work on behalf of the regime, who were currently promoting the force based on its benefits, and the salary, which its members received.

Enlistment takes place at the Brigade 313 headquarters in the city of Sa'Sa', and new members receive an ID, which has the logo of the Revolutionary Guard, ensuring his ability to pass through Regime forces checkpoints.